SK hynix: Fiscal 3Q21 Financial Results

SK hynix: Fiscal 3Q21 Financial Results

≠1 WW storage company consolidates this ranking with $10 billion+ revenue.

This is a Press Release edited by StorageNewsletter.com on October 28, 2021 at 2:02 pm| (in won million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

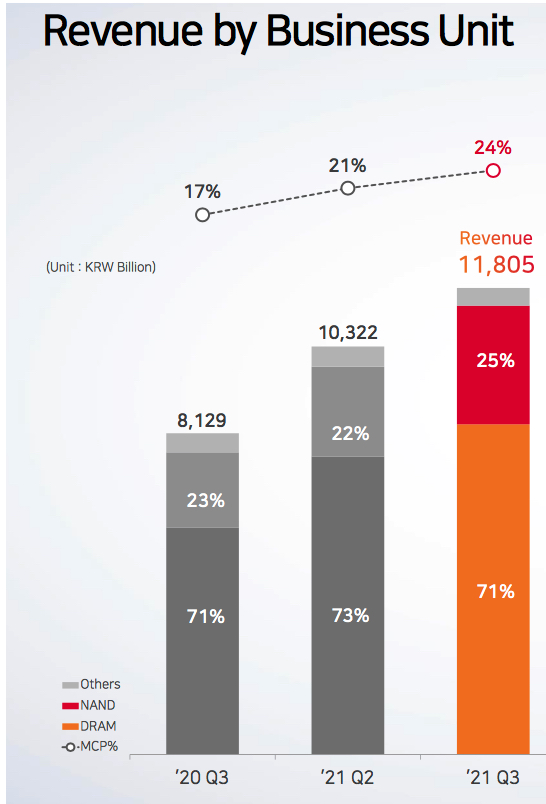

| Revenue | 8.129 | 11.805 | 23.935 | 30.721 |

| Growth | 45% | 28% | ||

| Net income | 1.084 | 3.315 | 3.003 | 5.296 |

SK hynix Inc.announced financial results for its third quarter 2021 ended on September 30, 2021.

The consolidated revenue was 11.805 trillion won, while the operating profit amounted to 4.172 trillion won and the net income 3.315 trillion won. Operating margin for the quarter was 35% and net margin was 28%.

The company achieved record high quarterly revenue since its foundation, and regained operating profit more than 4 trillion won after 2 and a half years since 4FQ18.

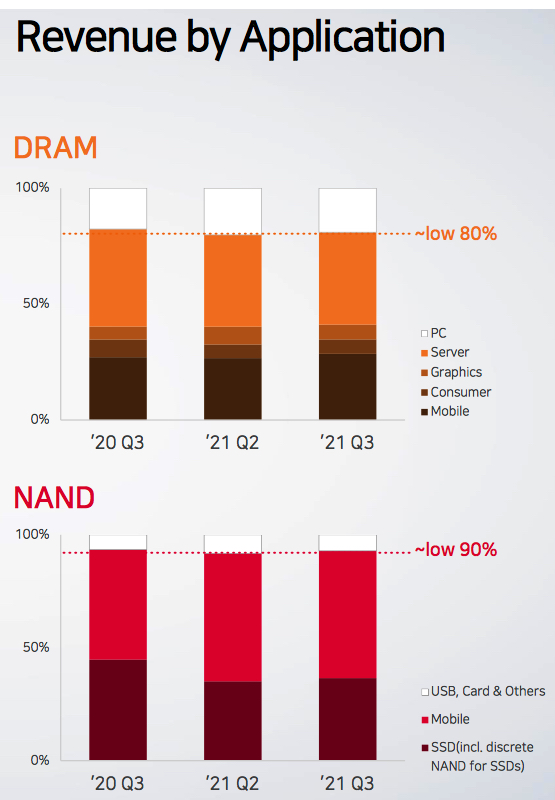

The increased semiconductor memory demand for server and smartphone (mobile) applications, alongside the improved product prices, contributed to this record-breaking quarterly revenue.

During last quarter th firm managed to increase the yield rate of its mainstream products including 1znm DRAM and 128-layer 4D NAND flash, while expand their proportion among its production volume. As a result, with enhanced cost competitiveness the quarterly operating profit exceeded 4 trillion won.

Notably, SK hynix’s NAND flash business has finally turned to a surplus in the third quarter.

Kevin (Jongwon) Noh, EVP and head of corporate center (CFO), said: “Despite the concerns over recent global supply chain disruptions, the remarkable quarterly performance signals that the semiconductor memory industry is continuing its growth momentum.”

SK hynix forecasts market demand for semiconductor memory will grow consistently, and will react flexibly to market condition changes and focus on securing profitability.

At the same time, it expects to enhance the competitiveness of its NAND flash business, which has recently turned to a surplus, with the completion of Intel NAND and SSD business acquisition until the end of this year.

“After the completion of the acquisition, SK hynix will establish complementary product portfolio which maximizes both companies’ strengths, and seek to achieve economies of scale,” Noh said. “For the future SK hynix will expand its R&D foothold and evolve into a global semiconductor memory leader.“

Comments

Revenue for the quarter, equivalent to $10.1 billion is up 14% Q/Q and as much as up 45% Y/Y, passing former record in 2FQ18, and with comfortable net income.

Once more, according to our calculation, SK hynix is and will remain the ≠1 WW storage company in front of Micron, both in DRAM and flash chips, with Micron also in SSDs.

NAND

- 25% of global revenue

- 4Q bit growth low 20%

- 2021 bit growth higher than market demand

- ASP in mid single percentage

- Start mass production of 176L within 2021 bit portion of 128L reached 75% in 3Q, one quarter ahead of schedule

- NAND profit turnaround for FY21 due to smooth ramp-up of 128L

DRAM

- 71% of global revenue

- 4Q bit growth mid-high single digit percentage

- 2021 bit growth slightly below market demand

- ASP in high single percentage

- Increase production of 1znm 16Gb, start shipment of 1anm, which uses EUV Start mass production of DDR5 in 2H21.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter