Future of Emerging Non-Volatile Market (ENVM) in Embedded Applications

By 2028, ~1 million 12-inch wafers with ENVM to be shipped in market worth $2.7 billion

This is a Press Release edited by StorageNewsletter.com on May 31, 2023 at 2:02 pmIn July 2022, Intel confirmed it was ending Optane development. Although this represents a significant blow for stand-alone ENVM, prospects remain bright for embedded ENVM as adoption is pushed by the lack of embedded flash for process nodes below 28nm, according to a report from analysts from Yole Group.

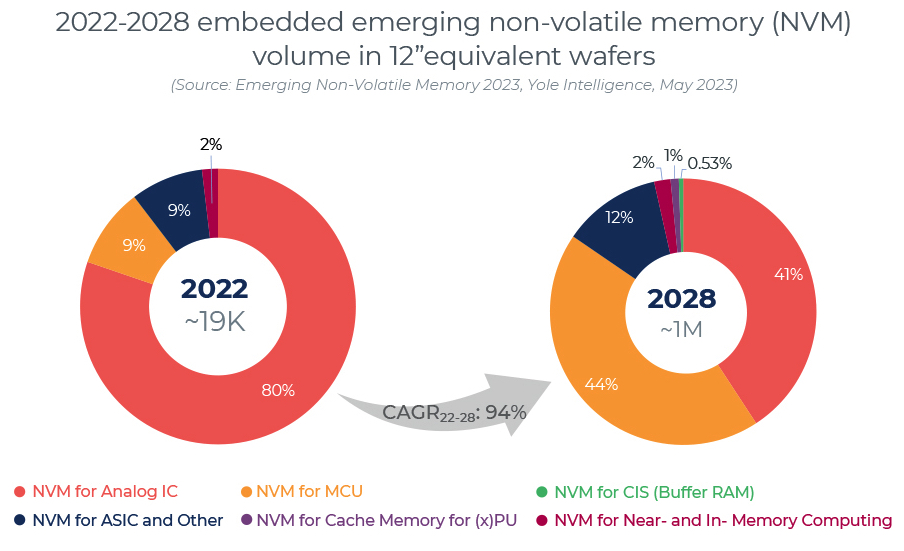

By 2028, they forecast that more than 1 million 12″ equivalent wafers per year will be manufactured by leading foundries using technology platforms that incorporate embedded PCM, ReRAM, or MRAM (CAGR 2022-2028 of ~94%). By then, this would represent a market worth ~$2.7 billion, with RRAM accounting for ~60% of the wafer volume and MRAM with ~25%.

The most important applications will be embedded NVM for microcontrollers (MCUs) and analog ICs, with ~450,000 and ~420,000 wafers per year, respectively. The MCU segment is now taking off, driven by ongoing technology migrations towards nodes smaller than 40nm. In addition, on-die embedded memory solutions will be necessary for applications requiring low latency, low power consumption, and reliable operation in terms of security and safety.

MRAM will dominate embedded NVM market, followed by RRAM

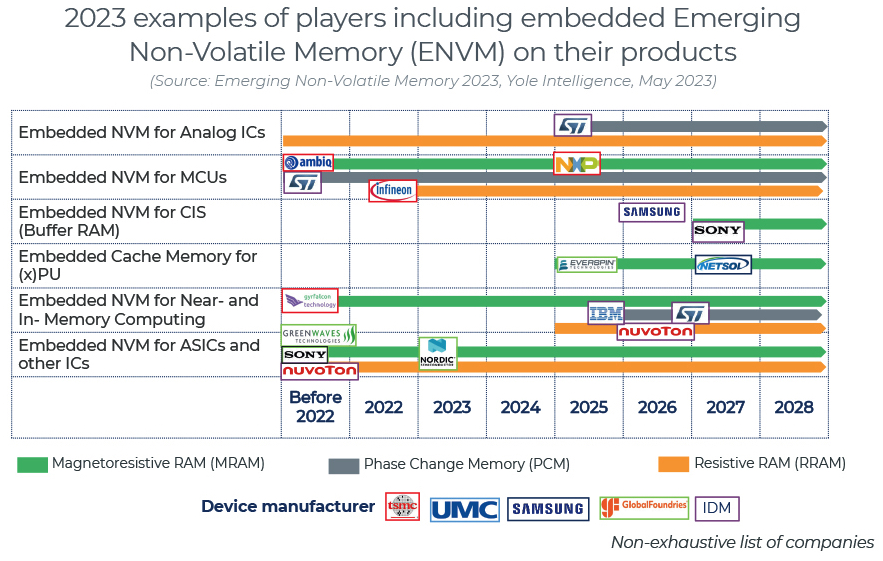

After a long time in R&D, embedded ENVM – i.e., MRAM, PCM, and RRAM – are finally in the market or very close to commercialization. Spin-Transfer Torque (STT) MRAM continues to gain momentum and has the most significant revenue potential compared to RRAM and PCM (49%, 37%, and 14% of the total revenue in 2028, respectively).

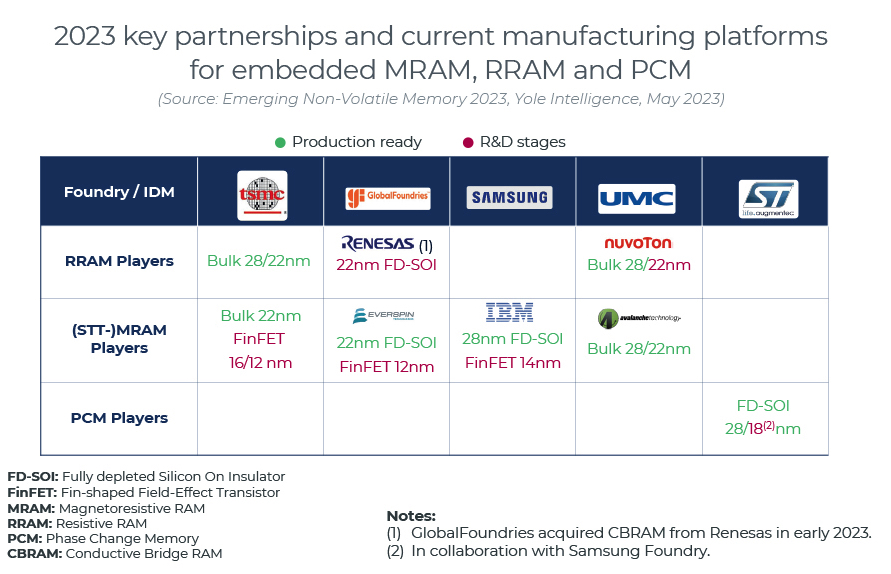

The leading foundries/IDMs are qualifying the technology for automotive MCUs, a market worth ~$8.7 billion in 2022.

Embedded MRAM (eMRAM) is expected to be used for low-power MCU/SoC chips and in various ASIC products, IoT and wearables, for instance, and CMOS image sensors as a memory buffer.

While MRAM provides an exciting combination of low-power consumption, high density, and low latency, RRAM is appealing for its ease of integration with fab-friendly materials and relatively lower cost. Embedded PCM has potential for automotive MCUs (currently in sampling stages) and power ICs (under development), offering good performance for high-temperature operation.

New products recently announced confirm embedded ENVM ecosystem growth

There is consensus in the industry that 28/22nm could be the end of eFlash, not because of scalability limitations but because of economic barriers, and therefore a new embedded NVM for code/data storage is needed.

The leading foundries/IDMs offering embedded ENVM in their catalogs are TSMC, GlobalFoundries, Samsung, UMC, and STMicroelectronics. Most have established strategic alliances with specialized ENVM suppliers to leverage their IP and accelerate mass adoption of embedded emerging NVM at process nodes below 40nm.

In late 2022, the first microcontroller product for automotive applications employing embedded RRAM was announced by Infineon, manufactured on a 28nm process by TSMC.

The announcement has renewed interest in RRAM technologies, highlighting its readiness for mass production for automotive MCUs.

In April 2023, Nordic Semiconductor launched its low-power wireless SoC nRF54H20, manufactured on a 22nm FD-SOI process by GlobalFoundries. Anaysts believe it utilizes embedded MRAM (2MB).

In May 2023, NXP and TSMC disclosed being in the development stage of MRAM IP using 16nm FinFET technology, confirming the sound dynamics and prospects for embedded NVM, as well as TSMC leadership in terms of ENVM scaling and maturity.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter