Western Digital: Fiscal 3Q22 Financial Results

Western Digital: Fiscal 3Q22 Financial Results

Revenue down 3% for HDD and 14% for flash

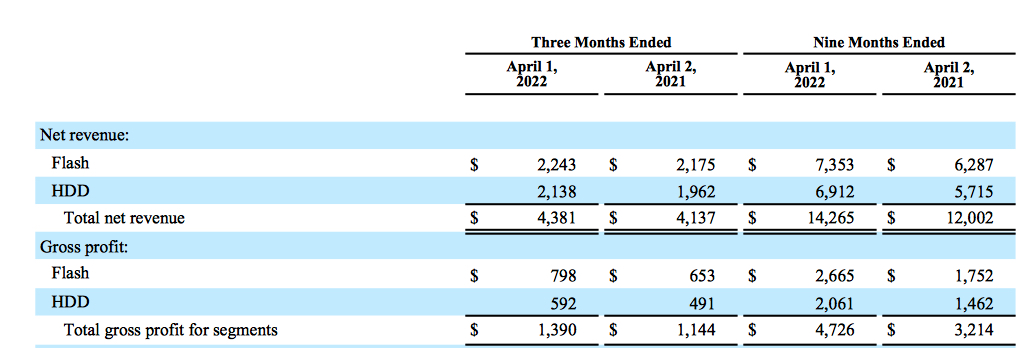

This is a Press Release edited by StorageNewsletter.com on May 2, 2022 at 2:02 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 4,137 | 4,381 | 12,002 | 14,268 |

| Growth | 6% | 19% | ||

| Net income (loss) | 197 | 25 | 100 | 1,199 |

Western Digital Corp. reported fiscal third quarter 2022 financial results.

“The entire Western Digital team worked together to deliver excellent financial performance while navigating a dynamic geopolitical and macroeconomic environment, as well as ongoing supply challenges. This has all been made possible by the operational and portfolio improvements we have made over the last couple of years, which enable us to unlock the earnings power of the Western Digital model,” said David Goeckeler, CEO. “Looking ahead, we are optimistic about the business outlook for calendar year 2022. We believe the secular demand for storage and our new product ramps in HDD and flash will drive growth across our end markets.”

The company generated $398 million in cash flow from operations, made a discretionary debt repayment of $150 million and ended the quarter with $2.51 billion of total cash and cash equivalents.

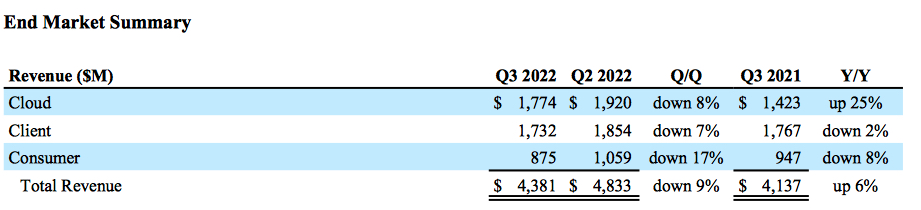

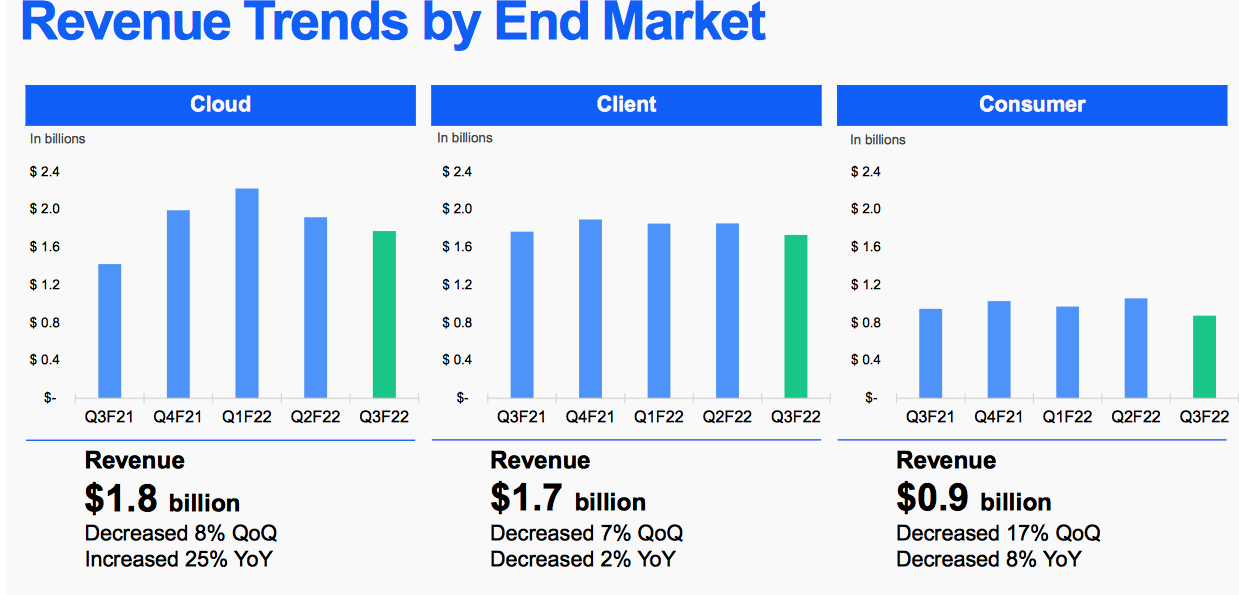

Cloud represented 40% of total revenue

Firm’s position at the 18TB capacity point, and ramp of 20TB drives, drove a nearly 40% Y/Y increase in nearline revenue. This growth was partially offset by lower enterprise SSD and smart video HDD revenues.

Client accounted for 40% of total revenue

Within client SSD, demand from PC OEM customers improved as they worked through their own supply chain issues. The sequential decrease in revenue was primarily due to typical seasonality in both flash for mobile and client HDDs.

Consumer represented 20% of total revenue

On a sequential basis, the decline was led by lower retail flash shipments. The company drove 35% Y/Y growth in average capacity per unit in consumer flash, building on the broad consumer recognition of the strength and the value of its brands, including WD_BLACK, SanDisk and SanDisk Professional.

Comments

During the former quarter, WD expects revenue to be in the range of $4.45 billion to $4.65 billion or -8% o -4% sequentially, with sales declining for both flash and HDD businesses.

Total revenue for the quarter was below that, at $4.4 billion, down 9% Q/Q and up 6% Y/Y at the higher end of its updated guidance ranges provided in early March.

40% of the world's data are stored on its products, stated the company.

Cloud represented 40% of total revenue at $1.8 billion, down 8% Q/Q and up 25% from a year ago. Within cloud, its position at the 18TB capacity point and ramp of 20TB HDDs drove a nearly 40% Y/Y increase in nearline revenue. This growth was partially offset by lower enterprise SSD and smart video HDD revenue. The client end market represented 40% of total revenue at $1.7 billion, down 7% Q/Q and 2% Y/Y.

The sequential decrease was primarily due to typical seasonality in both flash for mobile and client HDDs. On a yearly basis, growth in flash was offset by a decline in HDD. Lastly, consumer represented 20% of revenue at $0.9 billion, down 17% Q/Q and 8% Y/Y. On a sequential basis, the decline was primarily due to lower retail flash shipments.

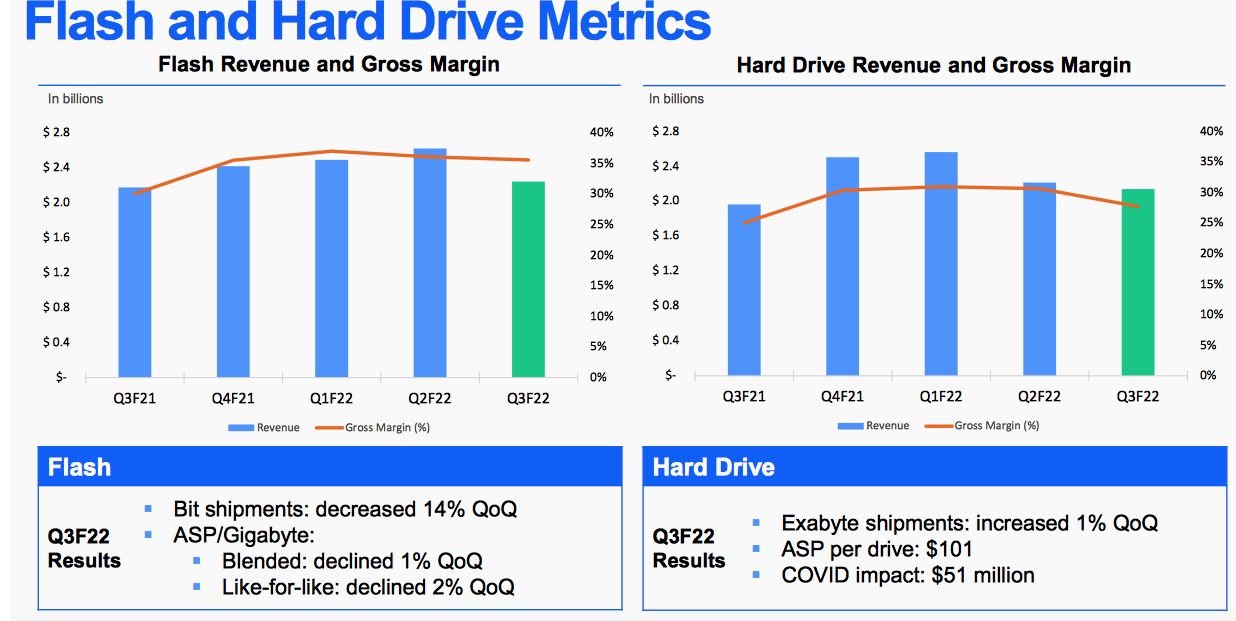

The Y/Y decrease was roughly evenly split between HDD and flash products. Turning now to revenue by segment, the manufacturer reported flash revenue of $2.2 billion, down 14% Q/Q and up 3% Y/Y. On a blended basis, flash ASPs were down 1% sequentially.

On a like-for-like basis, flash ASPs were down 2% sequentially. Flash bit shipments decreased 14% Q/Q and increased 9% Y/Y. During the quarter, the firm recognized that the majority of the bit supply impact caused by the fab contamination.

HDD revenue was $2.1 billion, down 3% Q/Q and up Y/Y, total hard drive exabyte shipments and average price per drive increased by 20% and 22%, respectively.

Flash

• The secular demand for storage and product ramps in HDD and flash, will drive growth across our end markets.

• Client SSD demand improved in the quarter as PC OEM customers successfully worked through their own supply chain issues.

• Qualifications of BiCS5 based products for client and consumer end markets were largely completed, and the company is making progress in qualifying its next-gen BICS5 enterprise SSD products.

• BiCS5 represented nearly half of flash revenue.

. Impacted by firm's ability to ship product due to the fab excursion. In light of this event, coupled with the supply chain challenges facing all companies across the industry.

HDDs

• Revenue was as forecast and in-line with typical March quarter seasonality, led by growth in capacity enterprise drives.

• Robust demand in the cloud end-market for 18 and 20TB drives generated a nearly 40% increase in nearline revenue from the same period last year.

• Qualification of OptiNAND-based hard drives progressed as planned across multiple cloud and OEM customers.

• The company has positioned its OptiNAND and SMR to drive results in its capacity enterprise business. Its largest cloud customers are accelerating adoption of SMR products within their datacenters later this year.

WD expects 4FQ22 revenue to be in the range of $4.50 billion to $4.70 billion (or up 3% to 7%) with sequential revenue growth for both hard drive and flash businesses, and with non-GAAP EPS in the range of $1.60 to $1.90.

It continues to expect HDD sales to increase driven by growth in nearline drives. It also expects flash revenue to increase sequentially in 4FQ22 as flash supply improves.

HDD and flash revenue

| in $ million | 1FQ21 | 2FQ21 | 3FQ21 |

4FQ21 |

1FQ22 |

2FQ22 |

3FQ22 |

2FQ21/3FQ22 growth |

| HDDs |

1,844 | 1,909 | 1,962 | 2,501 | 2,561 | 2,213 |

2,138 |

-3% |

| Flash |

2,078 | 2,034 | 2,175 | 2,419 | 2,490 | 2,620 |

2,243 |

-14% |

By business, and HDD

| Client revenue (1) |

Cloud revenue (1) |

Consumer revenue (1) |

Total HDDs (2) |

HDD ASP |

|

| 1FQ21 |

1,750 | 1,291 | 881 | 23.0 |

$79 |

| 2FQ21 |

1,869 | 1,014 | 1,060 | 25.7 |

$73 |

| 3FQ21 |

1,767 | 1,423 | 947 | 23.2 |

$82 |

| 4FQ21 |

1,895 | 1,995 | 1,030 | 25.4 |

$97 |

| 1FQ22 |

1,853 | 2,225 | 973 | 24.1 |

$102 |

| 2FQ22 |

1,854 | 1,920 | 1,059 | 21.6 |

$97 |

| 3FQ22 |

1,732 | 1,774 | 875 | 19.8 |

$101 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter