Micron: Fiscal 1Q23 Financial Results

Horrific quarter, next one not to be better, cutting 10% of workforce

This is a Press Release edited by StorageNewsletter.com on December 23, 2022 at 2:02 pm| (in $ million) | 1Q22 | 1Q23 | Growth |

| Revenue |

7,687 | 4,085 | -47% |

| Net income (loss) | 2,306 | (195) |

Micron Technology, Inc. announced results for its first quarter of fiscal 2023, which ended December 1, 2022.

1FQ23 highlights

• Revenue of $4.09 billion vs. $6.64 billion for the prior quarter and $7.69 billion for the same period last year

• GAAP net loss of $195 million, or $0.18 per diluted share

• Non-GAAP net loss of $39 million, or $0.04 per diluted share

• Operating cash flow of $943 million vs. $3.78 billion for the prior quarter and $3.94 billion for the same period last year

“Micron delivered fiscal first quarter revenue and EPS within guidance ranges despite challenging conditions during the quarter,” said president and CEO Sanjay Mehrotra. “Micron’s strong technology, manufacturing and financial position put us on solid footing to navigate the near-term environment, and we are taking decisive actions to cut our supply and expenses. We expect improving customer inventories to enable higher revenue in the fiscal second half, and to deliver strong profitability once we get past this downturn.”

Investments in capital expenditures, net were $2.47 billion for 1FQ23, which resulted in adjusted free cash flows of negative $1.53 billion. The company repurchased approximately 8.6 million shares of its common stock for $425 million during 1FQ23 and ended the quarter with cash, marketable investments, and restricted cash of $12.08 billion, for a net cash position of $1.81 billion. Board of directors has declared a quarterly dividend of $0.115 per share, payable in cash on January 19, 2023, to shareholders of record as of the close of business on January 3, 2023.

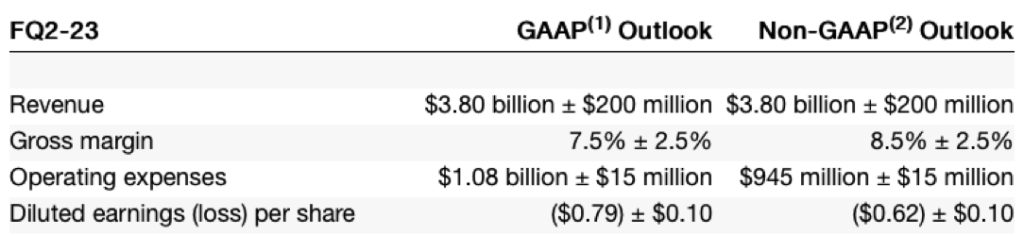

Outlook for 2FQ23

Comments

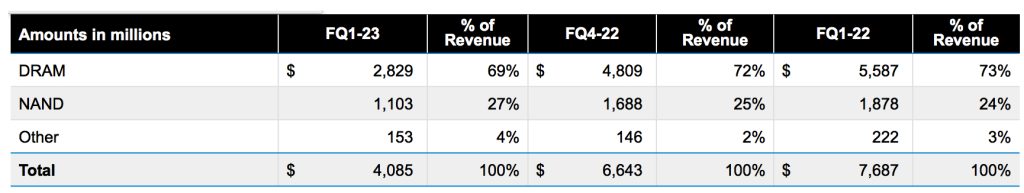

Total 1FQ23 revenue was $4.085 billion, down 39% Q/Q and 47% Y/Y, in the low end of guidance ($4.0 billion and $4.5 billion).

The firm explains that the industry is experiencing the most severe imbalance between supply and demand in both DRAM and NAND in the last 13 years.

DRAM

1FQ23 DRAM revenue was $2.8 billion, representing 69% of total revenue, declining 41% Q/Q, with bit shipments decreasing in the mid-20% range and prices declining in the low-20% range.

NAND

1FQ23 NAND revenue was $1.1 billion, representing 27% of total revenue, declining 35% Q/Q, with bit shipments declining in the mid-teens percentage range and prices declining in the low-20% range.

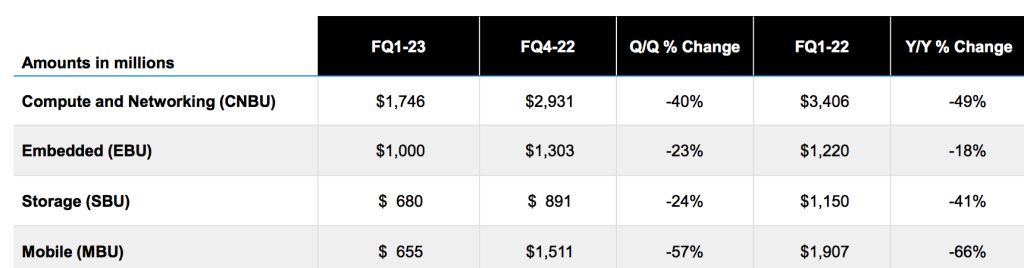

1FQ23 revenue by business unit

Compute and networking business unit revenue was $1.7 billion with weakness across client, data center, graphics, and networking.

Embedded business unit revenue was $1.0 billion with automotive staying stronger than consumer and industrial markets.

Storage business unit revenue was $680 million, while QLC mix increased to a new high.

Mobile business unit revenue was $655 million, a low level partly due to the timing of shipments between 1FQ23 and 2FQ23.

Technology

1fl DRAM node, introduced in 1FQ23, delivers around a 15% power efficiency improvement and more than a 35% bit density improvement vs. 1-alpha. 1fl will be used across firm's product portfolio including DDR5 (D5), LP5, HBM and graphics.

End markets

Across nearly all of our end markets, revenues declined sequentially in 1FQ23 due to weaker demand and steep decline in pricing.

Data Center

In data center, the company expects cloud demand for memory in 2023 to grow well below the historical trend due to the significant impact of inventory reductions at key customers.

In data center SSDs, it is continuing to proliferate its 176-layer SSD, and in 1FQ23, nearly doubling the number of customers qualified. It has also completed qualification of its 176-layer QLC with an important enterprise customer.

Customer inventory, which is impacting near-term demand, is expected to continue improving, and the firm expects most customers to have reduced inventory to relatively healthy levels by mid-calendar 2023.

Consequently, the manufacturer expects 2FH23 revenue to improve vs. 1FH23.

PC

In PCs, it now forecasts calendar 2022 units to decline in the high-teens percentage and expect 2023 PC unit volume to decline by low to mid single-digits percentage, to near-2019 levels. Client D5 adoption is expected to gradually increase through calendar 2023 with crossover in mid-calendar 2024, and the company is well-positioned for this transition with leading D5 products.

Outlook

Micron expects calendar 2022 industry bit demand growth in the low to mid single-digit percentage range for both DRAM and NAND. For calendar 2023, it expects industry demand growth of approximately 10% in DRAM and around 20% in NAND. For both years, demand in DRAM and NAND is well below historical trends and future expectations of growth, largely due to reductions in end demand in most markets, high inventories at customers, the impact of the macroeconomic environment, and the regional factors in Europe and China.

The firm expects revenue to be $3.8 billion, plus or minus $200 million or -2% to -12% Q/Q.

It is taking a number of decisive actions in this environment to align supply with demand and to protect our balance sheet.

First, it is reducing Capex investments to reduce bit supply growth in 2023 and 2024

Second, it has reduced near-term bit supply through a sharp reduction in wafer starts. As previously announced, it reduced wafer starts for DRAM and NAND by approximately 20%.

Third, in response to the decline in expected long-term CAGR for DRAM and NAND bit growth, it is slowing the cadence of our process technology node transitions.

Fourth, it is taking significant steps to reduce costs and operating expenses. It projects spending to decrease through the year, driven by reductions in external spending, productivity programs across the business, suspension of a 2023 bonus companywide, select product program reductions and lower discretionary spend. Executive salaries are also being cut for the remainder of fiscal 2023, and over the course of calendar year 2023, Micron is reducing headcount by approximately 10% through a combination of voluntary attrition and personnel reductions.

NAND revenue only

| Period | Revenue in $ million |

Q/Q or Y/Y change for FY |

% of global revenue |

| FY19 | 5,335 | NA | 23% |

| 1FQ20 | 1,422 | 18% | 28% |

| 2FQ20 | 1,514 | 6% | 32% |

| 3FQ20 | 1,665 | 10% | 31% |

| 4FQ20 | 1,530 | -8% | 25% |

| FY20 | 6,131 | 14% | 29% |

| 1FQ21 | 1,574 | 3% | 27% |

| 2FQ21 | 1,650 | 5% | 26% |

| 3FQ21 | 1,812 | 10% | 24% |

| 4FQ21 | 1,971 | 9% | 21% |

| FY21 | 7,007 | 14% | 25% |

| 1FQ22 | 1,878 | -5% | 24% |

| 2FQ22 | ∼2,000 | 6% | 25% |

| 3FQ22 | 2,300 | 11% | 26% |

| 4FQ22 | 1,688 | -26% | 25% |

| FY22 | 7,811 | 11% | 25% |

| 1FQ23 |

1,103 |

-35% | 27% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter