Marvell: Fiscal 2Q23 Financial Results

Marvell: Fiscal 2Q23 Financial Results

Demand from HDD market weakened but revenue from consumer SSD controllers continues to grow Q/Q and Y/Y.

This is a Press Release edited by StorageNewsletter.com on August 26, 2022 at 2:04 pm| (in $ million) | 2Q22 | 2Q23 | 6 mo. 22 | 6 mo. 23 |

| Revenue | 1,076 | 1,517 | 1,908 | 2,964 |

| Growth | 41% | 155% | ||

| Net income (loss) | (276.4) | 4.3 | (364.6) | (161.4) |

Marvell Technology, Inc. reported financial results for the second quarter of fiscal year 2023.

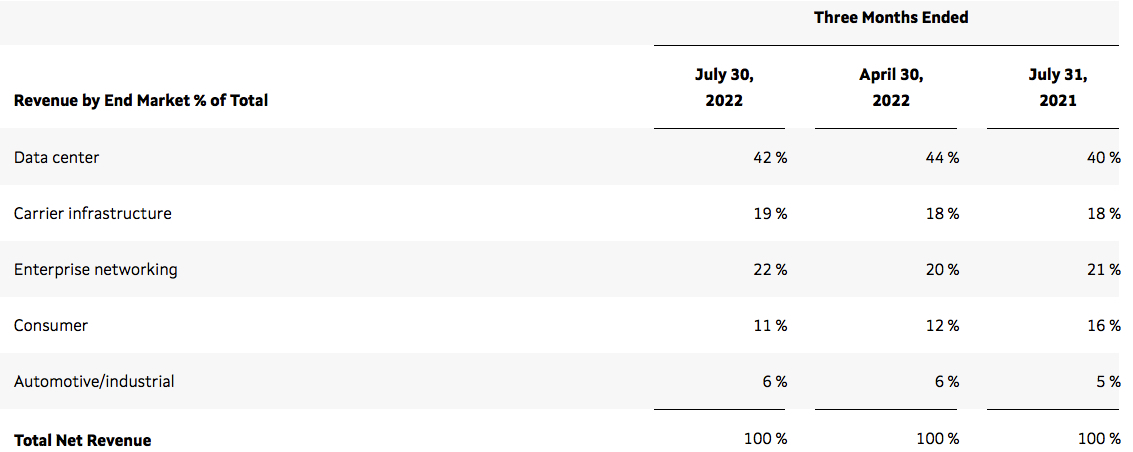

Net revenue for the quarter was $1.517 billion, consistent with the midpoint of the company’s guidance provided on May 26, 2022. GAAP net income for 2FQ23 $4 million, or $0.01 per diluted share. Non-GAAP net income for 2FQ23 was $486 million, or $0.57 per diluted share. Cash flow from operations was $331.5 million.

“In 2FQ23, we delivered record revenue of $1.52 billion, which grew 41% Y/Y and 5 percent sequentially. This was the 9th straight quarter of sequential revenue growth, and we are guiding for growth to continue in the third quarter, as we expand our leadership in data infrastructure,” said Matt Murphy, president and CEO. “Looking ahead, we expect sequential revenue growth to accelerate in the fourth quarter as supply constraints begin to ease. We believe we are well positioned to continue to benefit from our favorable end market exposure tied to strong secular growth trends and significant expected upcoming revenue contributions from a number of Marvell-specific product ramps.”

3FQ23 Financial Outlook:

• Net revenue to be $1.560 billion +/- 3%.

• GAAP gross margin to be 51.1% +/- 1.1%.

• Non-GAAP gross margin to be 65.0% +/- 0.25%.

• GAAP operating expenses to be $667 million to $677 million.

• Non-GAAP operating expenses to be $435 million to $440 million.

• Basic weighted average shares outstanding to be 854 million.

• Diluted weighted average shares outstanding to be 862 million.

• GAAP diluted income per share to be $0.09 +/- $0.04 per share.

• Non-GAAP diluted income per share to be $0.59 +/- $0.03 per share.

Comments

The company doesn't publish anymore specifically the figures of its storage revenue. It said that results were below guidance as demand from the HDD market weakened. In contrast to consumer HDD products, revenue in 2FQ23 from consumer SSD controllers continue to grow both Q/Q and Y/Y.

Looking ahead to 3FQ23 for consumer end market, the company is forecasting revenue to be flattish sequentially. On a Y/Y, it expects revenue from this segment to decline by approximately 10% due to softness in consumer HDD demand, partially offset by continued growth in SSD business.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter