Commvault: Fiscal 4Q22 Financial Results

Commvault: Fiscal 4Q22 Financial Results

Historical record for quarterly and fiscal year sales

This is a Press Release edited by StorageNewsletter.com on May 4, 2022 at 2:18 pm| (in $ million) | 4Q21 | 4Q22 | FY21 | FY22 |

| Revenue | 191.3 | 205.9 | 723.5 | 769.6 |

| Growth | 8% | 6% | ||

| Net income (loss) | 6.3 | 8.0 | (31.0) | 33.6 |

Commvault Systems, Inc. announced its financial results for the fourth quarter and fiscal year ended March 31, 2022.

“We are pleased to have delivered another record quarter to cap off the best year in our history,” said Sanjay Mirchandani, president and CEO. “Demand is strong for our differentiated portfolio, our team is executing, and we are taking market share. We are excited about our growth prospects in the new fiscal year.“

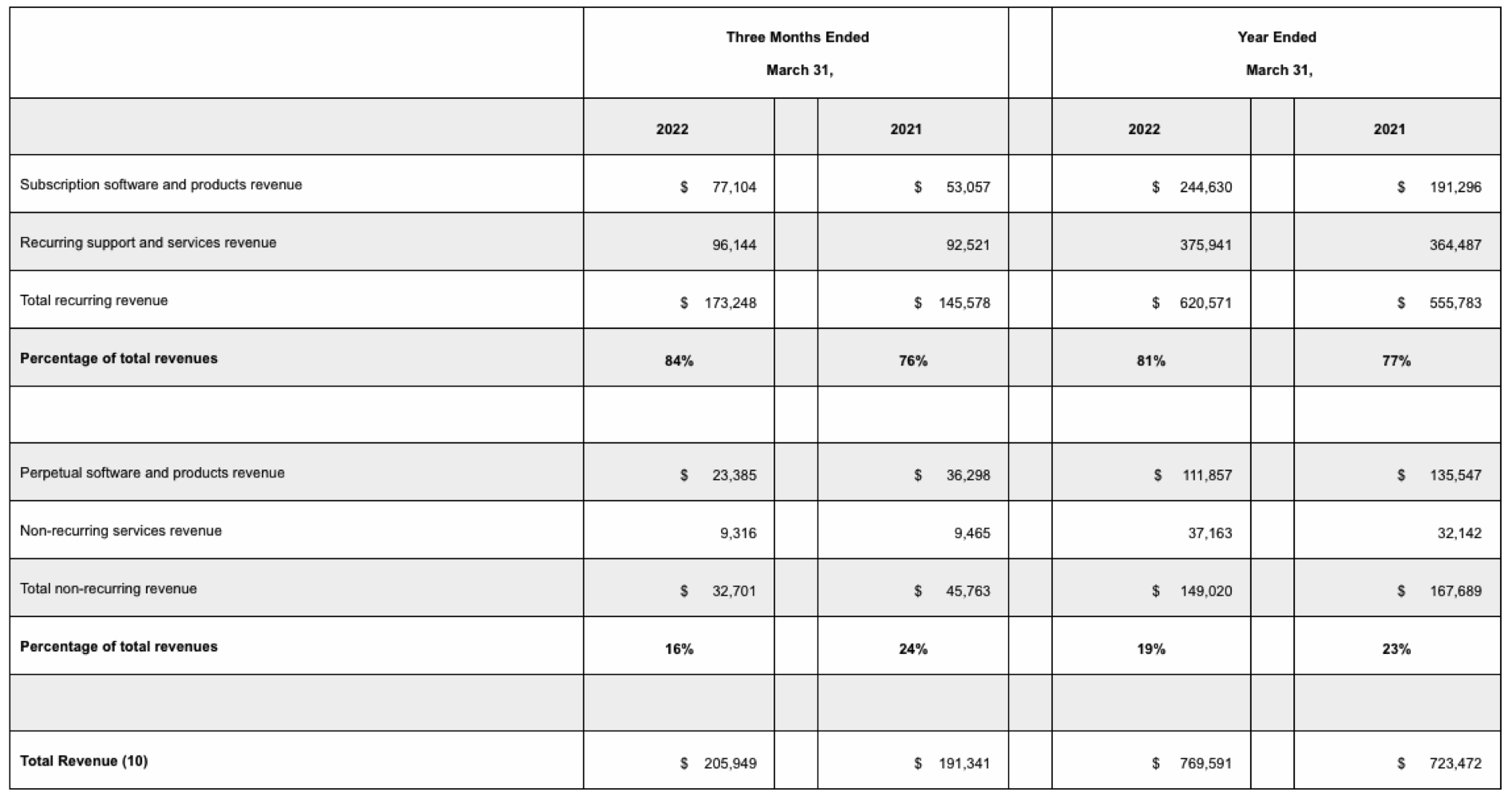

Total revenues for 4FQ22 were $205.9 million, an increase of 8% Y/Y. Total recurring revenue was $173.2 million, an increase of 19% Y/Y. For FY22, total revenues were $769.6 million, an increase of 6% from FY21.

Annualized recurring revenue (ARR), which is the annualized value of all active Commvault recurring revenue streams at the end of the reporting period, was $583.3 million as of March 31, 2022, up 13% from March 31, 2021. Software and products revenue in 4FQ22 was $100.5 million, an increase of 12% Y/Y. The yearly increase in software and products revenue was driven by a 19% increase in revenue from larger deals (deals greater than $0.1 million in software and products revenue).

Click to enlarge

Larger deal revenue represented 73% of software and products revenue in the three months ended March 31, 2022. The number of larger deal revenue transactions increased 14% Y/Y to 226 deals for the three months ended March 31, 2022. The average dollar amount of larger deal revenue transactions was approximately $327,000, representing a 4% increase from the 3FQ22.

Software and products revenue for FY22 was $356.5 million, an increase of 9% from FY21. The Y/Y increase in software and products revenue was driven by a 13% increase in revenue from larger deals.

Larger deal revenue represented 72% of software and products revenue in FY22. The number of larger deal revenue transactions increased 19% from FY21 to 799 deals. The average dollar amount of larger deal revenue transactions was approximately $320,000, representing a 4% decrease from the prior year.

Services revenue in 4FQ22 was $105.5 million, up 3% Y/Y. For FY22, services revenue was $413.1 million, up 4% from fiscal 2021. Services revenue growth was driven by Commvault’s software-as-a-service offerings.

On a GAAP basis, income from operations (EBIT) was $11.4 million for 4FQ22 compared to $10.3 million in 4FQ21. Non-GAAP EBIT was $46.6 million in 4FQ22 compared to $38.8 million in 4FQ21.

On a GAAP basis, income from operations (EBIT) for FY22 was $41.6 million compared to loss of $22.3 million in FY21. Non-GAAP income from operations (EBIT) was $161.7 million in 4FQ22 compared to $137.5 million in 3FQ22.

For 4FQ22, the company reported net income of $8.0 million. Non-GAAP net income for 4FQ22 was $34.6 million, or $0.75 per diluted share.

For FY22, it reported a net income of $33.6 million. Non-GAAP net income for FY22 was $118.7 million, or $2.51 per diluted share.

Operating cash flow totaled $87.1 million for 4FQ22 compared to $64.7 million in the prior year quarter. For FY22, operating cash flow was $177.2 million, compared to $124.0 million for FY21. Total cash and short-term investments were $267.5 million as of March 31, 2022 compared to $397.2 million as of March 31, 2021. There were no borrowings vs. the revolving line of credit.

During 4FQ22, the software firm repurchased approximately 600,000 shares of its common stock totaling $39.8 million at an average price of approximately $66.29 per share. During FY22, it repurchased approximately 4.3 million shares of its common stock totaling $305.2 million at an average price of approximately $70.87 per share.

On April 21, 2022, the board of directors approved a new share repurchase program of up to $250.0 million. The board’s authorization permits to make the firm purchases of its common stock from time to time in the open market or through privately negotiated transactions, subject to market and other conditions. The board’s authorization has no expiration date.

“We continue to believe that the strength of our balance sheet, coupled with the current and long-term outlook for our business, provides an opportunity to create value for our long-term shareholders,” said Mirchandani.

Comments

Commvault record sales of $205.9 million in 4FQ22, up 8% Y/Y and 2%Q/Q

It posted record quarterly revenue, EBIT, and EPS.

4FQ22 software revenue of $101 million was a new milestone for the company, and we crossed $200 million in total revenue for the second consecutive quarter. This growth was driven by the continued traction of software and SaaS offerings, increased multi-product adoption, and through large deals. Additionally, Metallic continue to scale and contribute meaningfully to revenue and customer growth.

Over the last 4 quarters, the company has surpassed consensus EPS estimates three times.

This quarter it saw 80% Y/Y growth in the number of customers with more than one product, which drives higher ASP, higher lifetime value, and higher recurring revenue.

Software and products revenue increased 12% Y/Y to $101 million. 4FQ22 marked the first time in company's history that it crossed the $100 million milestone in quarterly software revenue. Software only growth excluding appliance pass-through revenue was approximately 15% Y/Y. 4FQ22 subscription software revenue increased 45% Y/Y to $77 million. Subscription license sales represented 77% of total software revenue, an increase from 71% last quarter and 59% a year ago.

Revenue from software transactions over $100,000 increased 19% Y/Y, and represented 73% of software revenue. The volume of these transactions grew 14% Y/Y. And the average deal size increased 4% to $327,000. Commvault closed numerous 7-figure deals in the quarter.

Subscription and Metallic ARR grew 46% Y/Y to $346 million and now represents 59% of total ARR. Up from 55% last quarter and 46% in 4FQ21. Metallic ARR crossed the $50 million milestone during the quarter. Total ARR increased 13% Y/Y to $583 million. On a constant currency basis, ARRR was up 14% Y/Y. ARR growth has been driven by new subscription customers and Metallic.

Total recurring revenue, which includes subscription software, maintenance support services and SaaS, grew 19% Y/Y to $173 million. Recurring revenue represented 84% of total revenue in the quarter, an increase from 76% a year-ago.

The firm expects 1FQ23 software revenue of approximately $89 million. Due to the ongoing geopolitical uncertainty, it is closely monitoring potential risks to its business, particularly customer's spending patterns in Europe. Also note that Russian operations previously contributed approximately 1% of total revenue, which is factored into near-term guidance.

Next quarter, the company expects revenue of $195 million up 6% Y/Y and down 5% Q/Q.

Revenue and net income (loss) in $ million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

| 1Q21 | 173.0 | 7% | 2.3 |

| 2Q21 | 171.1 | 2% | (41.2) |

| 3FQ21 | 188.0 | 7% | 1.7 |

| 4FQ21 | 191.3 | 16% | 6.3 |

| FY21 | 723.5 | 8% | (31.0) |

| 1FQ22 |

183.4 | 6% | 13.9 |

| 2FQ22 |

177.8 | 4% | 1.7 |

| 3FQ22 | 202.4 | 8% | 10.0 |

| 4FQ22 | 205.9 | 8% | 8.0 |

| FY22 | 769.6 | 6% | 33.6 |

| 1FQ23 (estim. | 195 | 6% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter