MinIO Closes $103 Million Series B Round, Total at $126 Million

Now at $1 billion valuation becoming unicorn

This is a Press Release edited by StorageNewsletter.com on January 27, 2022 at 2:03 pmMinIO Inc., raised $103 million in series B funding at a $1 billion valuation.

The investment was led by Intel Capital with participation from new investor SoftBank Vision Fund 2, and existing investors Dell Technologies Capital, General Catalyst Partners and Nexus Venture Partners.

This financing brings total funding raised to $126 million.

“MinIO’s ability to solve the multi-cloud storage challenges faced by developers is impressive and we are delighted to continue supporting their mission through investment from Intel Capital,” said Greg Lavender, CTO; SVP, GM, software and advanced technology group, Intel Corporation. “Developers represent the engine of value creation in the enterprise and MinIO’s object storage suite is uniquely suited for their evolving requirements. MinIO’s power, simplicity and capacity to run anywhere – from the edge to the cloud – make it one of the most compelling companies in the storage space.”

MinIO has established itself in AWS S3 compatible, multi-cloud object storage. Available on every cloud, it has more than 1.2 million active deployments on the public cloud, private cloud and edge. This includes public cloud deployments on Google Kubernetes Engine, Amazon’s Elastic Kubernetes Service, Azure Kubernetes Service, private cloud deployments on Red Hat OpenShift, VMware Tanzu, HPE Ezmeral, SUSE Rancher as well as millions of colocation and edge deployments.

The company continues to extend its feature with the addition of click to deploy capabilities on AWS, Google Cloud and Microsoft Azure. This complements its capabilities in ILM, ransomware protection and active-active, strictly consistent multi-site replication.

“High performance, multi-cloud object storage represents a foundational component in the modern software stack,” said Vikas Parekh, managing partner, SoftBank Investment Advisers. “We believe that MinIO has established itself as the leader for a diverse set of workloads from AI/ML, advanced analytics, databases and modern applications. We are delighted to partner with Anand Babu Periasamy, Garima Kapoor and the team as they ramp up commercialization of the technology.”

MinIO has seen adoption from organizations around the globe.

Growth metrics include:

• In the last year, ARR grew by over 201%

• Customer count grew by over 208% in 2021

• Total number of Docker pulls of 762,000,000, now averaging over 1,000,000 per day

• More than 31,000 GitHub stars and 16,000+ MinIO Slack community members

Open source under GNU AGPL v3, th firm has received more than 9,000 pull requests from 855 contributors since 2015.

“MinIO is a foundational component of our Epiphany Data Foundation and Panoptic Compliance Audit Platform that provides the data ingestion, auditing and ML capabilities at PRGX,” said Amir Karuppaiah, CTO, PRGX USA Inc. “Together, we are on the journey of cloud-native solutions with data lakes and advanced, throughput-oriented ML approaches that deliver secure, accurate insights to our customers.“

“Rakuten Symphony was created with a vision that modern telco infrastructure should be cloud-native, open and interoperable, giving mobile network operators the ability to build, deploy and scale at speeds and low costs never before seen,” commented Tareq Amin, CEO, Rakuten Symphony. “To achieve this we need like-minded partners like MinIO to enable operational efficiencies from the edge to the cloud.”

MinIO is a high performance, Kubernetes-native, S3 compatible object store for a range of storage use cases. Its performance exceeds comparable object stores, delivering tens of gigabytes of data per node in throughput. The performance characteristics have made its the object store of choice for ML frameworks, analytics applications, databases, web applications and other performance-oriented workloads. Its architecture is renowned for its simplicity and scales from terabytes to exabytes.

CEO and co-founder AB Perisamy said: “MinIO is fueled by developers. They drive our growth and enhance our product. This funding round will accelerate our efforts to deliver the world’s best multi-cloud storage software and provide us with the resources to build a modern, developer-centric go-to-market machine.”

Read AB’s blog post to learn more about the latest funding round and how it will support MinIO’s vision for an object storage centric world.

Comments

This announcement could be seen as anecdotic but for the object storage segment it is a significant news. It represents a validation of the MinIO model, its impact in the industry and obviously of the open source power. With a $1 billion valuation, it exceeds by far the one for some other commercial players who finally dream about it and never reached it. We understand that this round was oversubscribed meaning that the company could have received $200 or even $300 million.

Launched in 2014, we discovered MinIO in 2015 and unveiled the project to the world. We remember a famous meeting in December 2015 at GSV Labs with AB Periasamy, Garima Kappor and Harshavardhana. Since then the company had a unique trajectory, promoting a singular view that has shaken established market positions. The company was ignored that the market for quite a long time but have silently climbed the mountain at its pace.

We also wrote that MinIO has initiated a tsunami in its sector. Just look at numbers, AB Periasamy told us that he has stopped counting as numbers are too big and passed by far barriers than others can detect on the horizon. Guess what the tsunami is now touching the coast accelerating the disaster for other players. Among these players, of course classic historical ones that have raised large amount of money, got traction in the past, but are still independent and private without a real perspective for an IPO or even an exit. Why the IPO for them didn't already happen? Same for acquisition? Some have accepted proposal and finally changed their destiny, it is the case of the pioneer Caringo, owned now by DataCore, or Hedvig that joined Commvault in September 2019, almost 2 and half years ago already. This event will be seen as a key milestone in this storage industry segment.

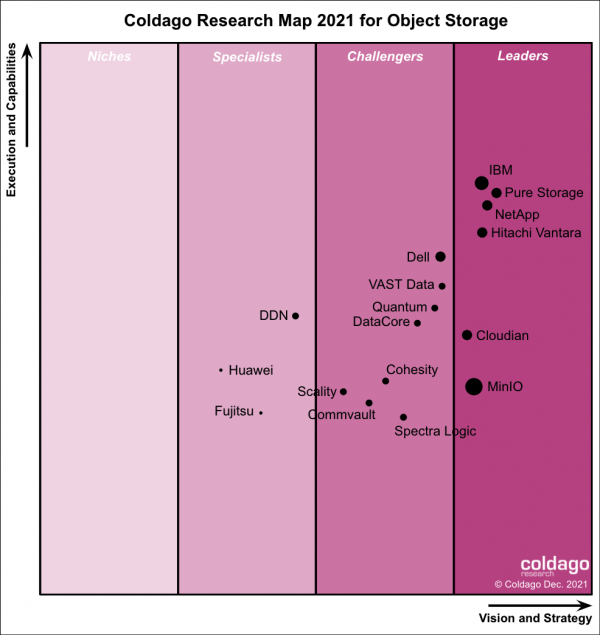

Believer of a pure object storage model, a simple and efficient one, based on AWS S3 API, for on-premises and cloud oriented workloads, the team have continued to dig in that direction while others added some file access methods to try to gain positions and grow their footprint. This is interesting and well illustrated below with the maps who study and display file and object storage players on different maps. For the last 3 Maps, MinIO was placed as an obvious leader.

MinIO illustrates well the SDS model transforming a set of independent servers with storage into a large scalable storage farm exposing S3. And, by servers, we almost mean everything as MinIO is everywhere from agile configurations on Raspberry Pi to large secondary storage clusters. And it's even remarkable that the imagination of adopters goes beyond what the company has anticipated. We found MinIO in so various configurations that it invites you to smile when you learn that.

This is also a perfect example of a U3 - Universal, Unified and Ubiquitous - approach.

It will be interesting to see how other vendors will react. In fact, some of them already tried to mimic MinIO having copied multiple of their initiative with less success, users prefer the original and the copy, and some have even used some of the tools developed by the team. It will potentially trigger some moves and acquisitions as some players, of any size, wish to stay in the game and need now an answer to the growing demand.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter