Storage Giants Develop Essentially Block Storage Products

Confirmed by 81% of them

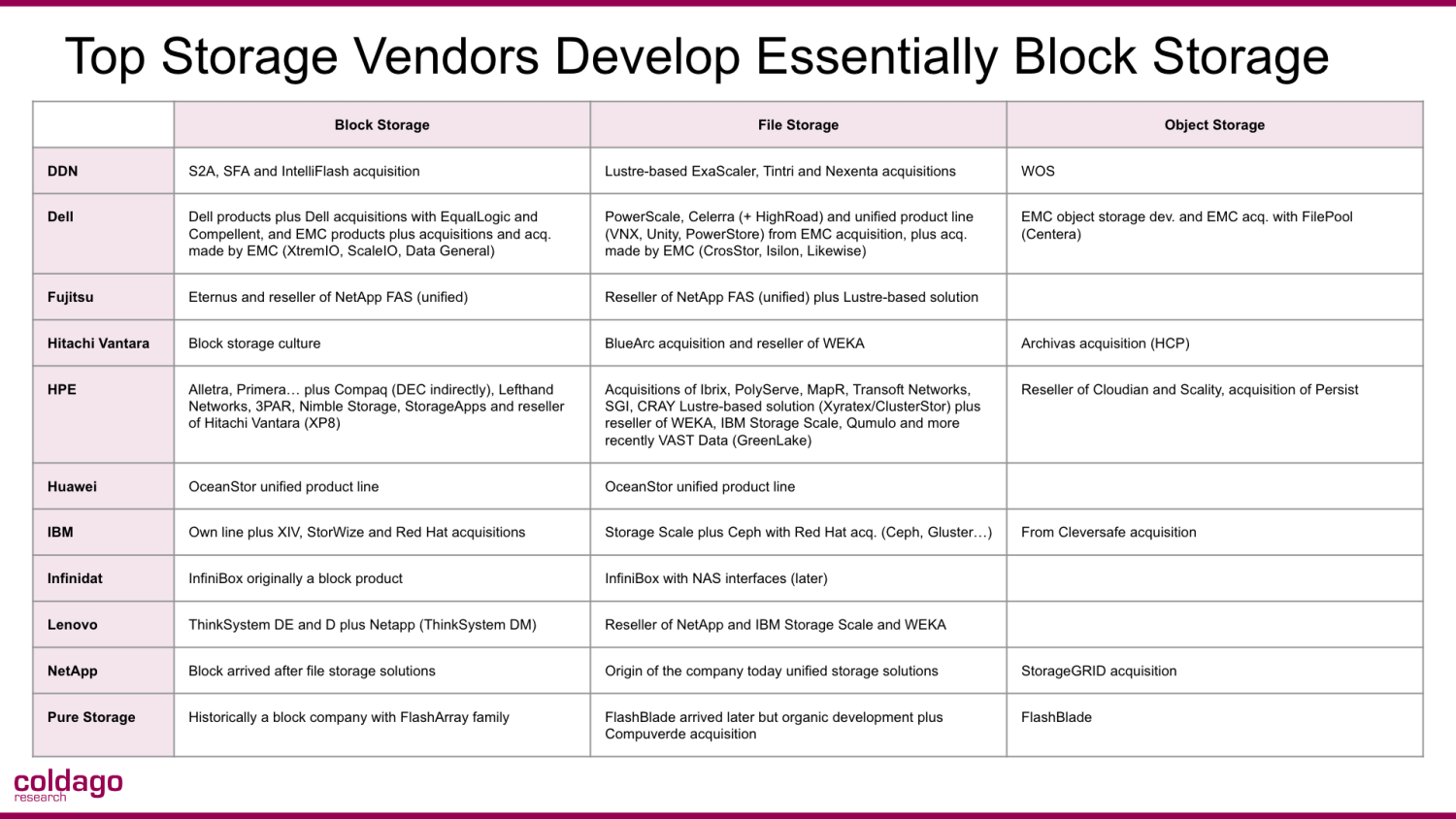

By Philippe Nicolas | April 24, 2023 at 2:02 pmThe first element resides in the list of storage giants, who are they? Of course, we don’t consider cloud providers but hardware vendors such as DDN, Dell, Fujitsu, Hitachi Vantara, HPE, Huawei, IBM, Infinidat, Lenovo, NetApp and Pure Storage. The segment analyzed is the mid to high-end on-premises storage.

Then we consider block storage only, it means storage arrays that expose outside a block interface such as SATA, SAS and NVMe today. Of course in terms of transport, the array could be locally attached to the host and dedicated or networked attached with NVMe-oF or historically via iSCSI, Ethernet (like AoE for Coraid for instance) or FC. It could be from a dedicated pure block device or subsystem but also from a unified entity. We eliminate HCI of course.

Several of these vendors consider, like many people in the industry or even end-users, that block storage equals primary storage and it’s a big mistake.

Let’s come back to this, primary storage is defined by the role of the storage whatever is the interface exposed and used. Obviously it can be block, file or object and really depends on the application and the use case. And it is the same for secondary storage. Now the 2nd dimension refers to production and protection data. Production data defines primary storage, this is where data is created supporting the business of the enterprise. Protection data defines secondary storage, it receives a copy of data from the primary and thus supports and protects the primary storage and not the business. Primary storage should be considered as a business asset and secondary as an IT asset.

Now, let’s review each of the vendors listed at the beginning.

DDN

They started with block storage and invested deeply in that domain with S2A or SFA products, no doubt on this. File storage is based on Lustre with ExaScaler and the company later developed the object storage WOS. More recently the company has acquired Tintri, Tegile asset from Western Digital named IntelliFlash and Nexenta. The real historical IP of DDN is block.

Dell

Here of course it means EMC products that was an historical block storage vendor famous since the Symmetrix invented by Moshe Yanai team, then the DMX, VMAX and finally PowerMAX. EMC made a small silent asset acquisition from DEC in 1994 to then build the file storage flavor of the Symmetrix with the Symmetrix Network File Storage later renamed Celerra. This NAS offering got some developments to offer a SAN file sharing mode under the product HighRoad. More recently unified solutions such VNX, Unity or PowerStore plus Power Scale and even Centera are results of acquisitions of Data General, CrosStor, Isilon, Likewise or FilePool but also block storage like XtremIO and ScaleIO. Clearly the culture is block as you can see but has for a few decades globally a strong block, file and object offering again based on acquisitions.

We can also mention the pure Dell stuff as it confirms this analysis. Historically, Dell acquired Compellent and EqualLogic on the.block side, they sold Windows-based file servers and decided to acquire Exanet to start dedicated enterprise file servers.

Fujitsu

The web site is just crazy mentioning HCI in primary storage. Again HCI is not storage, in that case Data Warehouse is storage as well as it embed storage and it is not. We never saw an HCI vendor chosen in a block, file or object storage project. Now you can use HCI for a project where servers and storage are replaced but again we never saw any users connect a compute farm to HCI for block, file or object storage services.

The Eternus product line is clearly purely block and we also see some NetApp FAS as a unified storage offering who can expose various protocols. On the HPC side, Fujitsu uses a Lustre-based file system so again no file storage or object culture, only block.

Hitachi Vantara

This other Japanese company shows almost the same thing except it uses the term Primary Block Storage as a category on their web site but Primary file storage doesn’t exist so at the end it is the same approach. Obviously with the history of Hitachi, block is king and the company is really focused on the high-end and we see some iterations toward some modular approaches. The company has made 2 key acquisitions: BlueArc more than 10 years ago and Archivas even older to build respectively its NAS and HCP products. More recently the company decided to partner with Weka to deliver high-end file services based on a parallel design for very demanding workload and AI/ML type of applications.

HPE

Its DNA in storage is questionable as the company has acquired giants Compaq and indirectly DEC, but also Lefthand Networks, 3par, Nimble Storage, SGI, Cray, Ibrix, PolyServe, StorageApps, BlueData, MapR, Transoft Networks, SimpliVity (real hesitation to add the company here) or Persist. Wow. The firm has made acquisitions in various storage domains: block and file essentially.

Selling its own stuff for years but also based on acquired technologies, again Compaq, 3par and Nimble Storage, the team has also sold partners block storage products like Hitachi Vantara with the XP8. The current Alletra product line is of course the result of HPE engineering teams fed by all technologies swallowed for years. HPE continues to promote its own brand.

This is not the case for file and object storage where HPE is really naked without its own products, just reselling partners’ products with Qumulo and more recently Vast Data for its GreenLake line. The motivation behind is to sell more server hardware. The acquisitions listed above are even completely destroyed, confirming that HPE is a poor integration company, eliminating some offerings for its competitors.

And again, HPE made the same error putting a HCI solution in storage.

On the HPC side, it acquired SGI and Cray, leveraged Lustre and signed partners with Weka and IBM for Storage Scale, which illustrate the hardware first strategy.

Huawei

It is interesting with its various product lines. Today it is essentially covered by the OceanStor product family and especially the Dorado and Pacific series. The firm has essentially made the choice to have unified storage solutions with some editions limited to some access protocols. Huawei makes the same error others make with HCI in the storage category.

IBM

It is of course a block storage vendor and even if it design its own products it also acquired some companies in that domain. Remember XIV, but it also swallowed Storwize, Diligent, Cleversafe and of course Red Hat.

On the file side, it has the famous Storage Scale and on the object side Cloud Object Storage, the product coming from Cleversafe. And again all software coming from Red Hat as recently Ceph appeared officially on IBM storage line.

Infinidat

It is very simple with this company, it started with InfiniBox as a consolidation array for large enterprises and offered only a block interface. Later it added file access protocols.

Lenovo

The company sells its own product with the ThinkSystem DE and D products and are pure block arrays, the ThinkSystem DM are based on NetApp and are unified storage devices. In HPC, it uses file storage software solutions based on IBM Storage Scale and more recently Weka.

NetApp

The company started with file storage and added later block arrays and globally they promote unified – block, file and object – storage servers.

Pure Storage

They marketed and promoted full-flash array since their inception with the famous FlashArray family and later introduced a combined file and object storage offering under the FlashBlade name. FlashArray model C has also received the capability to expose block and file thanks to Compuverde. And potentially something new soon.

Click to enlarge

To conclude, we reiterate our original statement saying that storage giants develop and promote only block storage, this is true for the vast majority of them, 9 on 11 vendors confirming that pattern so 81% of them.

What is really interesting is what Vast Data, Weka and Pure Storage, and potentially Qumulo are building, finding a real opportunity, shaking established positions in storage pushing really the limits of file storage with new design and architecture and confirming that file storage is a perfect primary storage as usages define its role.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter