Phison: Fiscal 2Q22 Financial Results

Phison: Fiscal 2Q22 Financial Results

Revenue up 2.4% Y/Y, -20% in net profit after tax

This is a Press Release edited by StorageNewsletter.com on July 29, 2022 at 2:02 pmPhison Electronics Corp. announced its consolidated financial results for the second quarter of 2022.

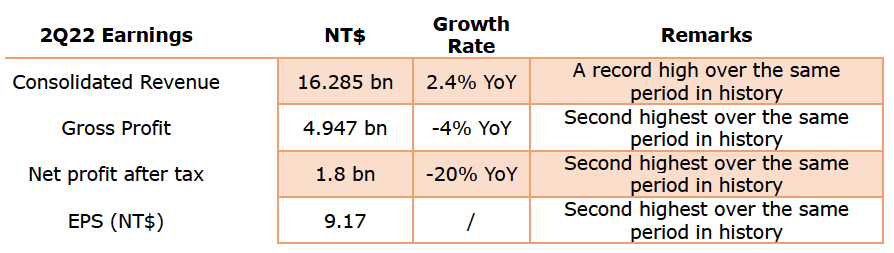

Consolidated revenue in 2FQ22 was NT$16.285 billion, an increase of 2.4% compared to 2FQ21, and the cumulative revenue for the year reached NT$33.391 billion, an increase of nearly 16% compared with 2FQ21, a record high for the same period in history; gross profit in the second quarter was NT$4.947 billion, and the cumulative gross profit for the year was NT$10.342 billion, with an annual growth of 15%, setting a new record for the same period in history. In addition, the gross profit margin in the second quarter was 30.37%, the net profit after tax was NT$1.8 billion, and the EPS was NT$9.17.

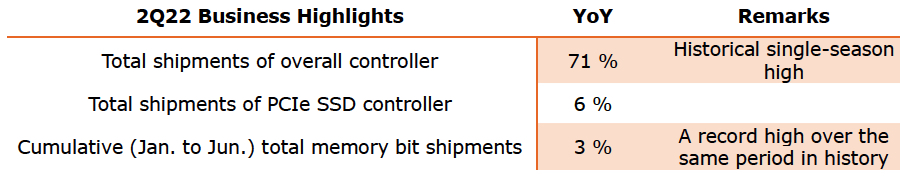

Compared with 2FQ21, the overall controller shipments in 2FQ22 grew by 71%, of which the total PCIe SSD controller shipments grew by nearly 6%. In addition, the total shipments of memory bits accumulated to the second quarter of the year increased by 3%, setting a new record for the same period in history.

K.S.Pua, CEO, said that due to factors such as epidemic control, war, inflation, and lack of consumer confidence, market demand has slowed down, and various industries around the world are facing varying degrees of impact, including the NAND storage market. In other words, it is reasonable to estimate that the time for the company to reduce the inventory level will be extended.

He went on to explain that market changes are the norm for Phison. Over the past 21 years, the firm has been riding the wind and waves in the NAND storage market, and has gradually consolidated its foundation through transformation. In other words, compared to its peers, it is less affected by market fluctuations. In addition, it will continue to expand its R&D investment vs. the trend to maintain its position in technology, and to achieve a new operating peak when the economy recovers.

In addition, it also announced the surplus distribution for 1FH22, with an estimated distribution of NT$10 per share.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter