Nutanix: Preliminary Fiscal 2Q23 Financial Results

Nutanix: Preliminary Fiscal 2Q23 Financial Results

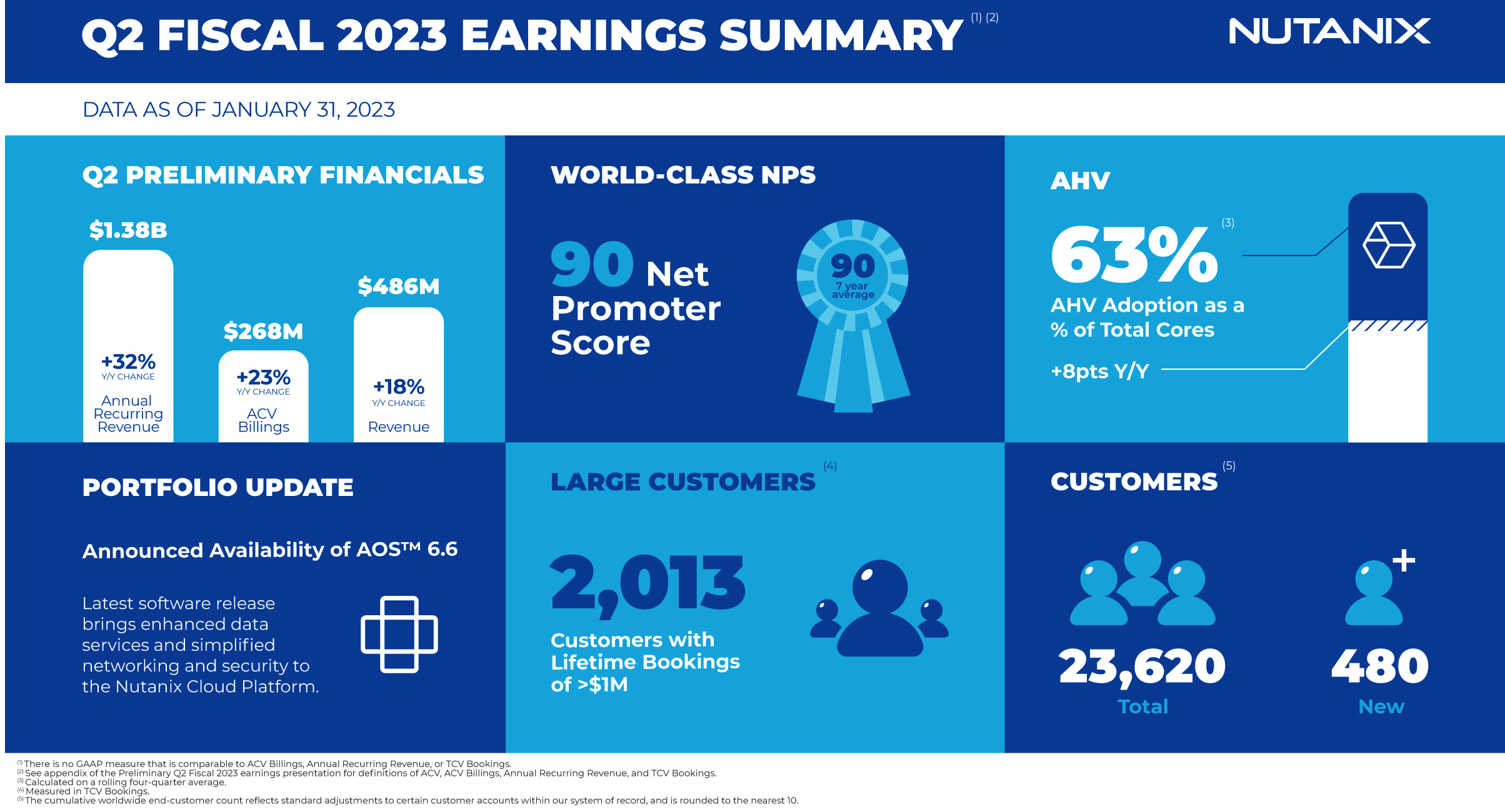

Sales up 18% Y/Y at $486.5 million, outlook of $430-$440 million in 3Q23

This is a Press Release edited by StorageNewsletter.com on March 13, 2023 at 2:02 pm| (in $ million) | 2Q22 | 2Q23 |

| Revenue | 413.1 | 486.5 |

| Growth | 18% |

Nutanix, Inc. announced selected preliminary financial results for its second quarter ended January 31, 2023.

All financial results for 2FQ23, and related comparisons to prior periods included in this release have not been reviewed or audited, are based on the company’s estimates, and were prepared prior to the completion of the company’s financial statement close process.

“We delivered a solid second quarter financial performance vs. an uncertain macro backdrop, underpinned by the strength of our subscription-based business model,” said Rajiv Ramaswami, president and CEO. “The value proposition of our platform is resonating with customers as they look to tightly manage their IT and cloud costs while modernizing their data centers and adopting hybrid multicloud operating models.”

“Our second quarter results demonstrated a good balance of topline performance and profitability with 23% Y/Y ACV billings growth and record free cash flow margin,” said Rukmini Sivaraman, CFO. “We continue to execute on our growing base of subscription renewals and remain focused on sustainable, profitable growth.“

Company management discovered that certain evaluation software from one of its 3rd-party providers was instead used for interoperability testing, validation and customer proofs of concept over a multi-year period. The audit committee commenced an investigation into this matter, which is still ongoing, with the assistance of outside counsel. The company does not believe that this will have a significant impact on the fundamentals of its business and overall prospects. It is in the process of assessing the financial reporting impact of this matter and it is likely that additional costs would be incurred to address the additional use of the software. As a result, it has not provided financial information regarding expenses in 2FQ23 preliminary results, or in its outlook for 3FQ23 or FY23.

While the company is working to complete its review of this matter as soon as possible, it does not expect to be able to file its quarterly report on Form 10-Q for 2FQ23, on time or following the 5-day prescribed extension period allowed under 12b-25.

3FQ23 outlook

- ACV billings: $220-$225 million

- Revenue: $430-$440 million

FY outlook

- ACV billings: $905-$915 million

- Revenue: $1.80-$1.81 billion

In addition, the company is reaffirming the guidance it previously provided regarding its expectations of $100 to $125 million of free cash flow for FY23.

Comments

Click to enlarge

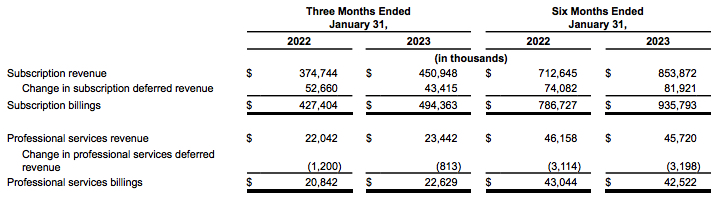

Revenue in 2FQ23 was $486 million, higher than guidance of $460 million to $470 million, and a growth rate of 18% Y/Y ad 10% Q/Q. Net income was not revealed.

ARR at the end of 2FQ23 was $1.378 billion, a yearly growth of 32%. New logo additions were about 480 in 2FQ23. Contract duration stayed flat Q/Q at 3 years as expected.

ACV billings in 3FQ23 was $268 million, higher than guidance of $245 million to $250 million and representing a Y/Y growth of 23%. The significant majority of that growth came from growth in renewals billings.

Rajiv Ramaswami, president and CEO, said: "We recently discovered that evaluation software from one of our 3rd-party providers was instead being used for interoperability testing, validation and customer proof of concept over a multiyear period. Our Audit Committee commenced an investigation into this matter, which is still ongoing with the assistance of outside counsel. I'd like to emphasize that we do not believe it will have a significant impact on the fundamentals of our business and overall prospects."

Rukmini Sivaraman, CFO, said: "We do not expect to be able to file our 10-Q on time or following the 5-day prescribed extension period allowed under 12b-25."

Last month, Nutanix reached an agreement to settle the outstanding securities class actions litigation, which is subject to documentation, notice to class members and court approval. It recorded a net charge of approximately $38 million for the settlement. This is the amount, inclusive of legal fees and expenses, net of company's expected recovery under its D&O insurance. The firm expects approximately $33 million to be paid and settled in 3FQ23, while the remainder was already paid for legal defense costs in previous quarters.

It ended 2FQ23 with cash, cash equivalents and short-term investments of $1.311 billion, down from $1.388 billion in 1FQ23.

It continues to expect to generate at least $300 million of free cash flow in FY25.

Revenue and loss of Nutanix

(in $ million)

| FY ended in July |

Revenue | Loss |

| 2012 | 6.6 | 14.0 |

| 2013 | 30.5 | 44.7 |

| 2014 | 127.1 | 84.0 |

| 2015 | 241.4 | 126.1 |

| 2016 | 444.9 | 168.5 |

| 2017 | 845.9 | 379.6 |

| 2018 | 1155 | 297.2 |

| 2019 | 1136 | 621.2 |

| 2020 | 1308 | 872.9 |

| 2021 |

1,394 | 1,034 |

| 1FQ22 |

378.5 | 419.9 |

| 2FQ22 |

413.1 | 115.1 |

| 3FQ22 |

403.7 | 111.6 |

| 4FQ22 |

385.5 | 151.0 |

| FY22 |

1,581 | 797.5 |

| 1FQ23 |

443.6 | 99.1 |

| 2FQ23 |

486.5 | NA |

| 3FQ23 (estim.) |

430-440 | NA |

| FY23 (estim.) |

1,800-1,810 | NA |

($238 million IPO in 2016)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter