FalconStor: Fiscal 3Q21 Financial Results

FalconStor: Fiscal 3Q21 Financial Results

Revenue down Q/Q and Y/Y at only $3.3 million, with tiny net income

This is a Press Release edited by StorageNewsletter.com on November 12, 2021 at 2:02 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 4.4 | 3.3 | 11.1 | 10.4 |

| Growth | -25% | -6% | ||

| Net income (loss) | 1.5 | 0.4 | 1.2 | 0.4 |

FalconStor Software, Inc. announced financial results for its third quarter, which ended on September 30, 2021, delivering a 35% Y/Y increase in subscription revenue fueled by the growth in MSP business and market adoption of hybrid cloud data protection solutions.

“We continue to make solid progress vs. our strategic plans to reinvent FalconStor and enable secure hybrid cloud backup and data protection,” said Todd Brooks, CEO. “Driven by continued adoption of the FalconStor StorSafe long-term data protection solution, we accelerated our strategic focus on a recurring revenue model better aligned with today’s market. As part of this focus, we introduced a new and disruptive recurring monthly pricing model for our MSPs, and continued migrating our installed based to a subscription revenue model. As a result, total subscription revenue increased 35% compared to 3FQ20, and 54% for the first 9 months of 2021 compared to the same period last year.

“While we are encouraged by our subscription revenue growth, we are continuing to work toward our goal of consistent total revenue growth, as total revenue decreased by 26% Y/Y during the quarter and is down 7% for the first 9 months of 2021 compared to the same period in 2020. As the recurring percentage of total revenue continues to increase over the next several quarters, and the reduction in perpetual license sales decreases, we are committed to driving more predictable total revenue growth, delivering profitability, and generating cash from operations, as we invest to grow.”

“Migration to the cloud, data center rationalization, and increased leverage of outsourced managed services are top priorities for enterprise CIOs in the post-pandemic world, and FalconStor plays a vital role in each,” he added. “We are excited by our hybrid cloud focus, the efficient routes to market that we are building through our MSP partners, and trust our shareholders have placed in our team to deliver customer and shareholder value.”

3FQ21 Results

- Subscription Revenue: 35% increase to $0.8 million, compared to $0.6 million in 3FQ20

- Subscription Revenue % of Total Revenue: 23%, compared to 13% in 3FQ20

- Total Revenue: $3.3 million, compared to $4.4 million in 3FQ20

- Total Cost of Revenue: $0.4 million, compared to $0.4 million in 3FQ20

- Total Operating Expenses: $2.4 million, compared to $2.3 million in 3FQ20

- GAAP Net Income: $0.4 million, compared to $1.5 million in 3FQ20

- Ending Cash: $3.5 million, compared to $0.9 million 3FQ20

Nine Months Ended 2021 Financial Results

- Subscription Revenue: 54% increase to $2.6 million, compared to $1.7 million in the first 9 months of 2020

- Subscription Revenue % of Total Revenue: 25%, compared to 15% in the first 9 months of 2020

- Total Revenue: $10.4 million, compared to $11.1 million in the first 9 months of 2020

- Total Cost of Revenue: $1.5 million, compared to $1.4 million in the first 9 months of 2020

- Total Operating Expenses: $8.6 million, compared to $7.9 million in the first 9 months of 2020

- GAAP Net Income: $0.4 million, compared to $1.2 million in the first 9 months of 2020

- Ending Cash: $3.5 million, compared to $0.9 million in the first 9 months of 2020

Revised FY21 Guidance

- Revenue from $14.1 million to $15.1 million

- Net income from $0.6 million to $1.7 million

Comments

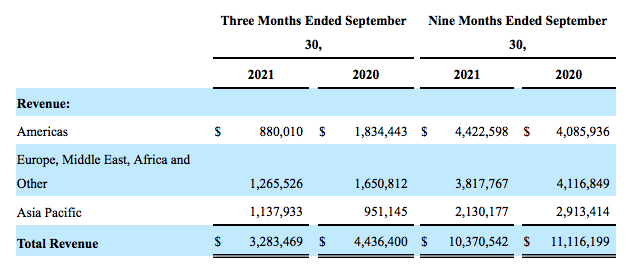

The public company records only $3.3 million in revenue for the quarter to be compared to $3.8 million the former one, and $4.4 million one year ago.

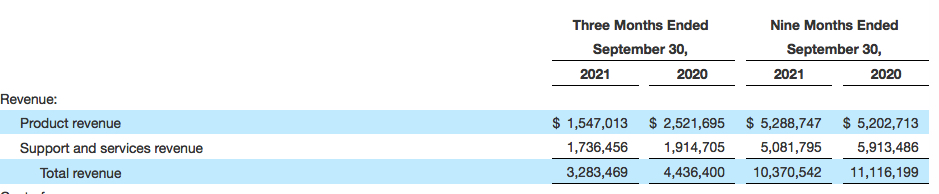

For the three months ended September 30, 2021 and 2020, product revenue represented 47% and 57% of total revenue, respectively. Product revenue of $1,547,013 for 3FQ21 decreased $974,682, or 39%, from $2,521,695 in the prior year period. The decrease is due to revenue from 3 large contracts in 3FQ2O that did not repeat in 3FQ21.

For the 9 months ended September 30, 2021 and 2020, product revenue represented 51% and 47% of total revenue, respectively. Product revenue of $5.3 million for the 9 months ended September 30, 2021 increased $0.1 million, or 2%, from $5.2 million in the prior year period.

Maintenance and technical support services revenue for 3FQ21 decreased to $1.6 million, compared to $1.9 million 2FQ21. The decrease is primarily due to a decline in maintenance renewals. Maintenance and technical support services revenue for the 9 months ended September 30, 2021 decreased to $4.8 million, compared to $5.7 million in the prior year period. The decrease is primarily due to a decline in maintenance renewals.

Professional services revenue for 3FQ21 increased to $94,543, compared to $31,269 in the prior year period. Professional services revenue for the nine months ended September 30, 2021 increased to $255,522, compared to $183,976 in the prior year period.

Total cash and cash equivalents increased $1.6 million to $3.5 million at September 30, 2021 compared to December 31, 2020.

Company has slightly revised its FY21 guidance expecting now revenue from $14.1 million to $15.1 million, maybe the lowest figure in the history of the company for annual sales, being $14.8 million for FY20.

![]() Note that, on July 1, the firm's CEO Jim McNiel resigned to "pursue other opportunities" and was replaced by Tod Brooks. Prior to joining Falconstor, Brooks was COO at Aurea Software, and CEO of Update Software, a publicly traded company in Europe. Previously, he was COO at Trilogy where he was responsible for the strategic and operational leadership of the firm's automotive, financial services and telecom, technology and media business units. Earlier in his career, he co-founded and managed 2 technology consulting firms, including eFuel, in logistics optimization software for the automotive industry. In addition, he held leadership roles at FedEx.

Note that, on July 1, the firm's CEO Jim McNiel resigned to "pursue other opportunities" and was replaced by Tod Brooks. Prior to joining Falconstor, Brooks was COO at Aurea Software, and CEO of Update Software, a publicly traded company in Europe. Previously, he was COO at Trilogy where he was responsible for the strategic and operational leadership of the firm's automotive, financial services and telecom, technology and media business units. Earlier in his career, he co-founded and managed 2 technology consulting firms, including eFuel, in logistics optimization software for the automotive industry. In addition, he held leadership roles at FedEx.

At a time, IBM seems to be interested to acquire OEM FalconStor for its VLT, but the deal didn't happen, and we don't see now any company being interested to buy such a tiny old firm being one of the oldest storage company in the world, being founded in 2000.

| FY | Revenue in $ million |

Growth |

| 2004 | 28.7 | NA |

| 2005 | 41.0 | 43% |

| 2006 | 55.1 | 34% |

| 2007 | 77.4 | 41% |

| 2008 | 87.0 | 12% |

| 2009 | 89.5 | 3% |

| 2010 | 82.8 | -7% |

| 2011 | 82.9 | 0% |

| 2012 | 75.4 | -9% |

| 2013 | 58.6 | -32% |

| 2014 | 46.3 | -21% |

| 2015 | 48.6 | 5% |

| 2016 | 30.3 | -38% |

| 2017 | 25.2 | -17% |

| 2018 | 17.8 | -29% |

| 2019 | 16.5 | -7% |

| 2020 | 14.8 | -10% |

| 1FQ21 | 3.8 | 20% |

| 2FQ21 |

3.3 |

-7% |

| 2021 (estim.) |

14.1-15.1 |

-5% - +7% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter