Commvault: Fiscal 1Q24 Financial Results

Commvault: Fiscal 1Q24 Financial Results

Flat

This is a Press Release edited by StorageNewsletter.com on August 2, 2023 at 2:02 pm| (in $ million) | 1Q23 | 1Q24 | Growth |

| Revenue |

197.981 | 198.150 | +0% |

| Net income (loss) | 3.511 | 12.629 |

Commvault Systems, Inc. announced its financial results for the fiscal first quarter ended June 30, 2023.

“We’re off to a solid start to our fiscal year, highlighted by accelerated subscription revenue momentum and continued operating discipline,” said Sanjay Mirchandani, president and CEO. “We’re excited about the opportunity ahead and remain committed to helping our customers manage the shifting demands of an ever-changing data protection market.”

1FQ24 Highlights

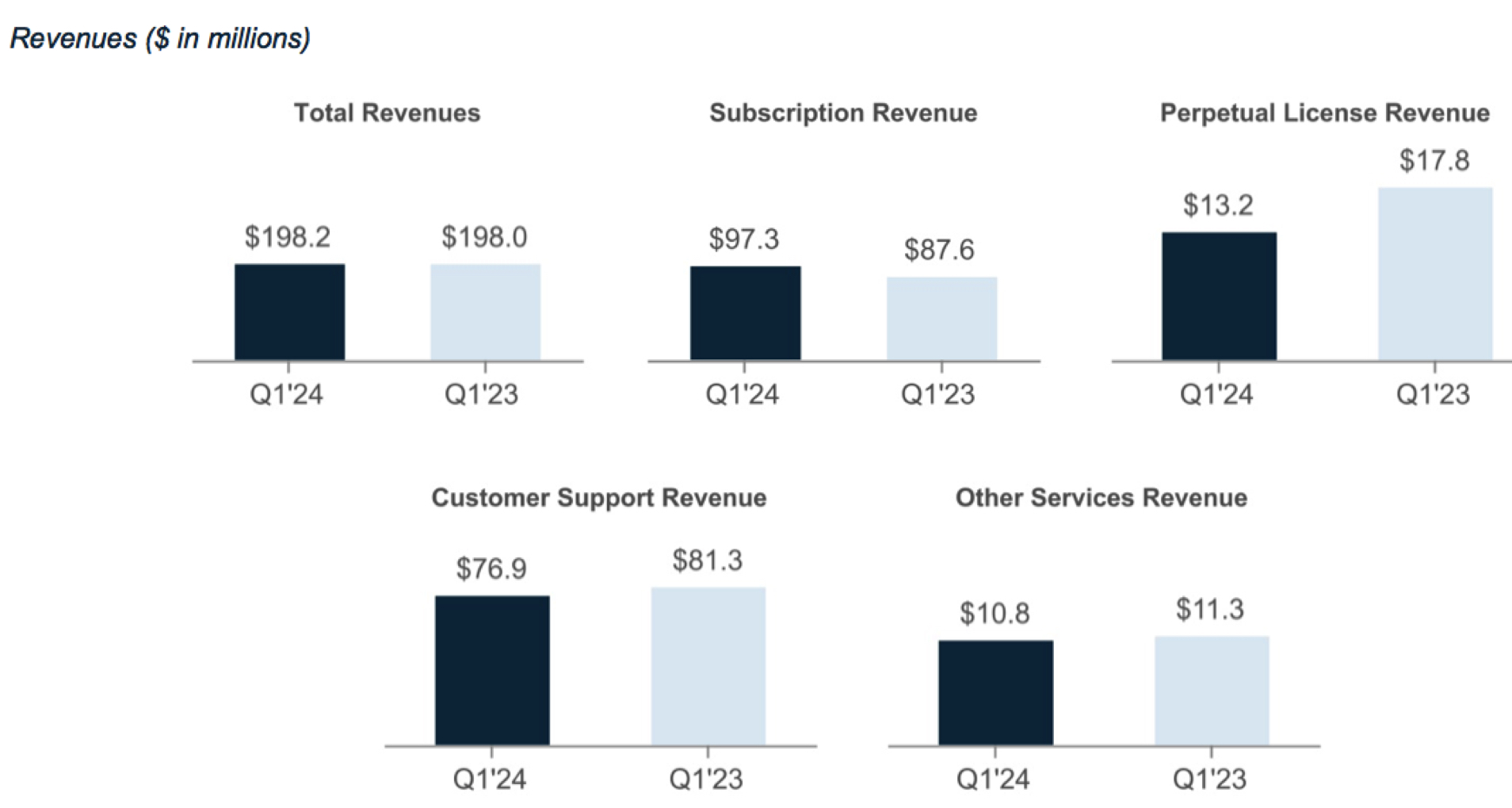

• Total revenues were $198.2 million, flat Y/Y

• Total ARR grew to $686 million, up 15% Y/Y

• Subscription revenue was $97.3 million, up 11% Y/Y

• Subscription ARR grew to $500 million, up 32% Y/Y

• Income from operations (EBIT) was $18.5 million, an operating margin of 9.3%

• Non-GAAP EBIT was $43.5 million, an operating margin of 22.0%

• Operating cash flow increased 74% Y/Y to $39.0 million, with free cash flow of $37.9 million

• First quarter share repurchases were $51 million, or approximately 779,000 shares of common stock

Income from Operations (EBIT)

• Income from operations (EBIT) was $18.5 million, a 9.3% operating margin

• Non-GAAP EBIT was $43.5 million, a 22.0% operating margin

GAAP and non-GAAP Net Income

• GAAP net income was $12.6 million, or $0.28 per diluted share

• Non-GAAP net income was $32.5 million, or $0.72 per diluted share

Cash Summary and Share Repurchases

• Cash flow from operations was $39.0 million in 1FQ24

• As of June 30, 2023, ending cash and cash equivalents was approximately $274.6 million

• During the first quarter, the company repurchased $51.0 million, or 779,000 shares, of common stock at an average share price of approximately $65.54 per share

Outlook for 2FQ24 …

• Total revenues between $193 million and $197 million

• Subscription revenue between $95 million and $99 million

• Non-GAAP operating margin approximately 20.0%

… And FY24

• Total ARR to grow 13% Y/Y

• Total revenue between $805 million and $815 million

• Subscription revenue between $420 million and $430 million

• Non-GAAP operating margin to grow between 50 to 100 basis points Y/Y

• Free cash flow to be approximately $170 million

Comments

Revenue is perfectly flat at $198 million in 1FQ24 compared to 1FQ23 and inside expectations ($195 million to $199 million), and down 3% Y/Y.

Total revenue increased by only $0.2 million, driven primarily by an increase in subscription revenues, offset by decreases in perpetual license and customer support revenues. The company remains focused on selling subscription arrangements through both term-based software licenses and SaaS offerings.

Subscription revenue increased $9.7 million, or 11% Y/Y, driven by the increase in SaaS revenue doubling Y/Y. This increase was partially offset by a decrease in term-based license revenue declining 4%, due to a decrease in the average selling price on larger term-based license transactions (deals greater than $0.1 million) period over period. Subscription revenue accounted for 49% of total revenues for 1FQ24 compared to 44% for 1FQ23.

Perpetual license revenue decreased $4.6 million, or 26% Y/Y as a result of firm's continued focus on subscription arrangements. It accounted for 7% of total revenue for 1FQ24 compared to 9% for 1FQ23.

Customer support revenue decreased $4.4 million, or 5% Y/Y, driven by an $11.5 million decrease in customer support revenue attached to perpetual license support renewals, partially offset by a $7.1 million increase in support allocated in term-based license arrangements.

Other services revenue decreased $0.5 million, primarily due to a decrease in professional services delivered during 1FQ24 to 1FQ23.

Total ARR, the metric used to measure the growth of recurring revenue streams, increased 15% Y/Y to $686 million. Subscription ARR grew 32% Y/Y to $500 million. Metallic, company's hyper growth SaaS platform grew ARR 72% Y/Y and now exceeds 4,000 customers.

Americas and international represented 62% and 38% of total revenue, respectively, for 1FQ24. Total revenue remained flat Y/Y in the Americas and increased 1% in international. Revenue in the Americas was impacted by a 10% increase in subscription revenue, offset by a 30% decrease in perpetual license revenue, driven by the shift from selling perpetual licenses to subscription arrangements.

Customer support and other services revenue declined 8% and 9%, respectively.

Commvault ended the quarter with a global head count of 2,800 employees.

Outlook for 2FQ24 ...

Subscription revenue, which includes both the software portion of term-based licenses and SaaS, is expected to be $95 million to $99 million, representing 24% Y/Y growth at the midpoint. Total revenue is expected to be $193 million to $197 million, with Y/Y growth of 4% at the midpoint.

... And FY24

Total revenue expected to be between $805 million and $815 million, exactly the same figures expected at the end for 4FQ23, and a historical record.

Revenue and net income (loss) in $ million

| Fiscal Period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| FY18 | 699.4 | 8% | (61.9) |

| FY19 | 711.1 | 2% |

3.6 |

| FY20 |

670.9 |

-6% |

(5.6) |

| FY21 | 723.5 | 8% | (31.0) |

| FY22 | 769.6 | 6% | 33.6 |

| 1FQ23 | 198.0 | 8% | 3.5 |

| 2FQ23 | 188.1 | 6% | 4.5 |

| 3FQ23 | 195.1 | -4% | (0.3) |

| 4FQ23 | 203.5 | -1% |

(43.5) |

| FY23 | 784.6 | 2% |

(35.8) |

| 1FQ24 | 198.2 | -3% |

12.6 |

| 2FQ24 (estim.) | 193-197 | 3%-5% |

NA |

| FY24 (estim.) | 805-815 | 3%-4% | N/A |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter