SK hynix: Fiscal 3Q22 Financial Results

SK hynix: Fiscal 3Q22 Financial Results

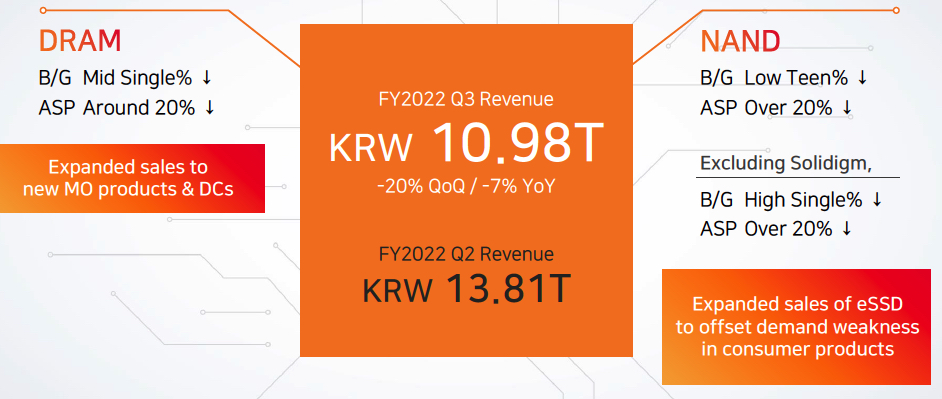

Sluggish demand for DRAM and NAND products

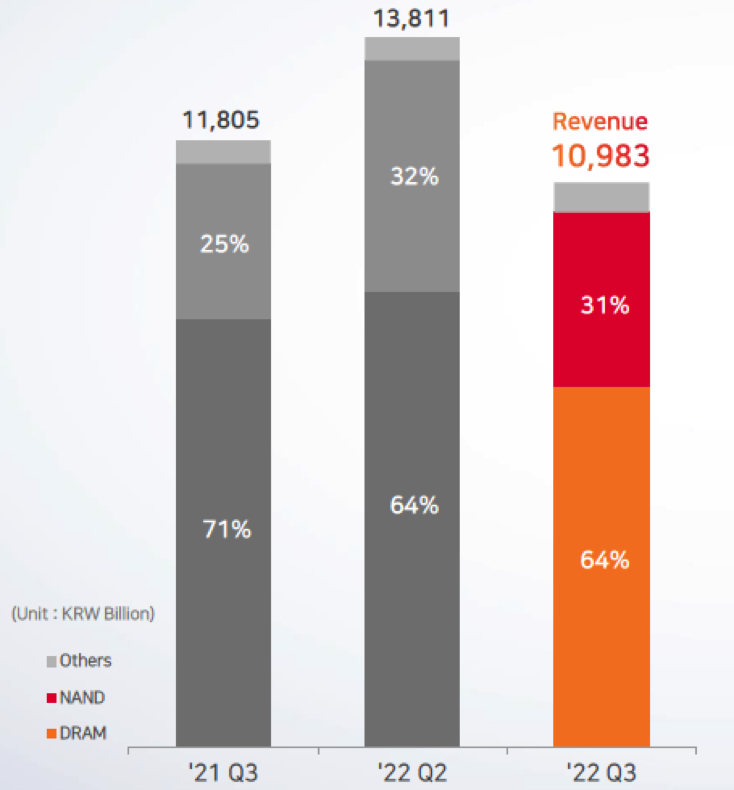

This is a Press Release edited by StorageNewsletter.com on October 26, 2022 at 2:03 pm| (in won billion) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 11,805 | 10,983 | 29,799 | 36,950 |

| Growth | -7% | 24% | ||

| Net income (loss) | 3,315 | 1,103 | 6,296 | 5,933 |

Highlights

- Quarterly revenue of 10.98 trillion won, operating profit of 1.66 trillion won, net profit of 1.1 trillion won

- Sales and profits reduced Q/Q due to decreasing demand and price of memory chips

- Will reduce investment in 2023 by more than 50% Y/Y, while reducing production volume focusing on less profitable products

- While focusing on server DRAMs, SK hynix is prepared to mass-produce the latest products and increase profitability

SK hynix Inc. reported revenue of 10.98 trillion won, operating profit of 1.66 trillion won (with OP margin of 15%), and net income of 1.1 trillion won (with net income margin 10%) in 3FQ22. Sales and operating profits decreased 20.5%, 60.5% respectively Q/Q.

By comparison, the company reported 13.81 trillion won in revenue, 4.19 trillion won in operating profit, and net income 2.88 trillion won in 2FQ22.

It analyzed that revenues fell Q/Q as both sales volume and price decreased due to sluggish demand for DRAM and NAND products amid worsening macroeconomic environment worldwide. In addition, it explained that despite the company improved cost competitiveness by increasing the sales proportion and yield of the latest 1anm DRAM and 176-layer 4D NAND, operating profit also decreased due to greater price drop than cost reduction.

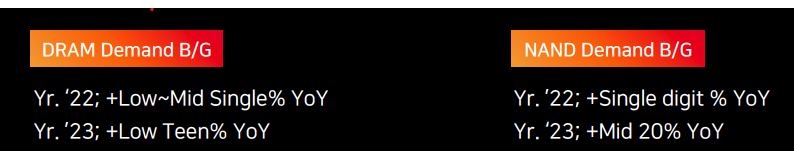

It diagnosed that the semiconductor memory industry is facing an unprecedented deterioration in market conditions as uncertainties in the business environment continued. The deterioration occurred as the shipments of PCs and smartphone manufacturers, which are major buyers of memory chips, have decreased.

However, the firm anticipated that the demand for memory chips in datacenter servers, while decreasing in the short term, will continue to grow in the mid- to long-term perspective, as hyperscale data centers are continuing their investment to meet the increasing scale of industries such as AI, big data and metaverse. It emphasized that as it is leading the latest DRAM technologies such as high bandwidth products including high bandwidth memory 3 (HBM3) and DDR5/LPDDR5, it will solidify its position in terms of long-term growth.

In addition, it will expand mass production of 238-layer 4D NAND next year, which was developed in 3CQ22, and by doing so secure cost competitiveness and increase profitability continuously.

Meanwhile, it predicted that supply will continue to exceed demand for the time being. Given such consideration, it has decided to reduce its investment next year by more than 50% Y/Y. The current year’s investment is expected to be at the upper range of 10-20 trillion won.

The vendor plans to gradually reduce production volume focusing on relatively less profitable products. The plan is to normalize the market’s supply and demand balance by maintaining such tendency in investment and production reduction for a certain period of time.

“We will leap forward as a leading semiconductor memory player by overcoming this downturn based on our potential that has always turned crises into opportunities in the past,” said Kevin (Jongwon) Noh, CMO.

Comments

Revenue of the big Korean DRAM and NAND company is down 20% Q/Q and -7% Y/Y.

Revenue analysis

Revenue by products

Market outlook

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter