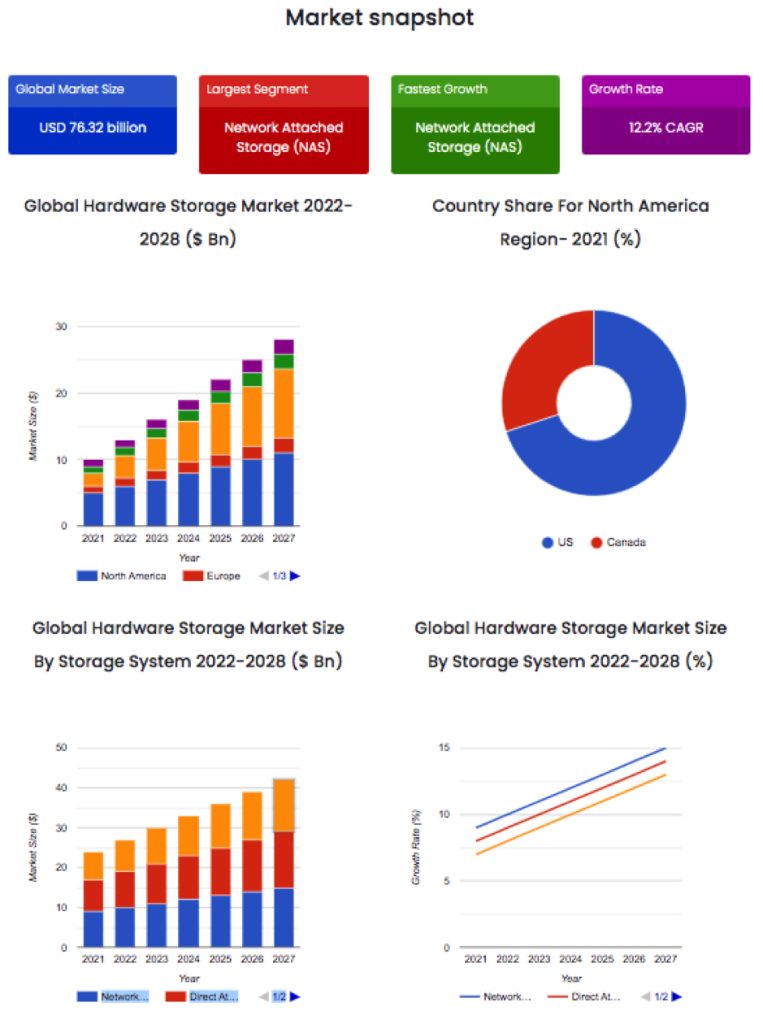

WW Hardware Storage Market Valued at $76 Billion in 2021, to Reach $171 Billion by 2028

CAGR of 12.2% over 2022-2028

This is a Press Release edited by StorageNewsletter.com on February 13, 2023 at 2:13 pmThis market report ($3,500), published on February 3, 2023, by SkyQuest Technology Group consulting firm.

Global Hardware Storage Market was valued at $76.32 billion in 2021, and it is expected to reach a value of $170.83 billion by 2028, at a CAGR of 12.2% over the forecast period (2022-2028).

The amount of data has increased in recent years. Emails, web pages, and other unstructured and disorderly data are used by the majority of enterprises. In order to achieve cost control and storage usage, storage has emerged as one of the major challenges for IT managers and business executives. The volume of stored data is growing, which drives up demand in the global industry. Furthermore, corporations and governmental entities are becoming more cognizant of the information protection system. Globally, the number of businesses has risen gradually over time as the economy has recovered. These new companies have proven to be prospective new clients for the storage vendors. In the near future, it is anticipated that this client base increase will fuel market expansion as a whole.

The need for storage facilities has increased along with the demand for more capacity due to the ever-growing size of documents. Upgrades to current systems and the creation of new technologies have been motivated by user demand. The demand for massive storage is about to spur technological innovation in the upcoming years. Along with the rising demand for stored data volume, customers have made significant concerns regarding data accessibility. As the working location is moved about more, data recovery is projected to be possible at any time, anyplace. Additionally, information security is a top need due to dangerous hacking techniques’ recent explosive expansion. Organizations regularly perform backups in order to lower the risk of data loss.

Because papers are getting more and bigger, there is a greater need for storage facilities and a greater need for capacity. User demand has driven the development of new technologies as well as improvements to existing ones. Technological advancement is about to be sparked in the future years by the desire for huge storage. Customers’ worries about data accessibility have grown along with the demand for stored data volume. Data recovery is anticipated to be possible whenever and wherever the working location changes. Information security is also urgently needed given the recent dramatic growth of harmful hacking tactics. To reduce the risk of data loss, organisations periodically perform backups. To keep their market share, large-scale players have been concentrating on innovation and new product development. This kind of competitive position offers chances for the expansion of the entire sector.

Global Hardware Storage Market Segmental Analysis

The Global Hardware Storage market is segmented based on Storage Architecture, Storage System, End-User, Storage Medium, and Region. Based on Storage Architecture, the market is segmented into File and Object-based Storage (FOBS), block btorage. Based on storage system, the market is segmented into NAS, DAS, and SAN. Based on end-user, the market is segmented into enterprise, government, cloud service providers, telecom, and others. Based on storage medium, the market is segmented into SSD, HDD, tape, and others. Based on region the global hardware storage market is segmented into North America, Europe, AsiaPac, South America, and MEA.

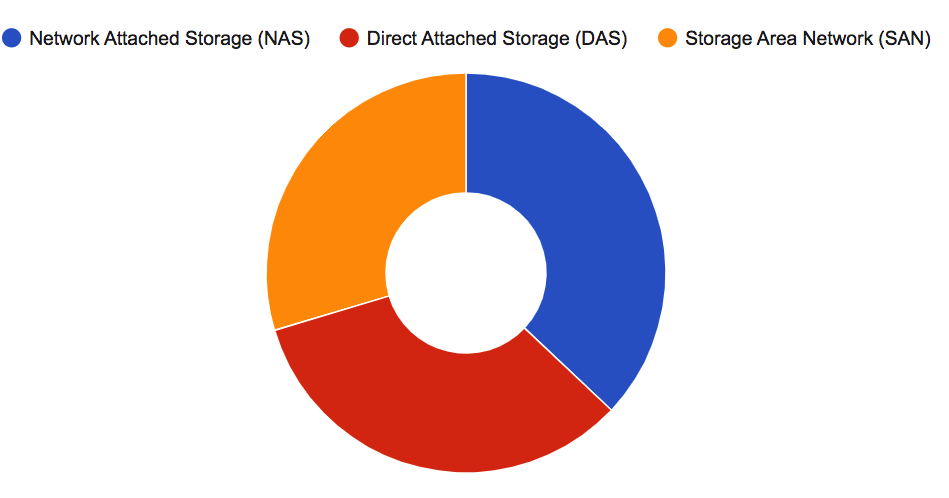

Analysis by Storage System

The NAS market dominates the hardware storage market. Due to their low cost, NAS-based systems are widely used in SMEs. NAS is primarily used in media sharing devices, allowing multiple server systems to access a common pool of data. Because of the increasing demand for backup and redundancy, the adoption of network-attached solutions is being driven primarily by an increase in hybrid and cloud storage deployment. Network-connected systems improve data manageability and expandability for storing and handling data. The growing popularity of smart connected and IoT devices like smartphones, tablet devices, and laptop computers has resulted in massive volumes of data which is expected to drive the segment over the forecast year.

Global Hardware Storage Market by Storage System, 2021 (%)

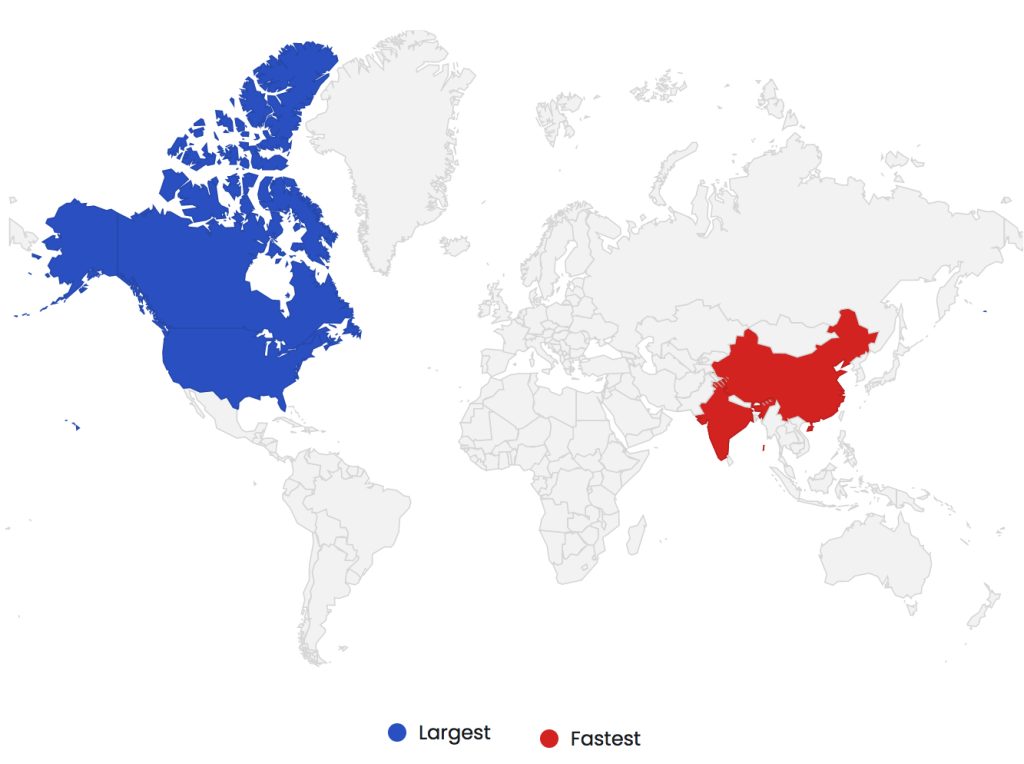

Global Hardware Storage Market Regional Insights

During the forecast period, North America is expected to have the largest market share. USA is a significant contributor to the region’s market growth. Popular US digital platforms such as Google, Facebook, and Amazon, among others, have a very strong market share all across the region. For instance, Google controls 90% of the global Internet search market; Facebook controls two-thirds of the global social media market and is the top social media platform in 90% of the world’s economies, and Amazon controls 40% of global e-commerce activity. These platforms rely heavily on digital data to provide their users with personalized services. Collecting such computer data (digital data) is therefore a basic requirement for them, and they collectively place a strong market for storage, both hardware, and software-based. Meanwhile, China is dominated by similar but domestically based companies such as Alibaba, WeChat (owned by Tencent), and others, all of which operate on data, thereby increasing demand for storage devices and facilities.

Over the forecast period, the AsiaPac hardware storage market is expected to grow. This increase is attributed to the region’s increased IT hardware spending. Furthermore, the implementation of data localization regulations has aided market growth. For instance, India implemented a cloud computing policy that required all government technology companies to store data in the country. This type of initiative from various countries’ governments is going to drive the market.

Global Hardware Storage Market By Geography, 2022-2028

Global Hardware Storage Market Dynamics

Driver

Growing Demand for Large Volumes of Digital Data to Support the Growth of the Hardware Storage Industry

Companies have become increasingly reliant on algorithms in recent years. Some examples of how companies use algorithms to provide goods and services to their target customers include Google notifying its customers about the newest news from around the world according to their previous searches, YouTube recommending YouTube content based on the types of content they have seen previously, and e-commerce websites popping up ads with a list of products that users had checked out previously.

These algorithms are based on a large amount of data. As a result, the growing need to store data for various purposes such as big data, AI, IoT, blockchain, cloud computing, and all Web services is a major driver of global industry growth. Demand is expected to increase as the digital economy grows. Furthermore, with the increasing popularity of smartphones and the culture of taking photos to capture memories, people are looking for computers that can efficiently store their data. Similarly, there is a strong desire for external drives in addition to the internal storage of their mobile phones, laptop computers, or other similar devices. These consumer characteristics are also expected to boost demand for global hardware storage during the forecast period.

Restraint

Concerns about cyber-attacks and data breaches on servers and HDDs are expected to stymie market growth.

Hardware storage device is a storage device that is connected to the device and provides file services. These devices include storage servers and file storage systems. This stored data is vulnerable to cyber security threats posed by cyber attackers. Privacy and data security are critical considerations for NAS arrays and hardware. Based on our study on the global hardware store market, analysts found that an approximated 240,000 Qnap NAS devices and approximately 3,500 Synology NAS devices were vulnerable to cyber-attacks in August 2021. 2nd off-recent incident was reported in September 2022, when Cisco confirmed that it was the victim of a cyberattack on May 24, 2022, after the attackers gained access to an employee’s personal Google account, which contained passwords synced from their web browser. Analysts also discovered that the cyber-attacks were carried out using the brute force technique. To avoid such attacks, Synology worked with the Taiwan computers emergency response team centre (TWCERT/CC). Synology raised awareness among all users as a result of this collaboration. This type of data security breach is expected to stymie that market growth over the forecast year.

Global Hardware Storage Market Competitive Landscape

To stay ahead of the competition, key players in the hardware storage market are expanding their product portfolios by leveraging innovative technologies. Despite this, many market participants are expanding their storage business by providing cloud solutions. Partnerships and collaborations are formed to broaden the product portfolio through the use of advanced technologies. Furthermore, key players are focusing on expanding their product portfolios to grow their businesses. For instance, NetApp Inc. acquired Talon Storage (US), a leader in next-gen SDS solutions, to enable global enterprises to centralize and consolidate IT storage infrastructure to public clouds.

Top Players:

- NetApp, Inc.

- Hewlett Packard Enterprise Company

- Hitachi, Ltd.

- Seagate Technology Public Limited Company

- Netgear, Inc.

- Buffalo Americas, Inc.

- Western Digital Corporation

- Synology, Inc.

- Dell Technologies

- Toshiba Corp.

Recent Development

In September 2022, Seagate introduces next-gen Exos X storage arrays with twice the performance and self-healing technology, powered by Seagate’s sixth-gen controller architecture. The new Exos X systems offer up to twice the performance of the previous gen as well as improved enterprise durability.

In September 2021, Amazon.com, Inc.’s subsidiary Amazon Web Service, Inc. collaborated with NetApp Inc. to make Ontap storage service with Amazon FSx managed file system available to the public. Customers could run fully managed NetApp ONTAP file systems in the cloud.

Global Hardware Storage Key Market Trends

The Covid-19 pandemic has hampered business operations in a variety of industries. To meet the growing demand for storage around the world, key suppliers are actively developing storage facilities. According to the Forbes report, an approximate 2.5 quintillion bytes of data will be generated each day in 2022, and the data is growing faster than Internet access adoption. In addition, with an increase in Internet traffic during the Covid-19 pandemic, demand for network-connected storage solutions increased. Based on Association for Computing Machinery Organization Report, European countries experienced a 20% increase in Internet traffic following the public announcement of the lockdown.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter