FalconStor: Fiscal 2Q22 Financial Results

FalconStor: Fiscal 2Q22 Financial Results

Historical lowest revenue expected in FY22 at only $10-$12 million

This is a Press Release edited by StorageNewsletter.com on August 5, 2022 at 2:03 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 3.3 | 2.4 | 7.1 | 4.4 |

| Growth | -27% | -42% | ||

| Net income (loss) | (0.4) | (0.9) | (0.05) | (2.0) |

FalconStor Software, Inc. announced financial results for its second quarter 2022, which ended on June 30, 2022.

“Our shift to recurring revenue-based hybrid cloud data protection solutions continued to progress in the quarter as we secured our first several hybrid cloud customers under the IBM reseller relationship we announced on May 11, 2022,” said Todd Brooks, CEO. “IBM’s hybrid cloud push has been a centerpiece of its corporate strategy, as highlighted in its first and second quarter 2022 results. Through our expanding relationship with IBM, enterprises can now leverage new joint hybrid cloud solutions from FalconStor and IBM. These solutions are especially important to the tens of thousands of companies around the globe that leverage IBM i and AIX environments, as they now have the ability to securely backup and restore to the cloud, as well as migrate their IBM i and AIX workloads to IBM Power VS Cloud with secure backup and recovery on an on-going basis.”

“Our aggressive focus on advancing critical hybrid cloud relationships and our efforts to realign to a subscription- and monthly consumption-based recurring revenue model continue to challenge our Y/Y revenue growth as 2FQ22 revenue was $2.4 million, compared to $3.3 million in 2FQ21. However, from a sequential quarter perspective, total revenue increased to $2.4 million, compared to $2.0 million in the first quarter of 2022,” he stated. “To more closely align with our current quarterly revenue level, we decreased operating expenses Q/Q by 8.8% in 2FQ22, and are making additional expense adjustments this quarter. Our sales pipeline for 2FH22 is growing, especially as it relates to our hybrid cloud initiatives. As a result, we expect sequential Q/Q revenue to continue growing over the next two quarters.”

2FQ22 Financial Results

- Annual Recurring Revenue: 4% Y/Y growth

- Ending Cash: $1.8 million, compared to $3.4 million in 1FQ22, and $3.7 million in 2FQ21

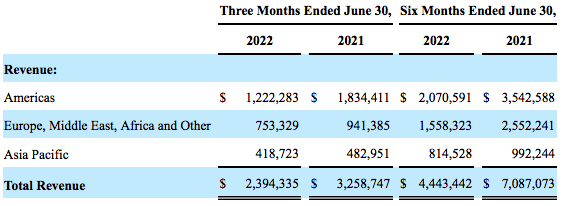

- Total Revenue: $2.4 million, compared to $2.0 million in 1FQ22, and $3.3 million in 2FQ21

- Total Cost of Revenue: $0.4 million, compared to $0.4 million in 1FQ22, and $0.4 million in 2FQ21

- Total Operating Expenses: $2.5 million, compared to $2.7 million in 1FQ22, and $3.0 million in 2FQ21

- GAAP Net Income (Loss): $(0.9) million, compared to $(1.1) million in 1FQ22, and $(0.4) million in 2FQ21

Guidance

Given 1FQ22 and 2FQ22 results, the company is reducing FY22 guidance as follows:

- Revenue between $10.0 million and $12.0 million

- Net income between $(1.8) million and $(0.5- million)

Comments

For 2FQ22 and 2FQ21, product revenue represented 40% and 49% of total revenue, respectively. Product revenue of $962,898 for 2FQ22 decreased $639,107, or 40%, from $1,602,005 in 1FQ22. This decrease is due to entering into several large multi-year contracts during 2FQ21 that did not repeat in 2FQ22.

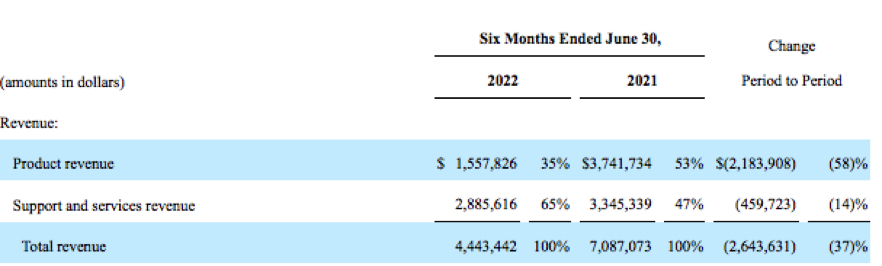

For 2FH22 and 2FH21, product revenue represented 35% and 53% of total revenue, respectively. Product revenue of $1,557,826 for 2FH22 decreased $2,183,908, or 58%, from $3,741,734 in 2FH21. This decrease is due to order delays as well as entering into several large multi-year contracts in 1FH21 that did not repeat in 1FH22.

Maintenance and technical support services revenue for 2FQ22 decreased to $1.4 million, compared to $1.6 million in 2FQ21. Maintenance and technical support service revenue results primarily from (i) the purchase of maintenance and support contracts by customers, and (ii) the renewal of maintenance and support contracts by existing and new customers after their initial contracts expire. This decrease from the previous year reflects a decline in new contracts and renewals.

There was no professional services revenue for 2FQ22 as compared to $56,486 in the prior year period.

Maintenance and technical support services revenue for 2FH22 decreased to $2.9 million, compared to $3.2 million in 2HF21. This revenue results primarily from (i) the purchase of maintenance and support contracts by our customers, and (ii) the renewal of maintenance and support contracts by our existing and new customers after their initial contracts expire. This decrease from the previous year reflects a decline in new contracts and renewals.

| FY | Revenue in $ million |

Growth |

| 2004 | 28.7 | NA |

| 2005 | 41.0 | 43% |

| 2006 | 55.1 | 34% |

| 2007 | 77.4 | 41% |

| 2008 | 87.0 | 12% |

| 2009 | 89.5 | 3% |

| 2010 | 82.8 | -7% |

| 2011 | 82.9 | 0% |

| 2012 | 75.4 | -9% |

| 2013 | 58.6 | -32% |

| 2014 | 46.3 | -21% |

| 2015 | 48.6 | 5% |

| 2016 | 30.3 | -38% |

| 2017 | 25.2 | -17% |

| 2018 | 17.8 | -29% |

| 2019 | 16.5 | -7% |

| 2020 | 14.8 | -10% |

| 1FQ21 | 3.8 | 20% |

| 2FQ21 | 3.3 | -7% |

| 3FQ21 | 3.3 | -25% |

| 4FQ21 | 3.8 | 4% |

| FY21 | 14.2 | -4% |

| 1FQ22 | 2.0 | -47% |

| 2FQ22 | 2.4 | -27% |

| FY22 (estim.) | 10.0 - 12.0 | -30% - -25% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter