Backup and Recovery Software Solutions

Dell and Exagrid strong performers; Cohesity, Druva, Rubrik and Veritas customer's choices

This is a Press Release edited by StorageNewsletter.com on February 8, 2023 at 1:02 pmThis market report by Peer Contributors has been published by Gartner, Inc. on January 20, 2023.

Voice of Customer for Enterprise Backup and Recovery Software Solutions

What Are Enterprise Backup and Recovery Software Solutions?

According to Gartner’s definition: “Enterprise backup and recovery software solutions are designed to capture a point-in-time copy (backup) of enterprise workloads in on-premises, hybrid, multicloud and SaaS environments, and write the data to a secondary storage target for the purpose of recovering this data in case of loss.”

Backup and recovery solutions have several core capabilities:

- Backup and recovery of OSs, files, databases and applications in the on-premises data center

- Backup and recovery of public cloud infrastructure as a service (IaaS), platform as a service (PaaS) and SaaS data

- Creation of multiple copies of the backup to support resiliency in case of DR and other use cases

- Assigning multiple backup and retention policies that align with the organization’s recovery objectives

- Reporting success and failure of backup/recovery tasks

What Is Gartner Peer Insights “Voice of the Customer”?

The “Voice of the Customer” is a document that synthesizes Gartner Peer Insights’ reviews into insights for IT decision makers. This aggregated peer perspective, along with the individual detailed reviews, is complementary to Gartner expert research and can play a key role in your buying process, as it focuses on direct peer experiences of implementing and operating a solution. In this document, only vendors with 20 or more eligible published reviews (and 15 or more ratings for “Capabilities” and “Support/Delivery”) during the specified 18-month submission period are included. Reviews from vendor partners or end users of companies with less than $50 million in revenue are excluded from this methodology.

Along with the historical peer-based perspective represented in this document, the analyst firm has a related expert-led Magic Quadrant for the enterprise backup and recovery software solutions market.

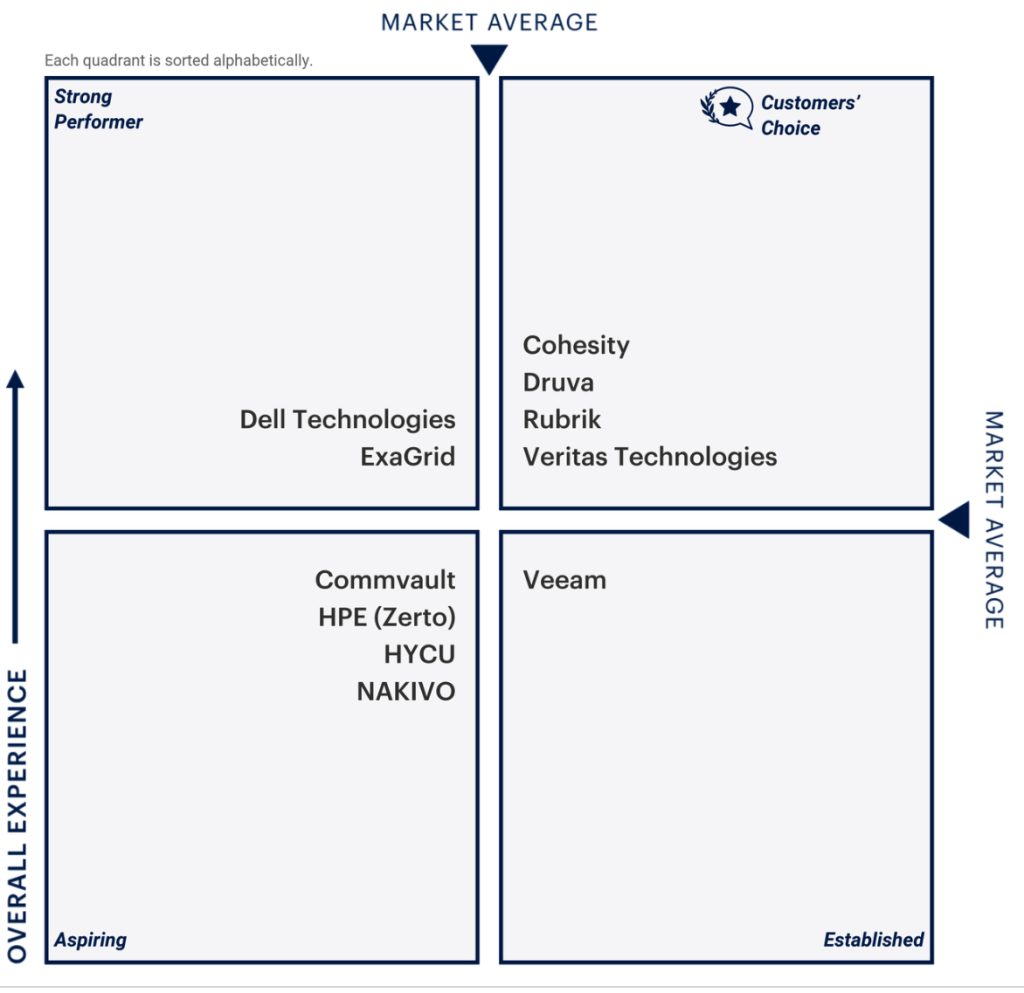

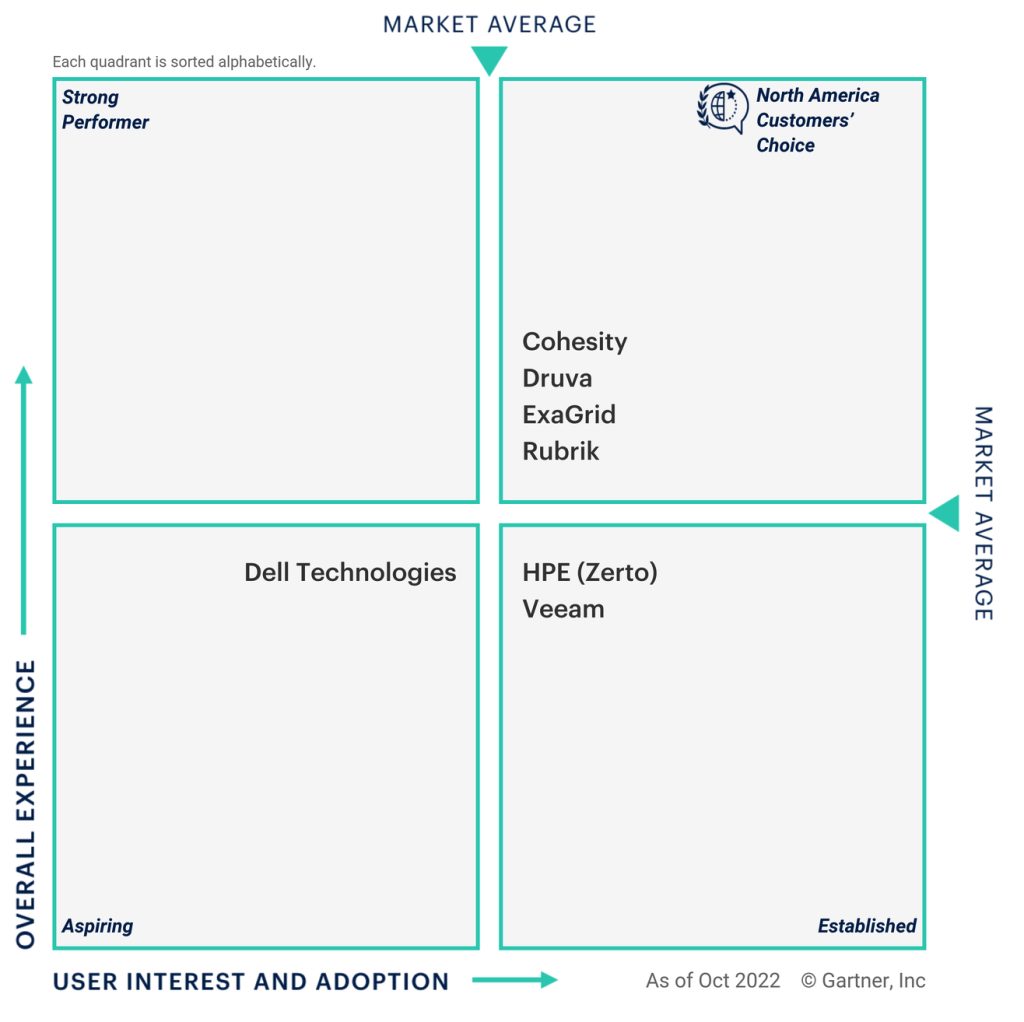

In the enterprise backup and recovery software solutions market, Peer Insights has published 1,844 reviews and ratings in the 18-month period ending October 31, 2022. Figure 1 shows all eligible vendors categorized into 4 quadrants based on User Interest and Adoption (X-axis) and Overall Experience (Y-axis). Within each quadrant, vendors are listed in alphabetical order.

Vendors’ User Interest and Adoption scores incorporate 3e factors, each given one-third weight: review volume, user willingness to recommend, and review market coverage across industry, company size, and deployment region. A vendor must meet or exceed the market average User Interest and Adoption Score to qualify for the right-hand quadrants.

Vendors’ Overall Experience is a composite score that incorporates the Overall Rating average and two sub-rating averages: “Capabilities” and “Support/Delivery.” The rating averages are the arithmetic means of the stated survey questions that are on a scale of 1 (poor) to 5 (truly exceptional). Each component is weighted in the score calculation based on the relative importance to the end user. A vendor must meet or exceed the market average Overall Experience Score to be positioned in an upper quadrant.

For ease of understanding, each quadrant is labelled as described below.

Vendors placed in the upper-right quadrant of the “Voice of the Customer” quadrants are recognized with the Peer Insights Customers’ Choice distinction, denoted with a Customers’ Choice badge. The recognized vendors meet or exceed both the market average Overall Experience and the market average User Interest and Adoption.

Vendors placed in the lower-right “Established” quadrant of the “Voice of the Customer” meet or exceed the market average User Interest and Adoption but do not meet the market average Overall Experience.

Vendors placed in the upper-left “Strong Performer” quadrant of the “Voice of the Customer” meet or exceed the market average Overall Experience but do not meet the market average User Interest and Adoption.

Vendors placed in the lower-left “Aspiring” quadrant of the “Voice of the Customer” meet neither the market average User Interest and Adoption nor the market average Overall Experience. Like all vendors in this report, their products align to this market and they have met the minimum criteria to be included.

Figure 1. Gartner Peer Insights Voice of the Customer Enterprise Backup and Recovery Software Solutions

Enterprise Backup and Recovery Software Solutions Peer Reviews and Ratings

In addition to the synthesis provided by the “Voice of the Customer,” you can read individual reviews and ratings on Peer Insights.

The rest of this document will highlight some key insights for the enterprise backup and recovery software solutions market based on 18 months of reviews, and will also point you to particular ways to use the site in your buying process.

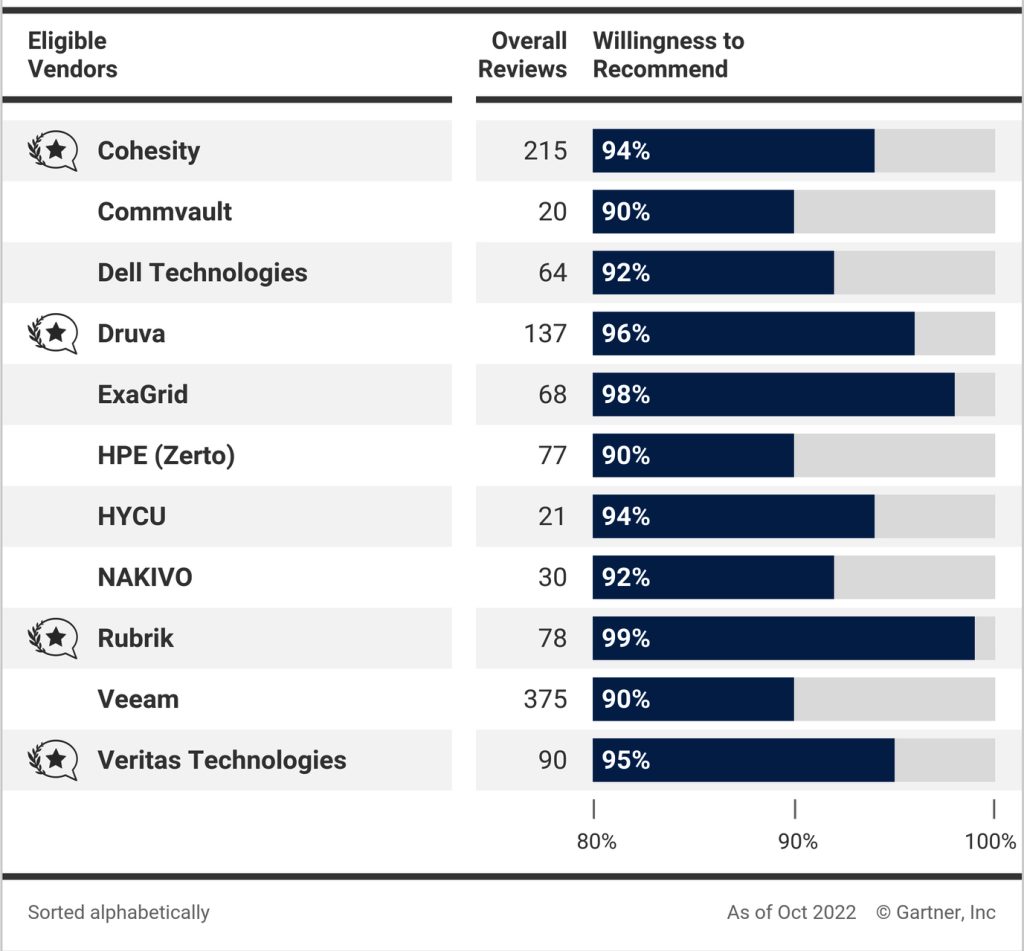

Peer Insights’ reviews give insight into end users’ willingness to recommend each vendor. Willingness to recommend is a component of the “Voice of the Customer” X-axis. Figure 2 compares vendors by the% of reviewers who were willing to recommend them.

Figure 2. Gartner Peer Insights “Voice of the Customer” Enterprise Backup and Recovery Software Solutions Willingness to Recommend

“Voice of the Customer” Segment view

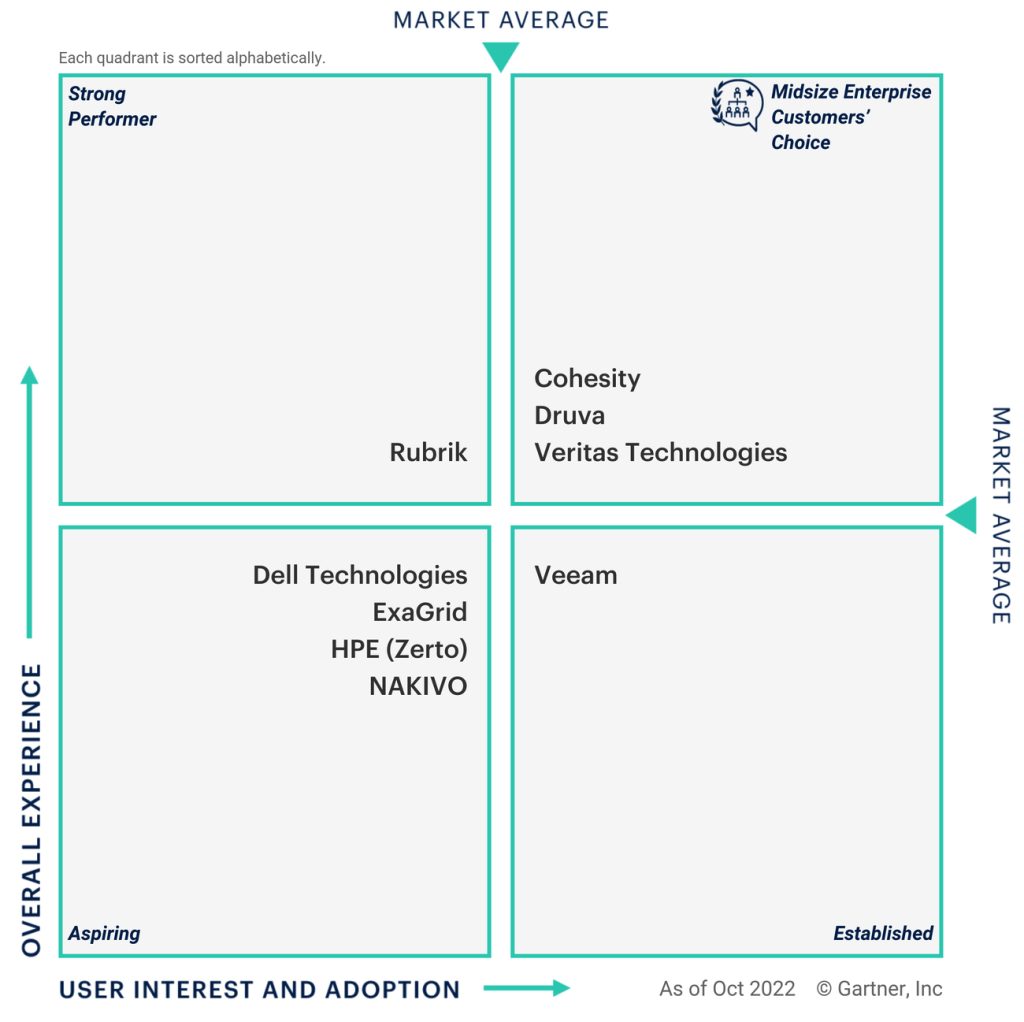

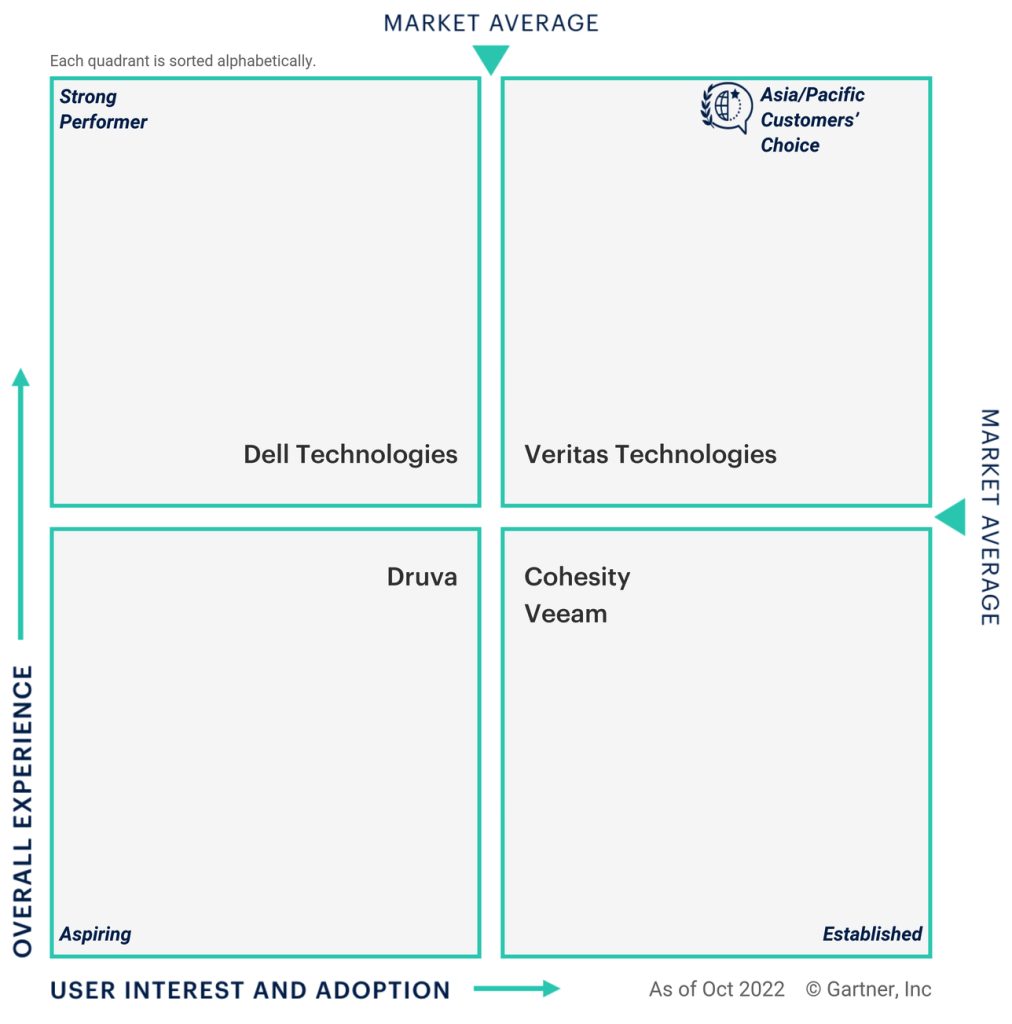

Figure 3 through Figure 5 group vendors in the market under a specific customer segment of industry, deployment region or company size based on the demographics of their reviewers.

Peer Insights collects this information from end users’ account profiles and submitted reviews. Only vendors with 20 or more eligible reviews (and 15 or more ratings for “Capabilities” and “Support/Delivery”) in the segment in the 18-month review period are included. For each segment, vendors are positioned based on the market average Overall Experience on the Y-axis and User Interest and Adoption on the X-axis. User Interest and Adoption is calculated from review count score and willingness to recommend (each weighted 50%). Only reviews from reviewers in the segment are included in the calculations for both axes. Review market coverage is not included in this calculation because each graph refers to one particular segment.

A vendor must meet or exceed the average User Interest and Adoption Score in the segment to qualify for the right-hand quadrants. A vendor must meet or exceed the average Overall Experience in the segment to be positioned in the upper quadrants. Both averages, for Overall Experience and User Interest and Adoption, are calculated using only reviews in the segment for vendors included on the graph.

Vendors placed in the upper-right quadrant of the segment quadrants are recognized through the Customers’ Choice Segment Distinction. The recognized vendors meet or exceed both the average Overall Experience and the average User Interest and Adoption for the segment).

Company Size Segment View (by annual revenue)

Figure 3. Peer Insights Voice of the Customer Enterprise Backup and Recovery Software Solutions Midsize Enterprise ($50 million-$1 billion)

Deployment Region Segment View

Figure 4. Peer Insights Voice of the Customer Enterprise Backup and Recovery Software Solutions AsiaPac

Figure 5. Peer Insights Voice of the Customer Enterprise Backup and Recovery Software Solutions North America

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter