Nutanix: Fiscal 1Q22 Financial Results

Nutanix: Fiscal 1Q22 Financial Results

Net loss higher than revenue even growing 21%

This is a Press Release edited by StorageNewsletter.com on November 26, 2021 at 2:03 pm| (in $ million) | 1Q21 | 1Q22 | Growth |

| Revenue |

312.8 | 378.5 | 21% |

| Net income (loss) | (265.0) | (419.9) |

Nutanix, Inc. announced financial results for its first quarter ended October 31, 2021.

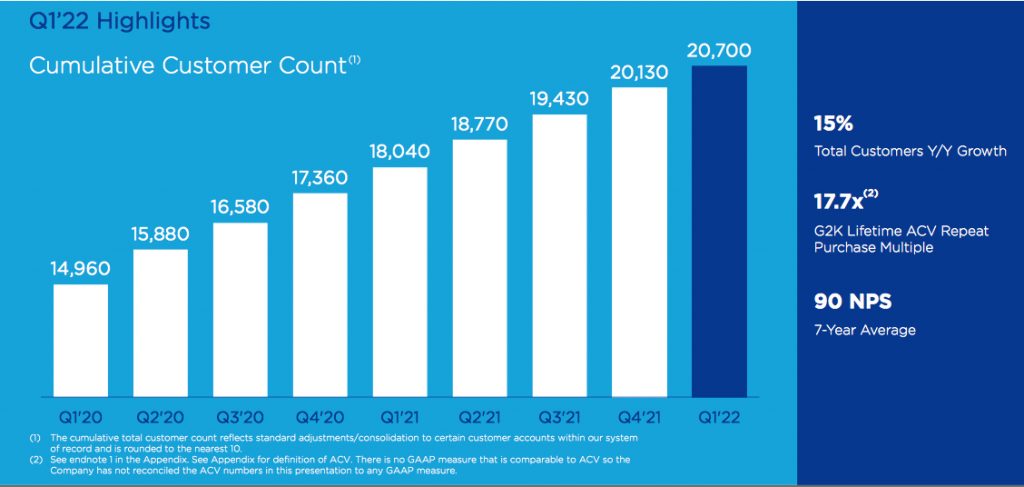

“Our first quarter was a good start to our fiscal year, demonstrating strong Y/Y top and bottom-line improvement,” said Rajiv Ramaswami, president and CEO. “We continued to execute towards our targets of free cash flow break-even in the second half of calendar 2022 and a 25%-plus ACV billings CAGR through fiscal 2025.”

“In our first quarter, we achieved record ACV billings, which grew 33% Y/Y, and saw 21% Y/Y revenue growth, our highest growth in over three years,” said Duston Williams, CFO. “With the continued progress we’ve made on our subscription model, we believe it’s now appropriate to provide annual guidance. Additionally, having gained a better understanding of potential fluctuations in our average contract term lengths, we are guiding to revenue, on both a quarterly and annual basis.“

2FQ22 Outlook

- ACV Billings: $195-$200 million

- Revenue: $400-$410 million

- Non-GAAP Gross Margin: Approximately 82% to 82.5%

- Non-GAAP Operating Expenses: $360-$365 million

- Weighted Average Shares Outstanding: Approximately 218 million

FY22 Outlook

- ACV Billings: $740-$750 million

- Revenue: $1.615-$1.630 billion

- Non-GAAP Gross Margin: Approximately 82%

- Non-GAAP Operating Expenses: $1.48 to $1.49 billion

Comments

Revenue of $379 million - above the Street consensus of $369 million -, is up 21% Y/Y and marks the company's highest revenue growth in over 3 years, but with enormous loss, $420 million.

Once more, the HCI leader never was profitable since as far as 2012 now with more than $3 billion cumulative loss!

It closed the quarter with cash and short-term investments of $1.28 billion, up from $1.21 billion in 4FQ21.

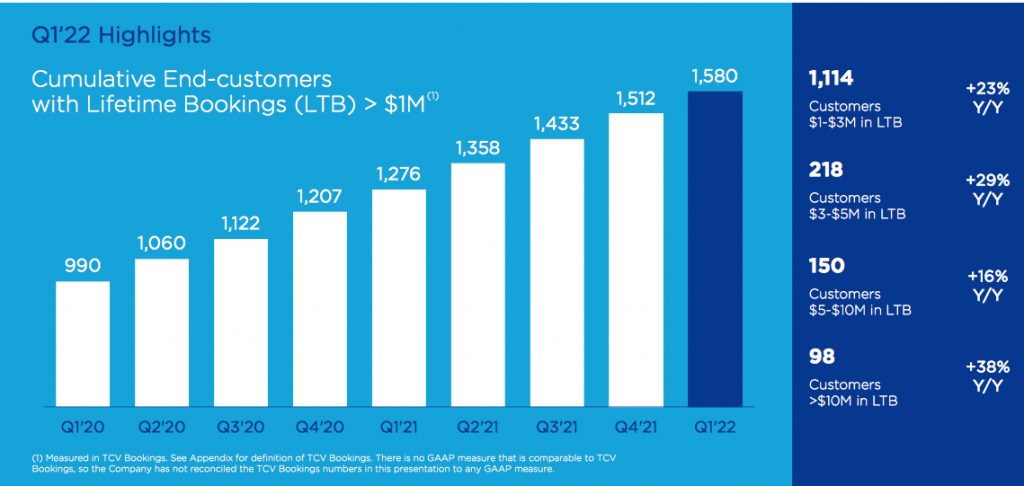

ACV billings for 1FQ22 were $183 million, reflecting 33% growth Y/Y, above firm's guidance range of $172 million to $177 million, and ahead of the Street consensus of $175 million.

In Q3, over the last 3 years, Nutanix have averaged a small sequential decline in ACV billings of 3% to 4%. It expects a similar trend for 3FQ22 for both ACV billings and revenue. It will use a bit of cash in 2FQ22, mostly related to a slight buildup in receivables associated with higher projected 2FQ22 billings.

Renewals business performed as expected. ARR, as of the end of 1FQ22, was $0.95 billion, growing 67% Y/Y, slightly ahead of expectation of 65% growth. Run rate ACV as of the end of 1FQ22 was $1.59 billion, growing 23% Y/Y.

Average contract term lengths decreased to 3.1 years vs. 3.4 years in 4FQ21, driven by usual 1FQ surge and federal business. On average, federal customers typically have much shorter contract term lengths.

The company expects a considerable Q/Q increase in emerging products new ACV bookings in 2FQ22. Average contract term length will most likely increase slightly next as federal business will return to a lower percentage of the overall business mix.

Nutanix added 560 new logos in 1FQ22 vs. 700 in 4Q21 and 680 in 1FQ21. In the prior 3 fiscal years, 1Q new logo count on average dropped by 115 new logos vs. 4Q.

Next quarter, the company expects revenue of $400 to $410 million corresponding to a 6% to 8% Q/Q growth. For FY22, guidance for sales is $1,615 to $1,630 million, or up 16% to 17%.

The firm said to remain on track to achieving its target of 25%+ annualized ACV billings growth through FY25.

Revenue and loss of Nutanix

(in $ million)

| FY ended in July |

Revenue | Loss |

| 2012 | 6.6 | 14.0 |

| 2013 | 30.5 | 44.7 |

| 2014 | 127.1 | 84.0 |

| 2015 | 241.4 | 126.1 |

| 2016 | 444.9 | 168.5 |

| 2017 | 845.9 | 379.6 |

| 2018 | 1155 | 297.2 |

| 2019 | 1136 | 621.2 |

| 2020 | 1308 | 872.9 |

| 2021 |

1,394 | 1,034 |

| 1FQ22 |

378.5 | 419.9 |

| 2FQ22 (estim.) |

400-410 | NA |

| FY22 (estim.) |

1,615-1,630 | NA |

| Total | 3,029 |

($238 million IPO in 2016)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter