Pure Storage: Fiscal 2Q23 Financial Results

Pure Storage: Fiscal 2Q23 Financial Results

Revenue up 30% Y/Y and 4% Q/Q, finally profitable

This is a Press Release edited by StorageNewsletter.com on September 1, 2022 at 2:02 pm| (in $ million) | 2Q22 | 2Q23 | 6 mo. 22 | 6 mo. 23 |

| Revenue | 496.8 | 646.8 | 909.5 | 1,267 |

| Growth | 30% | 39% | ||

| Net income (loss) | (45.3) | 10.9 | (129.5) | (0.6) |

Pure Storage, Inc. announced financial results for its fiscal second quarter ended August 7, 2022.

“Pure saw continued growth and solid market share gains as our expanding portfolio of industry leading products and services are recognized and embraced by more and more enterprises around the world,” said Charles Giancarlo, chairman and CEO. “Customers struggling with their ability to manage their exploding volumes of data look to Pure for simple, automated solutions.”

2FQ23 Highlights

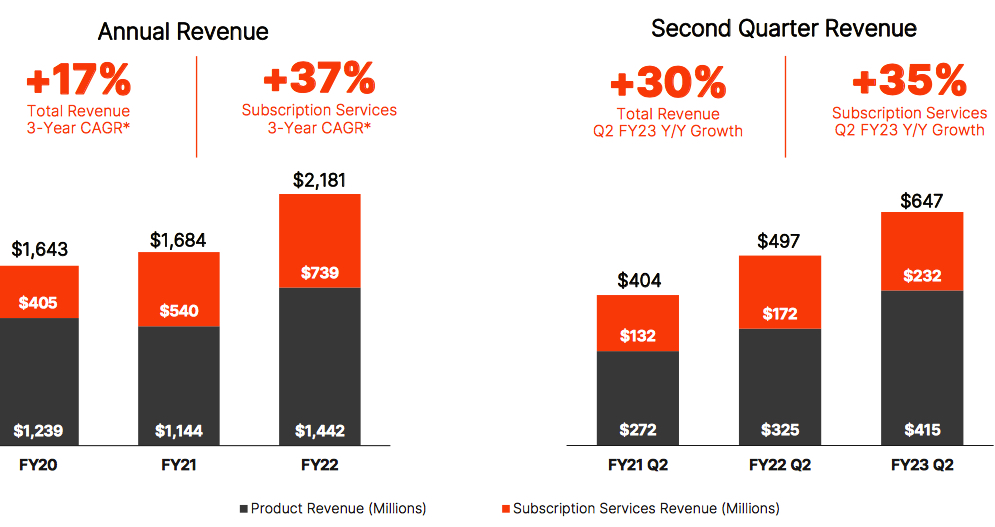

• Revenue $646.8 million, up 30% Y/Y

• Subscription services revenue $232.2 million, up 35% Y/Y

• Subscription Annual Recurring Revenue (ARR) $955.3 million, up 31% Y/Y

• Remaining Performance Obligations (RPO) $1.5 billion, up 25% Y/Y

• GAAP gross margin 68.6%; non-GAAP gross margin 70.4%

• GAAP operating income $14.4 million; non-GAAP operating income $106.0 million

• GAAP operating margin 2.2%; non-GAAP operating margin 16.4%

• Operating cash flow $159.4 million; free cash flow $134.2 million

• Total cash, cash equivalents, and marketable securities $1.36 billion

• Returned approximately $61 million in 2FQ23 to stockholders, repurchased 2.4 million shares

“We are pleased to again deliver strong revenue growth and profitability in 2FQ23,” said Kevan Krysler, CFO. “We are helping our customers navigate a dynamic and challenging environment as we continue our track record of delivering highly performant solutions within our normal lead times, requiring less energy and space than other storage alternatives.“

Guidance

3FQ23

Revenue: approx. $670 million

Non-GAAP operating income: $85 million

Non-GAAP Operating Margin: approx. 12.7%

FY23

Revenue: approx. $2.75 billion

Non-GAAP operating income: $390 million

Non-GAAP operating margin: approx. 14%

Comments

Total revenue for the quarter grew 30% to $646.8 million, as $635 million was expected at the end of 1FQ23, and the firm is back to profit with net income of $10.9 million.

Product revenue grew 28% and subscription services revenue grew approximately 35% representing approximately 36% of total revenue.

The ≠1 WW company in AFA only reports solid performance of Evergreen subscription offerings and Portworx. Subscription ARR grew 31% Y/Y to $955 million

New FlashBlade//S saw strong broad-based customer demand and sales with initial deployments. The expanded FlashBlade family broadens market opportunities and more than doubles the performance at less than a third of the energy consumption per terabyte of the prior gen.

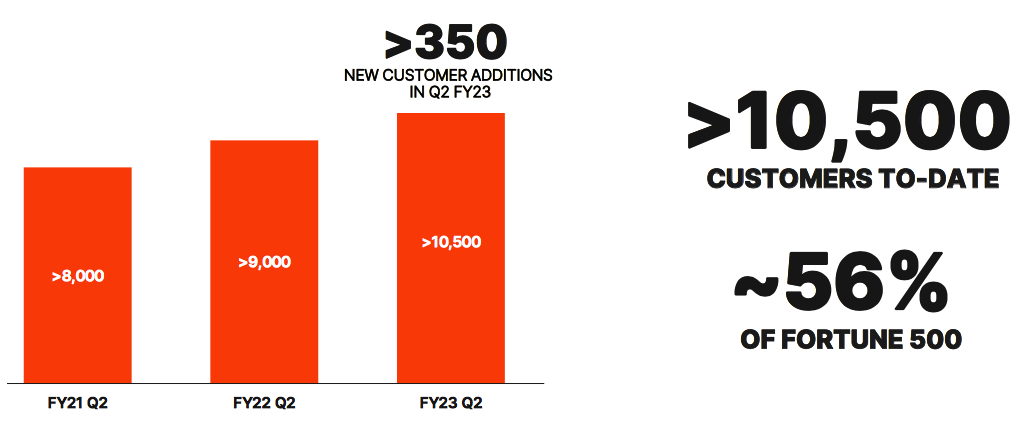

Pure added more than 350 new customers this past quarter and 56% of the US Fortune 500 customers.

US business continues to deliver strong revenue growth, growing 31% with particular strength this quarter in both commercial and public sector. Revenue growth of 29% from international business was also strong even with Fx headwinds due to the strengthening of the US dollar.

Headcount has increased to 4,600 employees.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

| 3F21 |

410,.6 | -4% |

(74.2) |

| 4F21 |

502.7 | 2% |

(52.2) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 |

412.7 | 12% |

(84.2) |

| 2F22 |

496.8 | 23% |

(45.3) |

| 3F22 |

562.7 | 29% |

(28.7) |

| 4F22 |

708.6 | 41% |

14.9 |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23 | 620.4 | 50% |

(11.5) |

| 2F23 |

646.8 | 30% |

10.9 |

| 3F23* |

∼670 | ∼19% | NA |

| FY23* |

∼2,750 |

∼26% |

NA |

* Estimations

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter