Western Digital: Fiscal 2Q22 Financial Results April 28

Western Digital: Fiscal 2Q22 Financial Results April 28

Sales $4.83 billion up 23% Y/Y and down 4% Q/Q, expected to decrease in 3FQ22

This is a Press Release edited by StorageNewsletter.com on January 31, 2022 at 2:02 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 3,943 | 4,833 | 7,865 | 9,884 |

| Growth | 23% | 26% | ||

| Net income (loss) | 62 | 564 | 2 | 1,174 |

Western Digital Corp. reported fiscal second quarter 2022 financial results.

“I’m proud of the Western Digital team for delivering another quarter of strong results that exceeded guidance, even in the midst of ongoing supply chain disruptions and Covid-related challenges,” said David Goeckeler, CEO. “While we continue to experience strong demand across our end markets, these challenges continue to present a headwind to near-term results. We’ve executed well in building a solid foundation for future profitable growth driven by innovative products within our flash and HDD businesses. As these transitory headwinds subside, we expect to emerge in a stronger position to drive better through-cycle results, creating value for our shareholders, employees and customers.”

The company generated $666 million in cash flow from operations, made a total debt repayment of $2.21 billion, issued $1.00 billion in notes and ended the quarter with $2.53 billion of total cash and cash equivalents.

During the quarter, the company repaid the remaining balance of its Term-Loan B-4 in an amount of $943 million, and repaid $1.27 billion on its Term-Loan A-1. In addition, the company closed a public offering of $1.00 billion aggregate principal amount in senior unsecured notes, bringing total gross debt outstanding to $7.40 billion at the end of 2FQ22.

New end market summary

Cloud represented 40% of total revenue. Supply chain disruptions impacted cloud HDD deployments at certain customers, which led to a sequential decline in exabyte shipments in 2FQ22. However, healthy overall demand for capacity enterprise drives, along with firm’s position at the 18TB capacity point, drove a greater than 50% Y/Y increase in exabyte shipments.

Client accounted for 38% of total revenue. The continued ramp of 5G phones helped offset declines in both client SSD and client HDD revenue. Within mobile, shipments of BiCS5 products into 5G smartphones increased over 60% sequentially and 50% Y/Y, led by strong content growth.

Consumer represented 22% of total revenue. With a strong holiday season, retail flash led the sequential growth. The WD_BLACK SSD product line, optimized for the gaming experience, continues to gain momentum, with revenue increasing approximately 50% sequentially and doubling in calendar year 2021.

Comments

Like Seagate few days ago, WD announced a good 2FQ22 financial quarter with revenue at $4.8 billion, down 4% Q/Q but up 23% Y/Y.

It's the 7th consecutive quarter that the company has met or exceeded guidance. At the end of former quarter, expected sales were perfectly in the middle, between $4.7 billion and 4.9 billion.

Flash and HDD metrics

HDD and flash revenue

| in $ million | 1FQ18 | 1FQ19 | 2FQ19 |

3FQ19 |

4FQ19 |

1FQ20 |

2FQ20 |

3FQ20 |

4FQ20 |

1FQ21 | 2FQ21 | 3FQ21 |

4FQ21 |

1FQ22 |

2FQ22 |

1FQ21/2FQ22 growth |

| HDDs |

2,610 | 2,494 | 2,060 | 2,064 | 2,128 | 2,408 | 2,396 | 2,114 | 2,049 | 1,844 | 1,909 | 1,962 | 2,501 | 2,561 | 2,213 |

-14% |

| Flash |

2,571 | 2,534 | 2,173 | 1,610 | 1,506 | 1,632 | 1,838 | 2,061 |

2,238 | 2,078 | 2,034 | 2,175 | 2,419 | 2,490 | 2,620 |

5% |

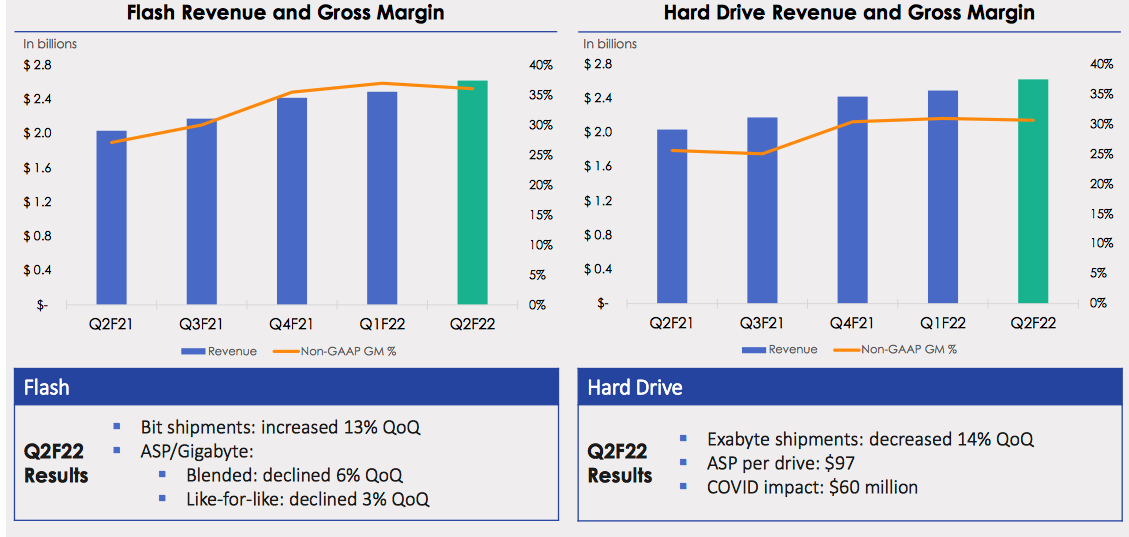

Flash

• Flash revenue was $2.6 billion, up 5% Q/Q and up 29% Y/Y. On a blended basis, flash ASPs were down 6% sequentially due to a seasonal increase in shipments to mobile and retail. On a like-for-like basis, flash ASPs were down 3% sequentially. Flash bit shipments increased by 13% Q/Q and 37% Y/Y.

• This growth was driven by seasonal strength in mobile and consumer. Within mobile, shipments of BiCS5 products into 5G smartphones increased over 60% Q/Q and 50% Y/Y

BiCS5 shipments represented over 40% of total revenue and production crossover took place during the quarter.

• Enterprise SSD products are qualified at 3 cloud titans and 2 major storage OEMs.

• WD_BLACK SSD product line optimized for the gaming experience continues to gain momentum, with revenue increasing about 50% sequentially and doubling in calendar year 2021. Along with flash products for gaming consoles, revenue has grown from zero to over 10% of flash portfolio over the last 2 years.

• Client SSD revenue declined sequentially due to supply chain disruptions at some of PC customers and pricing pressure in the more transactional markets.

HDDs

• HDD revenue was $2.2 billion, down 14% Q/Q and up 16% Y/Y. On a sequential basis, total exabyte shipments decreased by 14%, while the ASP per drive decreased by 5% to $97. On a Y/Y basis, total exabyte shipments increased by 27%

• Supply chain disruptions impacted cloud hard drive deployments at certain customers, which led to a sequential decline in exabyte shipments.

• Healthy overall demand for capacity enterprise drives, along with the 18TB model, drove a >50% Y/Y increase in exabyte shipments.

• The firm commenced shipments of 20TB units based on OptiNAND technology.

By business, and HDD

| Client revenue (1) |

Cloud revenue (1) |

Consumer revenue (1) |

Total HDDs (2) |

HDD ASP |

|

| 1FQ21 |

1,750 | 1,291 | 881 | 23.0 |

$79 |

| 2FQ21 |

1,869 | 1,014 | 1,060 | 25.7 |

$73 |

| 3FQ21 |

1,767 | 1,423 | 947 | 23.2 |

$82 |

| 4FQ21 |

1,895 | 1,995 | 1,030 | 25.4 |

$97 |

| 1FQ22 |

1,853 | 2,225 | 973 | 24.1 |

$102 |

| 2FQ22 |

1,854 | 1,920 | 1,059 | 21.6 |

$97 |

Cloud represented 40% of total revenue at $1.9 billion, down 14% Q/Q and up 89% Y/Y.

The client end market represented 38% of total revenue at $1.9 billion flat Q/Q and down 1% Y/Y. The continued ramp of 5G phones helped offset decline in both client SSD and client hard drive revenue, enabling total client revenue to stay flat.

Client HDDs represent less than 15% of HDD revenue.

Consumer represented 22% of revenue at $1.1 billion, up 9% Q/Q and flat Y/Y. With a strong holiday season, retail flash led the sequential growth in consumer. On a Y/Y basis, growth in consumer flash was offset by a decline in consumer HDD.

The company expects flash revenue to return to growth in the second half of calendar year 2022. Furthermore, it anticipates downward pressure on gross margins for the first half of this calendar year as cost reductions revert toward our long-term target of 15%.

It expects revenue to be in the range of $4.45 billion to $4.65 billion or -8% o -4% sequentially, with sales declining for both flash and HDD businesses.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter