Commvault: Fiscal 2Q23 Financial Results

Commvault: Fiscal 2Q23 Financial Results

Sales down 5% Q/Q and up 6% Y/Y

This is a Press Release edited by StorageNewsletter.com on November 3, 2022 at 2:12 pm| (in $ million) | 2Q22 | 2Q23 | 6 mo. 22 | 6 mo. 23 |

| Revenue | 177.8 | 188.1 | 361.3 | 386.0 |

| Growth | 6% | 7% | ||

| Net income (loss) | 1.7 | 4.5 | 15.6 | 8.0 |

Commvault Systems, Inc. announced its financial results for the second quarter ended September 30, 2022.

“Our 2FQ23 record results and double-digit constant currency growth reinforce that customers see the value of Commvault’s software and SaaS solutions,” said Sanjay Mirchandani, president and CEO. “We believe our comprehensive data protection portfolio has never been more important in today’s increasingly difficult world.“

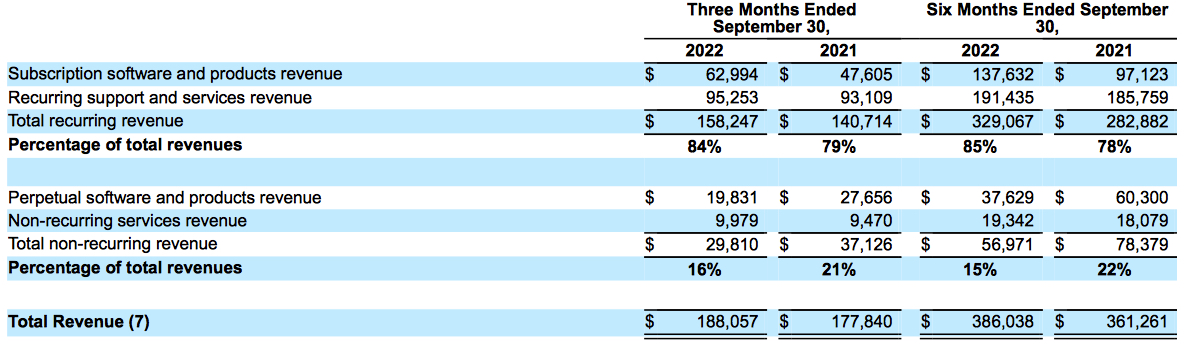

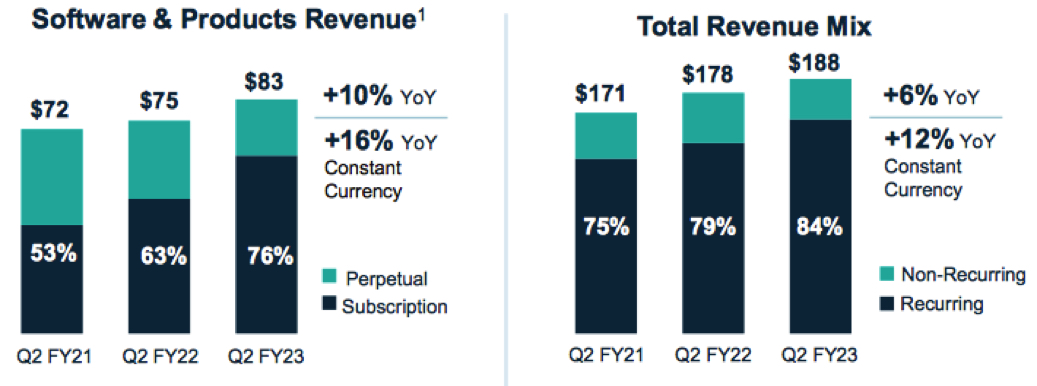

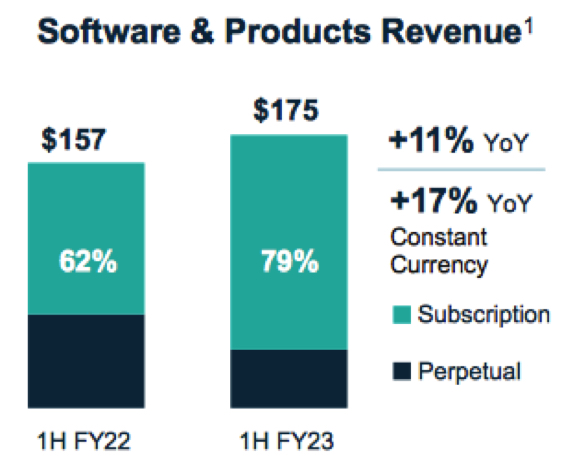

Total revenues for 2FQ23 were $188.1 million, a Y/Y increase of 6%. On a Y/Y constant currency basis, total revenue growth would have been 12%. Total recurring revenue was $158.2 million, an increase of 12% Y/Y. On a Y/Y constant currency basis, total recurring revenue growth would have been 19%. Recurring revenue represented 84% of total revenue.

Annualized recurring revenue (ARR), which is the annualized value of all active recurring revenue streams at the end of the reporting period, was $604.4 million as of September 30, 2022, up 11% from September 30, 2021. On a Y/Y constant currency basis, ARR growth would have been 18%.

Software and products revenue was $82.8 million, a Y/Y increase of 10%. The yearly increase in software and products revenue was driven by an 18% increase in larger deals (deals with greater than $0.1 million in software and products revenue). On a Y/Y constant currency basis, software and products revenue growth would have been 16%.

Larger deal revenue represented 72% of software and products revenue in 2FQ23. The number of larger deal revenue transactions was 173 for 2FQ22, compared to 163 for 2FQ21. The average dollar amount of larger deal revenue transactions was approximately $346,000, representing an 11% increase from the prior year.

Services revenue in 2FQ23 was $105.2 million, an increase of 3% Y/Y. Services revenue continues to grow primarily due to the increase in Metallic.

On a GAAP basis, income from operations (EBIT) was $9.3 million for 2FQ23 compared to $2.3 million in 1FQ23. Non-GAAP EBIT was $35.4 million in the quarter compared to $31.0 million in the prior year.

Operating cash flow totaled $49.8 million for 2FQ23 compared to $26.1 million in 1FQ23. Total cash was $262.5 million as of September 30, 2022 compared to $267.5 million as of March 31, 2022.

During 2FQ23, the company repurchased approximately 703,000 shares of its common stock totaling $39.9 million at an average price of approximately $56.74 per share.

Comments

At $188 million, revenue is up 6% Y/Y and down 5% Q/Q, with increasing yearly net income. Last quarter, expectations for 2FQ23 was between $184 million and $188 million in sales.

Software and products sales are up 10% Y/Y at $82 million, a growth driven by strength in the Americas and continued success in winning large transactions.

1 does not include SaaS revenue

Subscription software revenue increased 32% Y/Y to $63 million and represented 76% of total software revenue, which compares to 63% of total software revenue in 2FQ22.

The company ended the quarter with over 2,500 Metallic customers. In 2FQ23, 70% of Metallic customer additions were new. Half of those have another Commvault product and one-third have multiple Metallic offerings. Metallic SaaS offerings surpass 75 million in ARR in less than 2 years.

Americas region increased 20%, driven by large new customer transactions.

Outlook

The firm expects an additional $4 million of headwind on total revenues. As a result, it now expect 3FQ23 total revenues in the range of $202 million to $205 million, representing up 7% Q/Q and 0% Y/Y, and 9% Q/Q and 1% Y/Y, respectively. At the midpoint of guidance, this represents 7% constant currency total revenue growth.

Considering current foreign exchange rates, Commvault expects 3FQ23 software revenue in the range of $97 million to $100 million. On a constant currency basis, the midpoint of software revenue guidance would be up 7% Y/Y.

Revenue and net income (loss) in $ million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| FY18 | 699.4 | 8% | (61.9) |

| FY19 | 711.1 | 2% |

3.6 |

| FY20 |

670.9 |

-6% |

(5.6) |

| FY21 | 723.5 | 8% | (31.0) |

| 1FQ22 |

183.4 | 6% | 13.9 |

| 2FQ22 |

177.8 | 4% | 1.7 |

| 3FQ22 | 202.4 | 8% | 10.0 |

| 4FQ22 | 205.9 | 8% | 8.0 |

| FY22 | 769.6 | 6% | 33.6 |

| 1FQ23 | 198.0 | 8% | 3.5 |

| 2FQ23 | 188.1 | 6% | 4.5 |

| 3FQ23 (estim.) | 202-205 | 0%-1% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter