Spending on Compute and Storage Infrastructure Grew 17% Y/Y in 1Q22 to $18 Billion

Strongly across cloud and non-cloud IT environments

This is a Press Release edited by StorageNewsletter.com on July 6, 2022 at 2:02 pmAccording to the International Data Corporation‘s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on compute and storage infrastructure products for cloud deployments, including dedicated and shared environments, increased 17.2% Y/Y in 1Q22 to $18.3 billion.

This growth continues a series of strong yearly increases in spending on infrastructure products by both service providers and enterprises despite tight supply of some system components and disruptions in transportation networks. Investments in non-cloud infrastructure increased 9.8% Y/Y in 1Q22 to $14.8 billion, continuing a streak of growth for this segment into its 5th quarter.

Spending on shared cloud infrastructure reached $12.5 billion in the quarter, increasing 15.7% compared to a year ago. The analyst firm expects to see continuously strong demand for shared cloud infrastructure with spending expected to surpass non-cloud infrastructure spending in 2022 for the first time.

Spending on dedicated cloud infrastructure increased 20.5% Y/Y in 1Q22 to $5.9 billion. Of the total dedicated cloud infrastructure, 47.8% was deployed on customer premises.

For the full year 2022, IDC is forecasting cloud infrastructure spending to grow 22% compared to 2021 to $90.2 billion – the highest annual growth rate since 2018 – while non-cloud infrastructure is expected to grow 1.8% to $60.7 billion. The increased forecast for both segments is partially driven by inflationary pressure and expectations of higher systems prices during 2022 as well as improvements in the supply chain in 2H22. Shared cloud infrastructure is expected to grow by 24.3% Y/Y to $63.9 billion for the full year. Spending on dedicated cloud infrastructure is expected to grow 16.8% to $26.3 billion for 2022.

As part of the Tracker, IDC follows various categories of service providers and how much compute and storage infrastructure these service providers purchase, including both cloud and non-cloud infrastructure. The service provider category includes cloud service providers, digital service providers, communications service providers, and managed service providers. In 1Q22, service providers as a group spent $18.3 billion on compute and storage infrastructure, up 14.5% from 1Q21. This spending accounted for 55.3% of total compute and storage infrastructure spending. Spending by non-service providers increased 12.9% Y/Y, the highest growth in fourteen quarters. IDC expects compute and storage spending by service providers to reach $89.1 billion in 2022, growing yearly 18.7%.

At the regional level, Y/Y spending on cloud infrastructure in 1Q22 increased in most regions. Once again AsiaPac (excluding Japan and China) (APeJC) grew the most at 50.1% Y/Y. Japan, Middle East and Africa, China, and USA all saw double-digit growth in spending. Western Europe grew 6.4% and growth in Canada slowed to 1.2%. Central and Eastern Europe, affected by the war between Russia and Ukraine, declined 10.3%, while Latin America declined 11.3%. For 2022, cloud infrastructure spending for most regions is expected to grow, with 4 regions, APeJC, China, USA, and Western Europe, expecting to post annual growth in the 20-25% range.

Impact of the war will continue to hurt spending in Central and Eastern Europe, which is now expected to decline 54.6% in 2022.

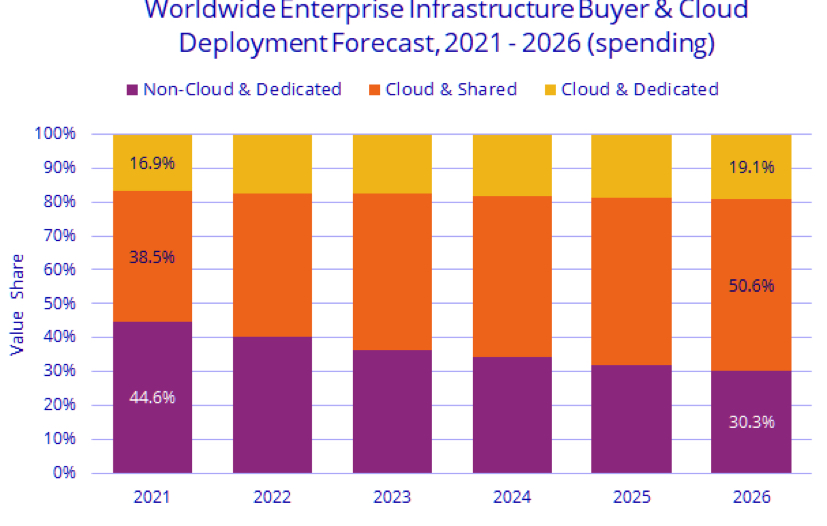

Long term, IDC expects spending on compute and storage cloud infrastructure to have a CAGR of 14.5% over the 2021-2026 forecast period, reaching $145.2 billion in 2026 and accounting for 69.7% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 72.6% of the total cloud amount, growing at a 15.4% CAGR. Spending on dedicated cloud infrastructure will grow at a CAGR of 12.1%. Spending on non-cloud infrastructure will grow at 1.2% CAGR, reaching $63.1 billion in 2026. Spending by service providers on compute and storage infrastructure is expected to grow at a 13.4% CAGR, reaching $140.8 billion in 2026.

Taxonomy notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service.

Shared cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The shared cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters; these services in total are called public cloud services. The shared cloud market also includes digital services such as media/content distribution, sharing and search, social media, and e-commerce.

Dedicated cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In dedicated cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter