Pure Storage: Fiscal 3Q22 Financial Results

Pure Storage: Fiscal 3Q22 Financial Results

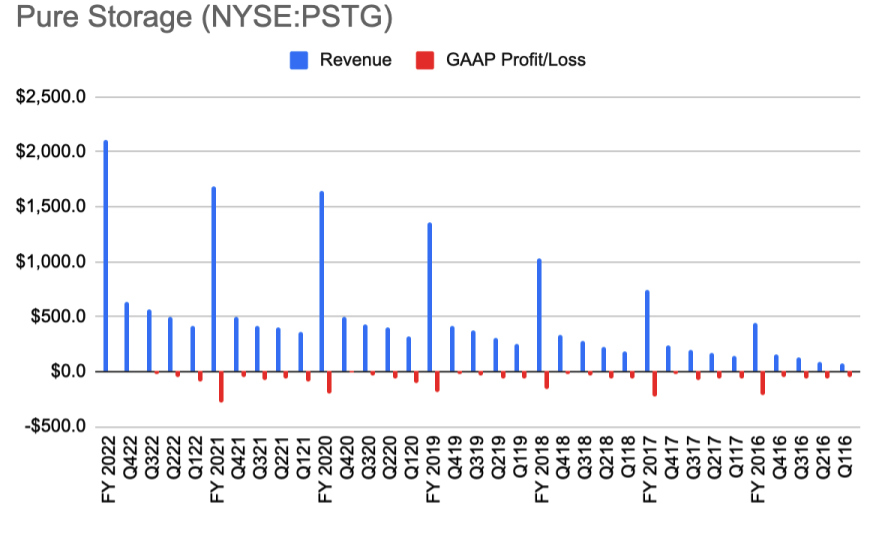

Revenue growing 37% Y/Y, more than $2 billion expected for FY22, smaller loss

This is a Press Release edited by StorageNewsletter.com on November 25, 2021 at 2:03 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 410.6 | 562.7 | 1,181 | 1,473 |

| Growth | 37% | 25% | ||

| Net income (loss) | (70.1) | (28.7) | (229.8) | (158.2) |

Pure Storage, Inc. announced financial results for its fiscal third quarter ended October 31, 2021.

“With 3Q revenue up 37% Y/Y and with increasing profitability, it’s clear that Pure continues to set the pace for the industry,” said Charles Giancarlo, chairman and CEO. “We’re delighted to provide cutting edge data services to customers and with our continued leadership in two Gartner Magic Quadrants.”

3FQ22 Highlights

• Revenue $562.7 million, up 37% Y/Y

• Subscription Services revenue $187.8 million, up 38% Y/Y

• Subscription Annual Recurring Revenue (ARR) $788.3 million, up 30% Y/Y

• Remaining Performance Obligations (RPO) $1.2 billion, up 27% Y/Y

• GAAP gross margin 66.6%; non-GAAP gross margin 68.5%

• GAAP operating loss $(18.1) million; non-GAAP operating income $69.5 million

• GAAP operating margin (3.2)%; non-GAAP operating margin 12.3%

• Operating cash flow $127.0 million; free cash flow $101.3 million

• Total cash and investments $1.4 billion

“Our strong 3Q performance was fueled by increased customer demand and execution across the entire business,” said Kevan Krysler, CFO. “We are in a great innovation cycle with our portfolio.”

4FQ22 Guidance

- Revenue: $630 million

- Non-GAAP Operating Income: $90 million

- Non-GAAP Operating Margin: approx. 14%

FY22 Guidance

- Revenue: $2.1 billion

- Non-GAAP Operating Income: $206 million

- Non-GAAP Operating Margin: approx. 10%

Comments

Editor's comments:

Revenue for the quarter at $563 million was above of the guidance ($530 million), up 37% Y/Y rather than 22%.

The company never was profitable since FY13 but net losses reaches $28.7 million, the lower figure since 2 years, to be compared to $45.3 million for the former 3-month period.

Following this announcement, stock surged 13.5% near 31.

The company records double digit Q/Q growth across all product lines, and across both US and international markets, these 2 markets growing 35% a nd 42% respectively compared to last year.

(*) Incremental purchases exclude Evergreen and unified subscription services purchases.

Pure estimates that the effects of the Covid environment are approximately two points of benefit to its operating margin for the most recent quarter. These reduced expenses generally relate to significantly reduced travel, physical marketing events, and slower than planned hiring.

Company's next announcement, on December 8, will push infrastructure modernization and extend the breadth of its FlashArray platform.

Pure expects a quarterly increase of 25% in revenue for next quarter and revised its prediction for FY22 from $2,040 million to $2,100 million, corresponding to an annual increase of 25% rather than 21%.

Revenues in $ millions

(FY ended in January)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

| 3F21 |

410,.6 | -4% |

(74.2) |

| 4F21 |

502.7 | 2% |

(52.2) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 |

412.7 | 12% |

(84.2) |

| 2F22 |

496.8 | 23% |

(45.3) |

| 3F22 |

562.7 | 29% |

(28.7) |

| 4F22* |

630 | 25% |

NA |

| FY22* |

2,100 |

25% |

NA |

* Estimations

Comments of Philippe Nicolas:

Pure Storage 3FQ22 earnings show a clear positive trend and illustrate that Covid nightmare has sometimes a positive impact on some businesses especially on IT.

Results are strong given by different metrics in a positive way and trajectory is also in the right segment.

The image below includes the objectives of Pure to show the new positive growth following almost a pause between FY20 and FY21 with a limited +2.48% on the revenue side. It also means that 4FQ22 could be the first quarter with the absence of loss as 3FQ22 shows "only" $29 million. We see seasonality pattern, not a surprise in IT as customers understand and leverage that with also aggressive and pressure from vendors in their end of quarters and years. Nothing new here but a confirmation clearly visible on the graphic below.

One of the main contributions is the enterprise demand fueled by the digital economy, the digital transformation and the drastic reduction of brick and mortar replaced by digital native players. Again it is an effect of the Covid that accelerated the trend.

For the first time, Pure Storage passed the $30 barrier for its stock yesterday and it finished the day above that value and even touched $31.88 during the day. It means that the market capitalization approaches $10 billion. Also the firm also reviewed its 4FQ22 number and clearly expresses its goal to pass $2.1 billion for the FY22 revenue.

The revenue is split in 2 parts: products and subscription services. The latter covers Evergreen, Pure as-a-Service and Portworx. Products are more aligned with Pure segmentation represented by systems on its web site i/e the FlashXXXX hardware line. This subscription shows 1/3 of the total revenue growing at 38% Y/Y. This illustrates once again a mutation of the company from a pure one hardware product - historical block AFA FlashArray - to a multiple hardware, software and services aligned with the market transformation towards the hybrid wave. At least it is what hardware vendors try to do as clearly there is an on-premises erosion they all try to limit.

One of the characteristics of these earnings patterns is the significant improvement of the profitability as a result of a new internal discipline, efficiency on cost control in sales and marketing and R&D and of course accelerated by Covid.

We mentioned that the demand was higher in 3FQ22 and it appears that it couhes all dimensions: geos, capacities, products ... confirming the digitalization of our life.

Speaking with Rob Lee, CTO, he confirmed that revenue is a mix of new projects and extension of established ones with capacity extension, FlashArray plus FlashBlade and FlashBlade plus FlashArray and some real interest and penetration for services around Pure as-a-service and Portworx Data Services.

He also added that the firm continues its internal development on new features and products but actively keeps an eye outside to find and detect some new gems.

The company prepares a significant launch December 8 around a new FlashArray family member with Pure Fusion and its view to make on-premises and cloud operations completely seamless without the need to choose.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter