Phison: May 2022 Financial Results

Phison: May 2022 Financial Results

Annual growth rate of 18% Y/Y for revenue

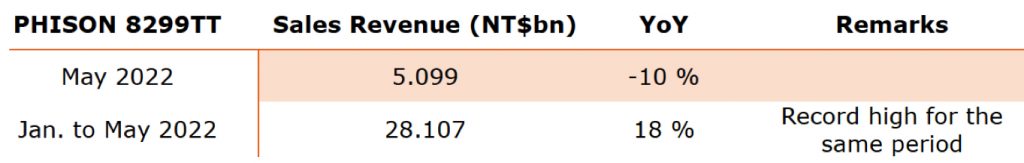

This is a Press Release edited by StorageNewsletter.com on June 13, 2022 at 2:02 pmPhison Electronics Corp. announced its operating results for May 2022, with consolidated revenue of NT$5.099 billion. The annual cumulative revenue reached NT$28.107 billion in May, with an annual growth rate of 18% (Y/Y), a new high for the same period.

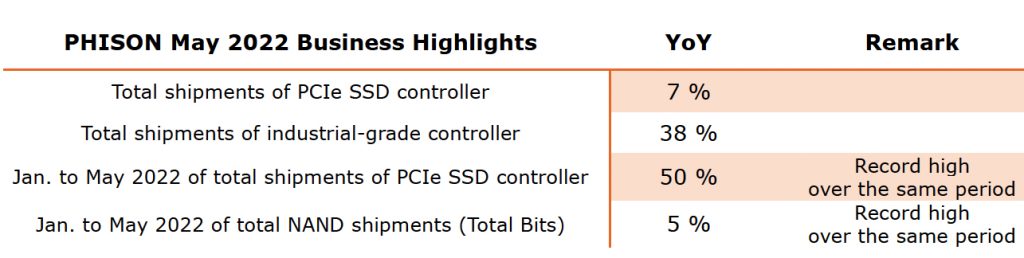

Compared with the same period last year, the total shipments of PCIe SSD controllers in May increased by nearly 7%, and the total shipments of industrial-grade controllers increased by nearly 38%, continuing to grow steadily. In addition, the total shipments of PCIe SSD controllers from the year to May increased by nearly 50% Y/Y, and the total memory bits shipments also increased by nearly 5%, both hitting new highs for the same period in history.

K.S.Pua, CEO, explained that the regional lockdown caused by the epidemic has affected the supply and the sales chain, including factory shutdown, transportation difficulties, and consumers unable to purchase goods, etc.; coupled with inflation, the prices of various commodities have also risen, which ultimately affects the purchase intention of end consumers or customers. These factors have indeed had varying degrees of impact on industries and companies around the world.

He went on to explain that because his company has accumulated more than 20 years of experience in the NAND industry, it is better able to grasp the pulse of the market and business opportunities than its peers. In addition, the firm also reserves energy when market demand slows down to prepare for the next wave of market recovery. Based on past experience and records, Phison can stand firm in the downturn, and also outperform its peers when the boom turns upward. This is the advantage of Phison and the success of its transformation. Although there are still many uncertainties in the coming quarters, the firm will continue to work with global customers and suppliers, and achieve new heights through its diversified strategy and technological leadership.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter