SK hynix: Fiscal 4Q22 Financial Results

SK hynix: Fiscal 4Q22 Financial Results

Sales down 38% Y/Y and first net loss in 3 years

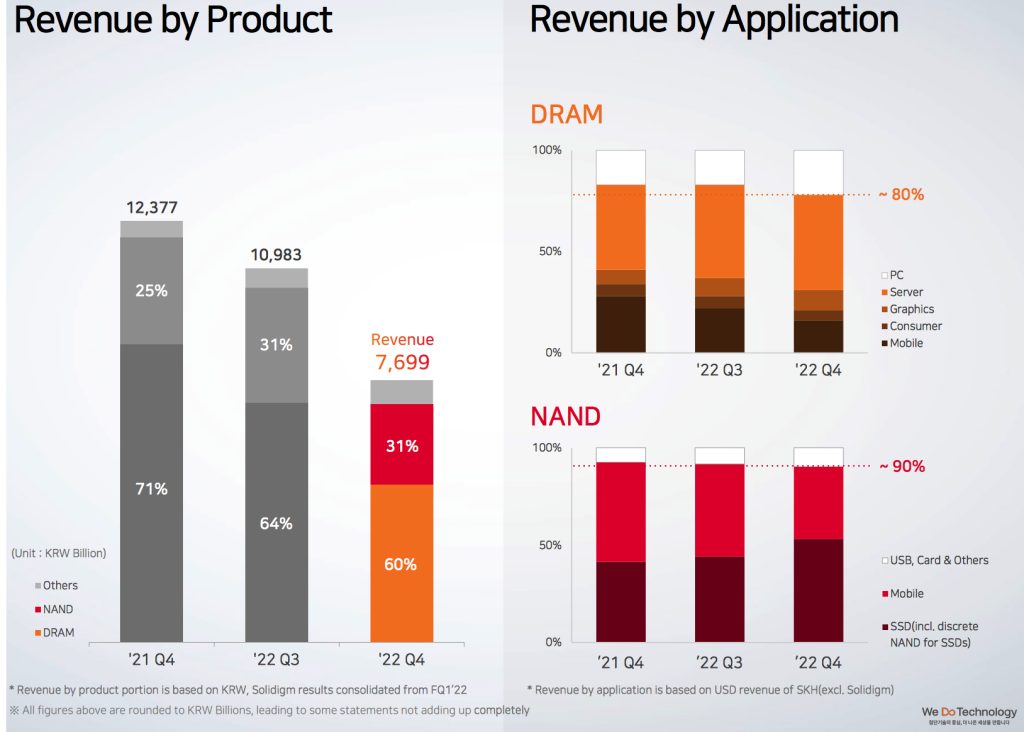

This is a Press Release edited by StorageNewsletter.com on February 2, 2023 at 2:02 pm| (in billion KRW) | 4Q21 | 4Q22 | FY21 | FY22 |

| Revenue | 12,377 | 7,699 | 42,998 | 44,648 |

| Growth | -38% | 4% | ||

| Net income (loss) | 3,320 | (3,524) | 9,616 | 2,439 |

SK hynix Inc. reported financial results for 2022 ended on December 31.

It recorded revenues of 44.648 trillion won for FY22, an operating profit of 7.007 trillion won and a net income of 2.439 trillion won. Operating and net profit margin for the full year was 16% and 5%, respectively.

“Revenues continued to grow last year, but the operating profit decreased compared with a year earlier as the industry entered into a downturn from the second half,” the company said. “With uncertainties still lingering, we will continue to reduce investments and costs, while trying to minimize the impact of the downturn by prioritizing markets with high growth potential.”

In 2022, the firm increased high-capacity DRAM shipments for server/PC markets, while boosting sales of DDR5 and HBM – of which products that the company has a market leadership – to customers in the growing markets of AI, big data, and cloud computing.

Particularly, revenues for the data center SSD more than quadrupled compared with a year earlier.

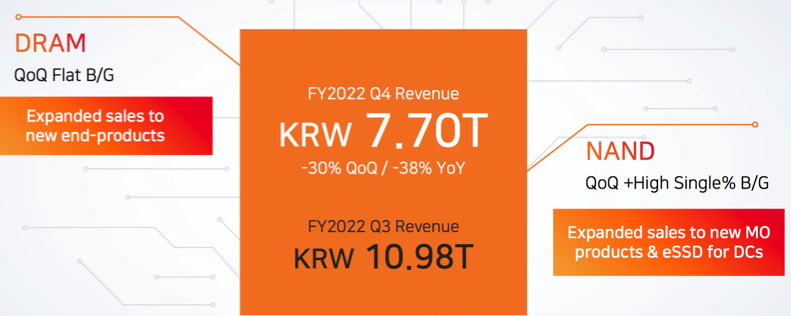

However, SK hynix recorded an operating loss in 4FQ22 due to weak demand and a sharp fall in memory-chip prices.

The revenues for 4FQ22 on a consolidated basis were 7.699 trillion won, while the operating loss amounted to 1.701 trillion won (operating loss ratio at 22%) and net loss was at 3.524 trillion won (net loss ratio at 46%). The latest result was the first quarterly operating loss since 3FQ12.

“Despite a deeper industry downturn in the first half, SK hynix forecasts market conditions to gradually improve into the latter part of the year,” the company said. “Industry experts do not expect an increase in supply of memory chips as market players are planning to reduce investments and production, which will lead the inventories to peak within the first half.“

In addition, the manufacturer forecasts a gradual recovery in demand as global tech companies start to adopt more memory chips as the prices are low.

“Intel’s launch of new server CPU adopting DDR5 and apparent positive signs of demand for new AI-based server memory chips bode well for a quick business turnaround,” CFO Kim Woohyun said. “With the world’s best technologies for DDR5 for data centers and 176-layer NAND flash-based enterprise SSD, we expect to see a quick turnaround when the market bottoms out.“

SK hynix will stay with the decision announced in October to more than halve the volume of investments compared with 19 trillion won in 2022. However, investments for mass production of mainstream products such as DDR5, LPDDR5, and HMB3 and markets with growth potential will be continued.

“A successful overcome of the current downturn will help us strengthen fundamental business competitiveness before eventually leaping forward as a leading technology company,” Woohyun said.

Comments

One of the biggest WW storage company reports revenue of KRW 7,699 billion, down 38% Y/Y and 30% Q/Q. For the former quarter, it was down 20% Q/Q and 7% Y/Y.

It recorded its first quarterly net loss in 3 years.

DRAM

- Increased sales of high density products for PV/SV

- Stronger sales and validation activities of products with high-growth potential, such as DDR5/HBM

- Maintained industry-leading position in HBM

- Flexible shipment growth to meet market demand growth in 2023

- Double digit percentage to decrease Q/Q in 1FQ23

NAND

- Improved cost-competitiveness for 176L products by quick ramp-up

- eSSD sales grew x4 Y/Y, through strengthened product competitiveness and wider customer base

- 176L, 60% of total NAND production by 2022 year and

- Secure readiness for 238L mass production by mid-23

Maintain critical investments for ramp-up of new products (DDR5/LPDDR5/HBM3), as well as investment in R&D/infrastructure to prepare for future growth

- Maximize equipment efficiency, and maintain throughout upturn

- Reduction of wafer starts of legacy and low-margin products in 4FQ22, expect FY23 DRAM/NAND wafer output to decline Y/Y

- Negative production bit growth for DRAM in 2023, and limited growth for NAND

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter