Seagate: Fiscal 2Q22 Financial Results

Seagate: Fiscal 2Q22 Financial Results

Revenue of $3.1 billion, highest figure over 6 years, but bad outlook

This is a Press Release edited by StorageNewsletter.com on January 28, 2022 at 2:03 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 2,623 | 3,116 | 4,937 | 6,231 |

| Growth | 19% | 28% | ||

| Net income (loss) | 280 | 501 | 503 | 1,027 |

Seagate Technology Holdings plc reported financial results for its fiscal second quarter ended December 31, 2021.

“Calendar 2021 was an outstanding year for Seagate. Compared with the prior calendar year, we grew revenue by 18% and more importantly, delivered free cash flow growth of 39%, which we are deploying effectively into our long-standing capital returns program,” said Dave Mosley, CEO. “The calendar year was capped by strong December quarter performance including our highest revenue level in over 6 years, supported by cloud data center demand for our high capacity nearline products. We continue to execute amid a very dynamic business environment. Barring any significant additional macro disruptions, we expect to build on our 2021 performance this calendar year and beyond as favorable demand trends support revenue expansion consistent with our long-term financial model range of 3-to-6% growth.“

The company generated $521 million in cash flow from operations and $426 million in free cash flow during 2FQ22. It maintained a healthy balance sheet, and during this quarter, it paid cash dividends of $151 million and repurchased 5.1 million ordinary shares for $471 million. Cash and cash equivalents totaled $1.5 billion. There were 219 million ordinary shares issued and outstanding as of the end of 2FQ22

Quarterly cash dividend

The board of directors declared a quarterly cash dividend of $0.70 per share, which will be payable on April 6, 2022 to shareholders of record as of the close of business on March 22, 2022. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon firm’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Business outlook

The company is providing the following guidance for its 3FQ22:

• Revenue of $2.9 billion, plus or min$ 150 million

• Non-GAAP diluted EPS of $2.00, plus or min $0.20

Guidance regarding non-GAAP diluted EPS excludes known charges related to amortization of acquired intangible assets of $0.02 per share and estimated share-based compensation expenses of $0.17 per share.

Comments

Trendfocus expected that in 1CQ21, the WW HDD market will be down Q/Q between 7.5% and 10.5% in number of units, and about the same for Seagate, the undisputable leader of this business.

But this later realizes an excellent fiscal quarter for the same period with revenue of $3.1 billion, its highest figure over 6 years, up 19% Y/Y and 3% Q/Q, or not far of what was expected at the end of former quarter, and good profitability.

But it dropped 2.9% to $93.50 during trading on the stock market after hours of this announcement.

Revenue by product line:

- HDD: 2,822 (91% of global sales)

- Systems, SSD and other: 294 (9%)

The firm grew total HDD revenue to 2.9 billion, up 5% sequentially and 34% Y/Y. Non business, revenue came in at $151 million, down 9% Q/Q of record June quarter revenue. System business have been partially impacted by some of the supplying constraints.

Over the near-term, the broader supply constraints may delay some of customers' new product builds due to non-HDD shortages. However, the company believes any pause would be temporary until shortages are alleviated.

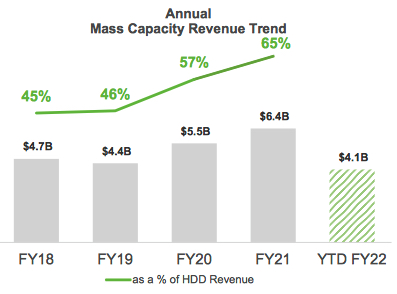

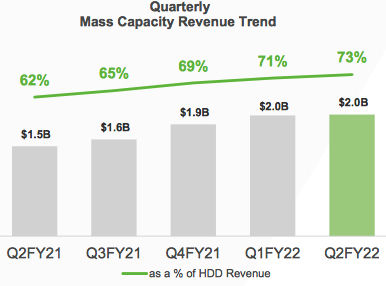

HDD capacity shipments increased 4% Q/Q to 159EB, up 39% from the prior year period. Growth was driven by increasing demand for mass capacity products, which contributed 71% of total HDD revenue and 83% of HDD exabyte shipments

Revenue from the mass capacity markets exceeded $2 billion for the first time, up 8% sequentially, and up 51%, compared with the prior-year period.

The manufacturer said that the HDD industry has being driven by long-term secular demand for mass capacity storage, a market expected to more than double by calendar 2026 to $26 billion.

Total of nearline shipments reached 106EB, up 5% Q/Q and 65% Y/Y, affecting demand for high-capacity drives. The firm got strong growth for dual actuator drives, and ongoing market momentum for its common platform products, spending 16TB through 20TB drives. Nearline growth was driven by high double-digit growth of 18TB HDDs.

The legacy market made up the remaining 29% of the HDD revenue, holding relatively stable at $831 million down 3% Q/Q, and up 5% Y/Y.

For next quarter expectations is flat or decreasing revenue between $2.850 billion and $3.150 billion, or -10% to 1%.

Seagate is raising its FY22 revenue growth outlook from the high single-digit percentage range to the low double-digit range.

HDDs from 2FQ15 to 2FQ22

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3F20 | $86 | 120.2 | 4,100 |

| 4F20 |

$89 | 117.0 | 4,500 |

| 1F21 |

$82 | 114.0 | 4,400 |

| 2F21 |

$81 | 129.2 | 4,300 |

| 3F21 | $91 | 139.6 | 5,100 |

| 4F21 | $97 | 152.3 | 5,400 |

| 1F22 |

$103 | 159 | 5,700 |

| 2F22 |

$106 |

163 | 6,100 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter