DRAM Module Market from $42 Billion in 2022 to $96.3 Billion in 2028, 16% CAGR

Mainly due to growth of server modules (2022-2028 CAGR of ~19%)

This is a Press Release edited by StorageNewsletter.com on April 25, 2023 at 2:02 pmAccording a report from analyst firm Yole Group, DRAM module revenue dropped by ~%8 in 2022. However, long-term perspectives are very bright.

The DRAM market is cyclical in nature.

It is characterized by periods of shortages and oversupply that give rise to strong price variations and revenue volatility. After an abrupt decline in 2019, followed by two positive years in 2020 and 2021, the DRAM market rapidly entered a new decline phase in 2022.

Multiple factors, including geopolitical tensions and global inflation – which worsened consumer economic sentiment – have weakened DRAM-bit demand, accelerating the shift into oversupply.

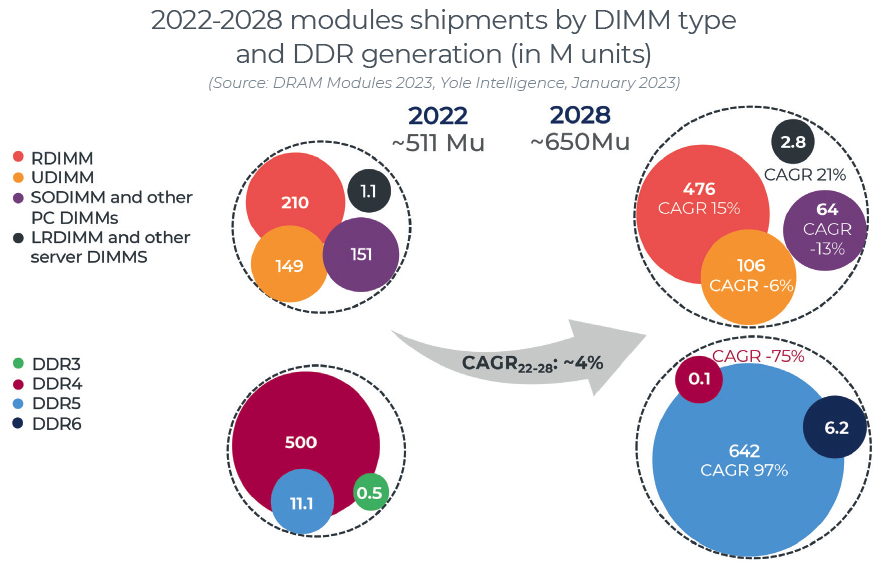

As an important segment of the DRAM market, DRAM modules are not spared from such macrotrends. For 2022, estimation is a -36% Y/Y decline in the PC-module market, which is poised to decrease from ~$10.3 billion in 2021 to ~$6.6 billion in 2022. For server modules, the market dynamics are better. The analyst firm estimates a moderate Y/Y revenue growth a of 0.4%, from ~$33 billion in 2021 to ~$33.1 billion in 2022. The total DRAM-module market size will increase from ~$42 billion in 2022 to ~$96.3 billion in 2028, with a CAGR 2022-2028 of ~16% – mainly due to the impressive growth of server modules (CAGR 2022-2028 of ~19%).

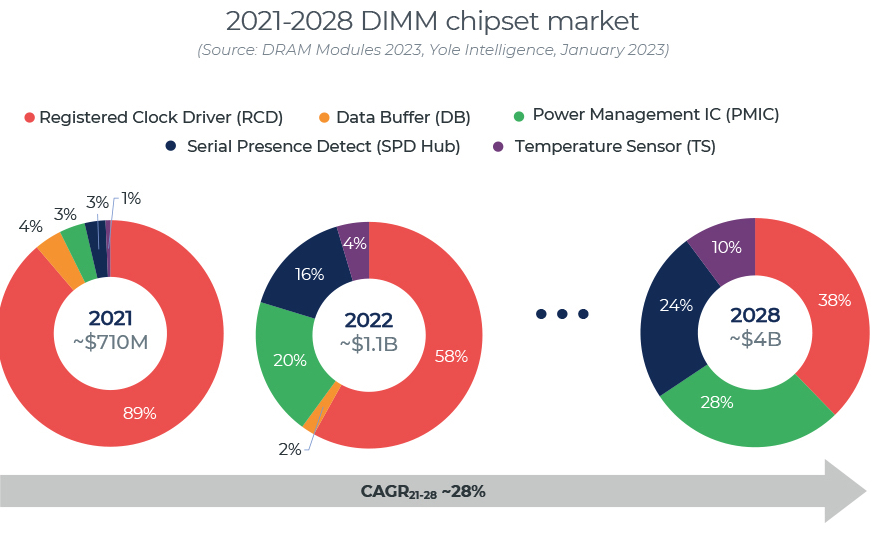

DDR5 is profiling as the jackpot for the DIMM chipset market: ~$4 billion by 2028, with a CAGR 2021-2028 of ~28%.

Each new DDR generation has offered improvements in terms of capacity, data rate, and power consumption. At the same time, new signal integrity challenges have emerged for module designers, making it harder to reach higher module capacities at higher speeds. To solve these issues, specific on-DIMM chips are needed.

The number of DIMM chips per module has increased with the most recent DDR generations. With the DDR5 ramp-up, which is expected to overtake DDR4 by 2024 in terms of market share, the on-module chipset will include RCD, DB, PMICs, SPD Hub, and temperature sensor chips for the most advanced modules. For PC, the DIMM chipset was first included with DDR5 at an average price of $3.5, while for data center modules the DIMM chipset price can be higher than $10. DDR5 penetration will lead to a market of about ~$4 billion by 2028 ($710 million in 2021, $1.1 billion in 2022) with a CAGR 2021-2028 of ~28%.

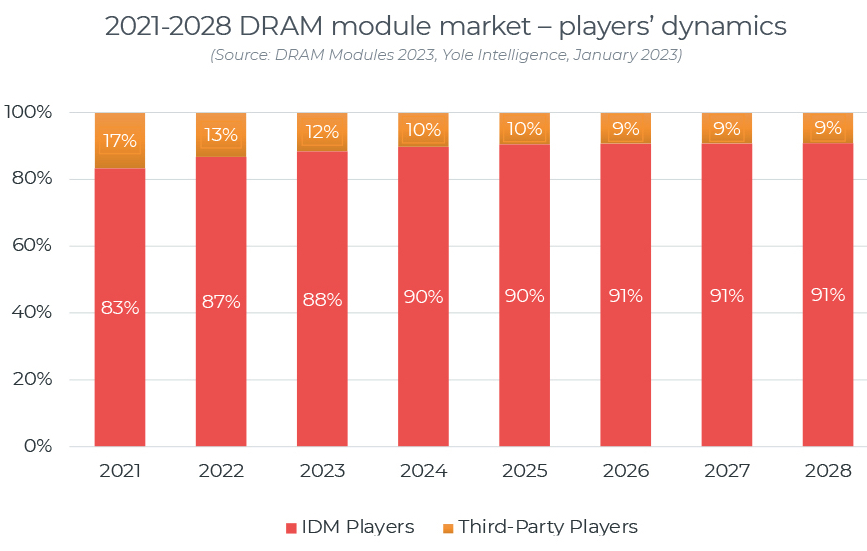

Market share of third-party module vendors is expected to decrease in the coming years, from 17% in 2021 to 9% by 2028.

Module suppliers can be classified into IDMs and 3rd-party vendors. The former (e.g., Samsung, SK hynix, Micron, Nanya, etc.) sell self-branded modules (or own module-specific brands), leveraging their chip manufacturing capabilities. Additionally, they sell known good (KG) DRAM wafers to 3rd-party vendors that package DRAM chips through OSATs and sell modules to final customers that include OEMs, hyperscalers, and channel distribution. The smallest 3rd-party suppliers tend to buy DRAM chips from IDMs.

Third-party module vendors are strongly focused on DRAM modules for PCs (notebook, desktop, and workstation). In 2021, more than 70% of their revenues came from such segments. However, this market is expected to decrease due to weak demand and the penetration of LPDDR DRAM in notebooks. On the other hand, and with interesting growth perspectives, the data center market is largely dominated by IDMs. Hence, the market share of 3rd-party suppliers is poised to decrease from 17% in 2021 to 9% in 2028, unless market conditions change and these players start targeting servers and other markets beyond PCs.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter