Recap of Flash Memory Summit 2023

Established event resisting to economic downturn

By Philippe Nicolas | August 14, 2023 at 2:02 pmFlash Memory Summit 2023, aka FMS, just took place at the classic Santa Clara convention center in Santa Clara, CA, and it was, once again, the right opportunity to take a snapshot of the flash and memory industry with several key players and a comprehensive lists of keynotes and break-out sessions. The event is really the annual rendez-vous of that industry with lots of announcements from vendors who really consider the venue as the right place to unveil new products, solutions or partnerships.

Organizers told us that the number of attendees passed the barrier of 3,000, exactly 3,278 attendees but it is still less than 50% of the largest editions before Covid. This erosion is something that touches all events following the pandemic.

FMS figures Y/Y

| Year | Total registration | Y/Y Growth | Sponsors/ Exhibitors |

| 2006 | 675 | NA | 16 |

| 2007 | 1,046 | 55% | 26 |

| 2008 | 1,297 | 24% | 32 |

| 2009 | 1,319 | 2% | 38 |

| 2010 | 1,976 | 50% | 66 |

| 2011 | 2,268 | 15% | 70 |

| 2012 | 3,437 | 52% | 79 |

| 2013 | 4,599 | 34% | 102 |

| 2014 | 4,954 | 8% | 108 |

| 2015 | 5,259 | 6% | 110 |

| 2016 | ≈5,900 | 12% | 115 |

| 2017 | 6,200 | 6% | 140 |

| 2018 | NA | NA |

NA |

| 2019 | ≈6,000 | NA |

130 |

| 2020 (virtual) | NA | NA |

NA |

| 2021 (cancelled) | |||

| 2022 | 3,000+ | NA |

76 |

| 2023 | 3,278 | 9% |

97 |

We count globally 97 sponsors and exhibitors, including industry associations (SNIA, CXL, NVMe, etc.), more than last year. And it is a good indicator. Exhibitors listed on the web site represent a good snapshot of the industry but some vendors have made some arbitrage and finally decided to not secure a booth. For instance, Micron was absent having chosen to show its products line at the Hilton on the other side of the street. Same remark for Phison, Smart Modular, ScaleFlux… who secure external places. Is it a question of sponsorship fee?

Beyond that, when companies join an event, they always expect to detect some projects and meet some end-users. This is not really the case at FMS as end-users are really marginal, in proportion, they probably represent around 5% maximum of the total attendees. At the same time, significant end-users are present like national labs, universities and a few others. We saw Gary Grider from Los Alamos.

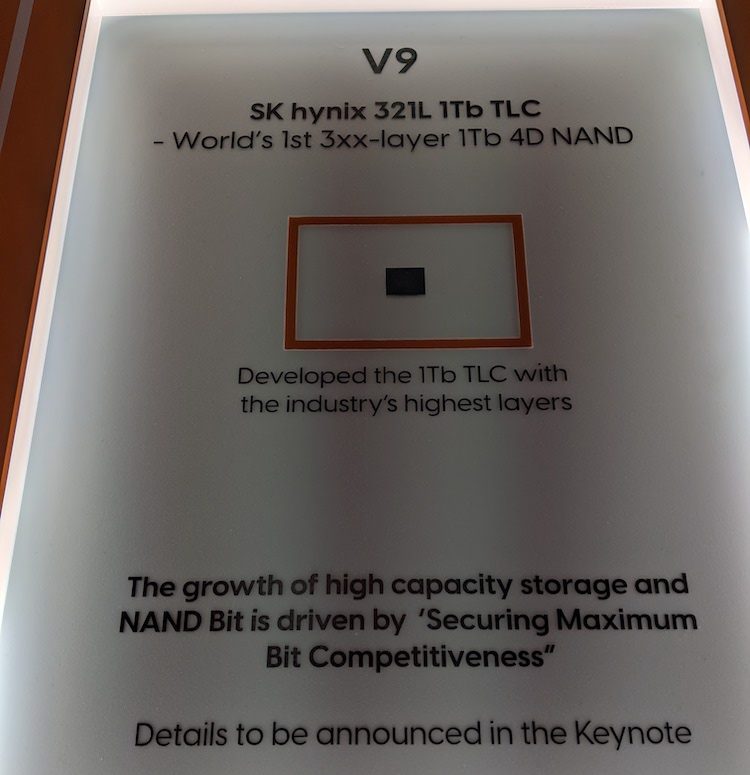

In terms of topics covered, we noticed lots of emphasis on NAND with several companies claiming to beat industry record or their own record regarding density with new layers number. It was the case for SK Hynix and its 321 layers. Other key topics were PCIe Gen 5 with new SSD controllers, NVMe, CXL, offload processing model and test solutions. In the background, analytics, AI and energy/sustainability got their noise as they were used a lot to justify new models, product generations and iterations.

As said, tons of news were unveiled and we select just a portion of them. At StorageNewsletter.com, present at the show, we already published all news related to the show before, during and even today with this recap.

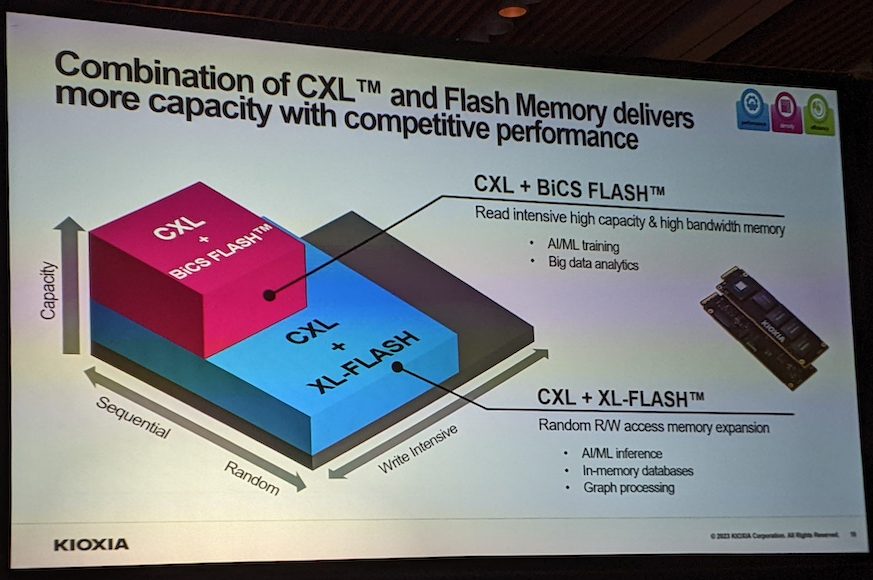

Kioxia made a splash at the show with Jerry Rice distributing autographs and signed balls but the company announced its last data center SSD with the CD8P aligned with PCIe Gen 5 and NVMe 2.0, its next gen of BiCX Flash 3D Flash Memory and few other things. At the same booth, Kioxia hosted partner solutions such as the NeuroBlade analytics approach, coupled with Kioxia CM7 SSDs, showing impressive numbers demonstrating real gain at scale for a fraction of a “classic” analytics solution price. We also get confirmation of the announce made last May available here that Kioxia stopped Kumoscale, the pure software approach for Disaggregated NVMe-oF. How does this decision reflect what happen on the market? Is it a sign of something or just for Kioxia with some difficulties to promote that software piece? Is it the natural destiny for software that finally becomes standard? Do partners and users expect such software from Kioxia?

Click to enlarge

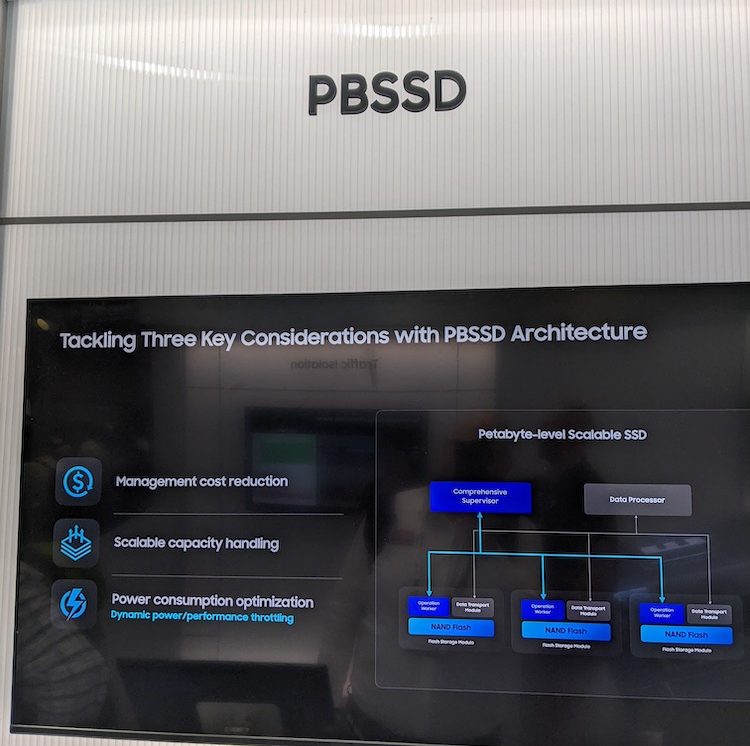

Samsung had a huge booth as well with products everywhere covering NVMe FDP, PBSSD, CXL, PCIe Gen 5 and NAND of course. We spent time to understand its PBSSD approach with 256TB drive based on QLC Flash and saw other product iterations around PM1743 now with PCIe Gen 5, PM9A3, still with PCIe Gen 4, and PM9D3A SSDs.

As said above, SK Hynix has shown its 321 layers project representing its V9 iteration and of others products. This illustrates a real market race on the density side with a battle on layers announcements across manufacturers. We noticed also the key-value CSD for data analytics demonstration illustrated by examples from Los Alamos.

Solidigm was also present and promoted its last D5-P5336 61.44TB SSD delivering a super dense 2U storage server.

Marvell presented its Bravera storage controller, a PCIe Gen 5 iteration, confirming once again that this 5th generation becomes ubiquitous now even if for more many workloads Gen 4 is good enough.

Microchip and NEO were there as well, the latter actively promoting its 3D DRAM.

Swissbit has introduced its D1200 PCIe Gen 4 NVMe SSD.

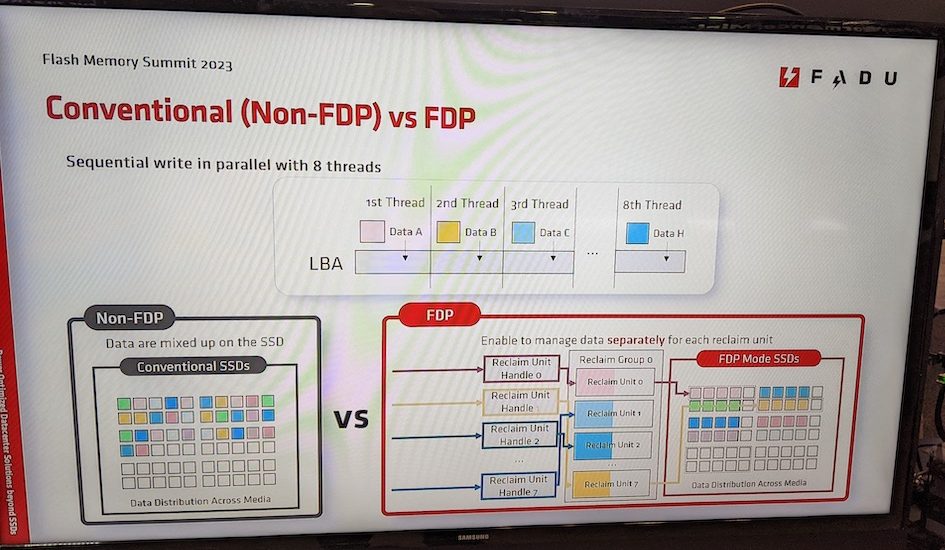

On the NVMe side, of course it was present in many places and we saw lots of examples of Flexible Data Placement aka FDP, for instance on FADU or Samsung booths.

Click to enlarge

FADU has promoted its Echo PCIe Gen 5 SSD platform represented by its controller and its family of SSDs of various form factors.

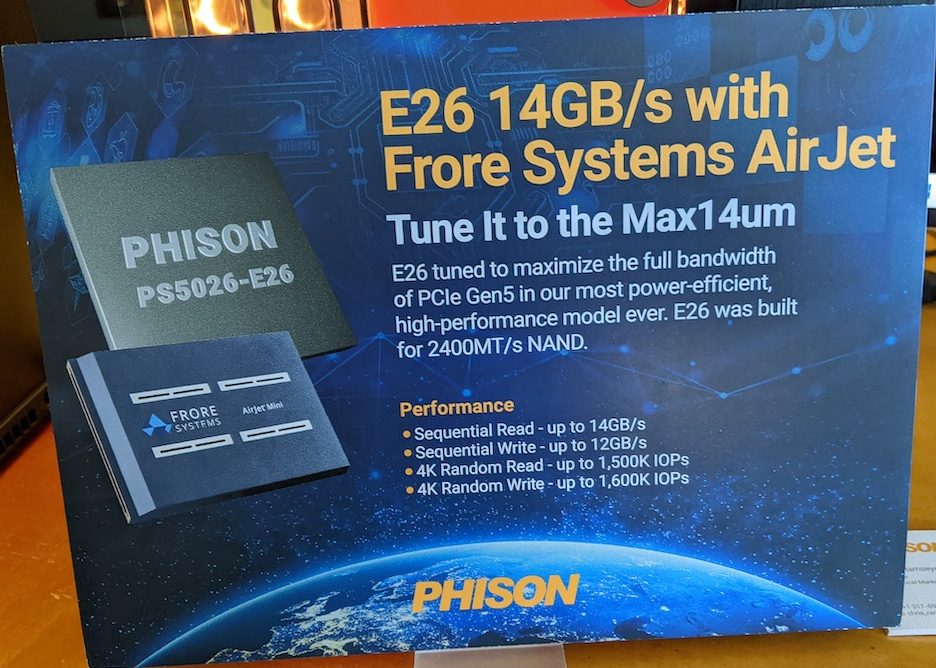

Some famous vendors had ridiculous booth, probably just to say “we’re part of the game“, it was the case for Seagate. The interesting thing on its zone was the demo of Nytro 5050 and 5060, being respectively the 2 Phison drives X1 and X2.

Western Digital, even with a small booth, displayed 3 new products: the OpenFlex Data24 3200 NVMe-oF JBOF, the RapidFlex A2000 and C2000 NVMe-oF fabric bridge devices following Kazan Networks acquisition in 2019, and its last SSD, the Ultrastar DC SN655 PCIe Gen 4.0 dual-port NVMe drive.

Phison chose an external venue but shared some interesting news around its X2 PCIe Gen 5 SSD, already chosen by Seagate, E26, E27T, ad its development platform Imagin+.

We also discovered Frore Systems developing Airjet, a novel cooling approach for servers and storage component that reduces temperature and has a positive impact on IO performance with 10 or 20% gain.

Click to enlarge

MaxLinear, a US company, was in the process to acquire Taiwan-based Silicon Motion. It was confirmed by a definitive agreement published on May 5, 2023, then on July 26, MaxLinear surprised the world with a letter breaking the deal. Silicon Motion, on its side, reacted to this event on August 7. We tried to get comments but of course nobody from each entity was able to share its opinion in this particular moment. MaxLinear demonstrated its last storage acceleration card, the Panther III, and Silicon Motion promoted its PCIe Gen5 SSD development platform, with their booth almost connected as they were very close.

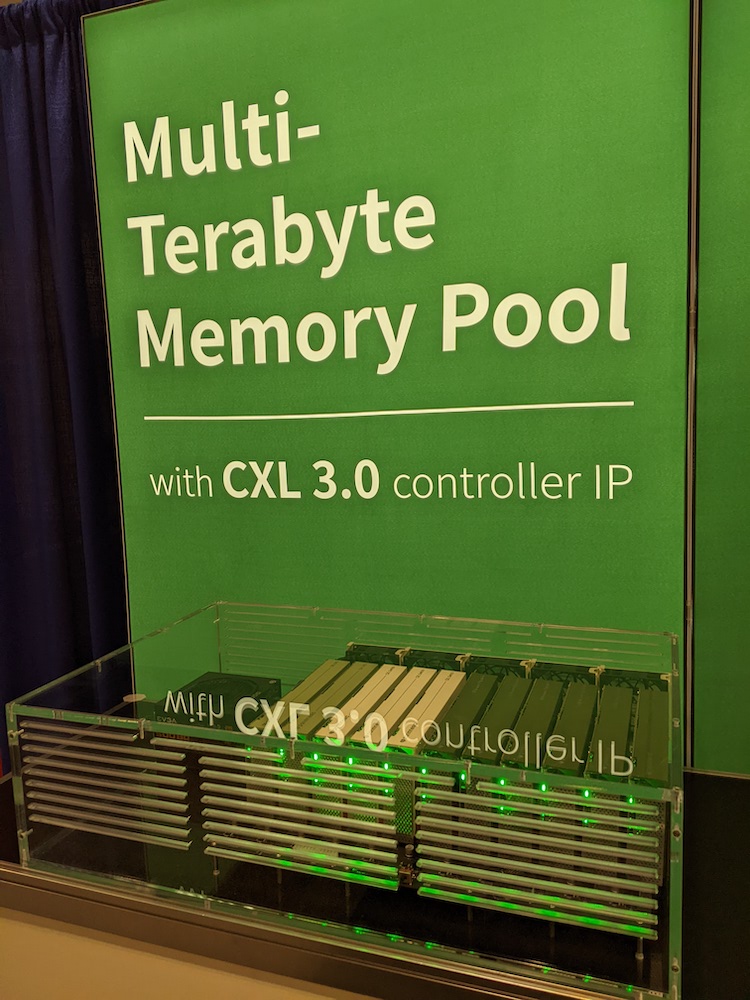

CXL was displayed on many booths with Montage, Samsung or Panmnesia, the latter demonstrating CXL 3.0 multi terabyte memory pooling. A special mention for Lightelligence for its optical interconnect for CXL. We noticed the absence of UnifabriX, IntelliProp, Astera Labs and others.

Off load card was also well represented with Pliops and GRAID Technology of course, both winning an award. GRAID also was present on various booths such as Supermicro, WDC, ASRock Rack and DapuStor, exposing its SupremeRAID card and show impressive performance results with its last software release.

A touch of humor with the presence of Infinidat at a flash show. Remember that the company founded by Moshe Yanai have promoted only a full HDD-based large block storage array claiming to deliver a better TCO. We know the rest of the story, this is not enough when companies ask for SSD in RFPs and guess what, Infinidat has jumped into the game a few years ago with a SSD-based array and they won an award for the most innovative hyperscaler implementation award.

We met as well Viking who displayed its Onyx products.

Nimbus Data listed on the exhibitor map finally didn’t exhibit.

Globally as a “component” event, we’re still wondering why systems companies wish to exhibit and therefore other leaders in storage subsystems were absent.

We met several representatives from not exhibiting vendors, we saw people from Astera Labs, Adi Gelvan from SpeeDB, Mike Shapiro from Iodyne, among others. We also discussed with Airmettle, a young company playing in analytics with a different approach coupling closely a S3 compatible object storage with embedded analytics engine. On this software side, it’s worth to mention that Hammerspace won the most innovative memory technology award.

On the company and products awards, tons were distributed, some surprised us like the category “Travel Bookings Solution“, we expect a category linked to Olympic Games next year…

We have to mention the 2 awards delivered to Amber Huffman, principal engineer at Google and president of NVM Express Consortium since 2013, for her significant impact in defining and driving important industry standards, including ONFI, NVMe, and form factors, which were quickly adopted throughout the industry. She received the Lifetime Achievement Award. Amy Fowler, VP and GM of the FlashBlade Business Unit at Pure Storage, was chosen for the SuperWomen in Flash Leadership Award. Just to mention that FlashBlade, Pure Storage’s Scale-out file storage solution has generated around $2 billion since its first shipment more than 6 years ago.

Once again FMS demonstrated its role in the industry.

FMS 2024 will take place at the same Santa Clara Convention Center from 6 to 8 of August, in the middle of the Olympic Games that will for sure make an impact on the expo.

As the name is being discussed we’ll see if it will be maintained as we know it or morphed behind a new name.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter