Overall SSD Shipments Fell 8% Q/Q to 87 Million in 2CQ22

While exabytes increased 4%

This is a Press Release edited by StorageNewsletter.com on August 25, 2022 at 2:02 pmThis is an abstract of NAND/SSD Information Service CQ2 ’22 Quarterly Update – Executive Summary, dated August 17, 2022, by TrendFocus, Inc.

SSD Units Decline Due to Soft Client Market

But Enterprise SSD Shipments to Data Center Customers Improve

Enterprise PCle SSDs rise while all other segments fall in CQ2 ’22

- Overall unit shipments fell 8.3% Q/Q to 87.051 million units, while exabytes increased 3.8% in the same timeframe, due to continued PC le demand going to data centers.

- Both lack of demand in the channel and high PC OEM inventories (coupled with continued component shortages) contributed to the 10.4% decline in SSD units along with an 8.4% decline in exabytes, to 70.724 million units and 35.356EB.

- Enterprise SATA, shipped mostly to system OE Ms and the channel, suffered as client SSDs did, with a unit reduction of 11.7% Q/Q to 5.874 million, and capacity shipments down 1.9% to 5.469EB.

- Enterprise PCle was the only bright spot in the market, posting an increase of 15.9% in units to 9.425 million SSDs, and a capacity increase of 25.9% to 29.418EB.

- Total NAND bit shipments declined slightly to 161.74EB, slipping 1.7% Q/Q, due to contracting demand in major markets, including mobile and client SSDs for PCs.

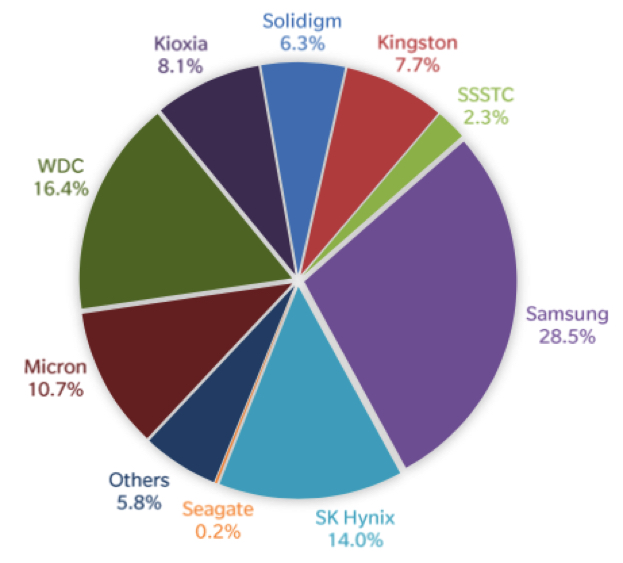

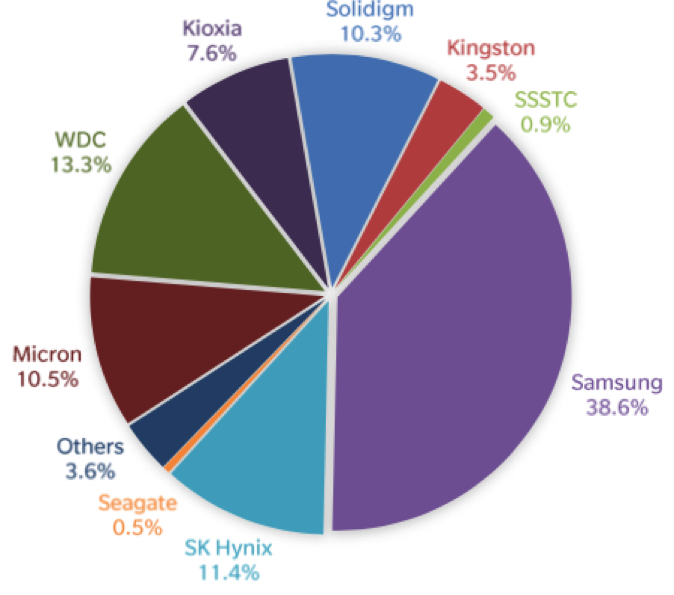

2CQ22 SSD Market Share, by Supplier, Units in Million, Exabytes

Total SSD Market: 87.051 Million Units

Total SSD Market: 74.105EB

* Preliminary data – volumes may change

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter