Micron: Fiscal 4Q21 Financial Results

Micron: Fiscal 4Q21 Financial Results

Outstanding quarter and fiscal year but bad outlook for next 3-month period

This is a Press Release edited by StorageNewsletter.com on September 30, 2021 at 1:32 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 6,056 | 8,274 | 21,435 | 27,705 |

| Growth | 37% | 29% | ||

| Net income (loss) | 990 | 2,720 | 2,710 | 5,861 |

Micron Technology, Inc. announced results for its fourth quarter and full year of fiscal 2021, which ended September 2, 2021.

4FQ21 highlights

• Revenue of $8.27 billion vs. $7.42 billion for 3FQ21 and $6.06 billion for 4FQ20

• GAAP net income of $2.72 billion, or $2.39 per diluted share

• Non-GAAP net income of $2.78 billion, or $2.42 per diluted share

• Operating cash flow of $3.88 billion vs. $3.56 billion for 3FQ21 and $2.27 billion for 4FQ20

FY21 highlights

• Revenue of $27.71 billion vs. $21.44 billion for FY20

• GAAP net income of $5.86 billion, or $5.14 per diluted share

• Non-GAAP net income of $6.98 billion, or $6.06 per diluted share

• Operating cash flow of $12.47 billion vers$8.31 billion for FY20

“Micron’s outstanding fourth quarter execution capped a year of several key milestones,” said president and CEO Sanjay Mehrotra. “In FY21, we established DRAM and NAND technology leadership, drove record revenues across multiple markets, and initiated a quarterly dividend. The demand outlook for 2022 is strong, and Micron is delivering innovative solutions to our customers, fueling our long-term growth.“

Investments in capital expenditures, net were $2.01 billion for 4FQ21 and $9.72 billion for FY21, which resulted in adjusted free cash flows of $1.88 billion for 4FQ21 and $2.75 billion for FY21.

The company repurchased approximately 13.9 million shares of its common stock for $1.05 billion during 4FQ21 and 15.6 million shares of its common stock for $1.20 billion during FY21 and ended the year with cash, marketable investments, and restricted cash of $10.46 billion, for a net cash position of $3.69 billion.

Outlook for 1FQ22: Revenue of $7.65 billion ± $200 million

Comments

If you consider DRAM as a storage component, Micron is the ≠2 storage company in the world behind SH hynix and in front of Dell, WD and Seagate.

Global sales are up 11% Q/Q and up 37% Y/Y.

The fiscal year ended with $10.5 billion of total cash and investments and $13 billion of total liquidity. 4FQ21 total debt was $6.8 billion.

Highlights for Micron for 4FQ21 ...

- Robust profitability and th second-highest quarterly revenue in firm's history

- Record quarterly revenue in NAND as well as in our embedded business.

... for FY21

- Highest-ever mobile revenue, driven by all-time-high managed NAND revenue and MCP mix; embedded business had a record year, with auto and industrial businesses both at substantial new highs; crucial-branded consumer business and overall QLC mix in NAND all hit records in FY21

- Revenue for the storage business unit at $1.2 billion, up 19% 3FQ21 and up yearly 32%; data center SSDs had strong growth in the quarter driven by enterprise and cloud strength; QLC shipments set a new record in the fiscal year, in terms of percentage of NAND shipments

Technology and ops

- Technology leadership in DRAM and NAND with 1-alpha DRAM and 176-layer NAND, respectively, 20% to 30% faster than prior nodes

- First to introduce LP5x DRAM and uMCP5 managed NAND in mobile and functional safety capable LP5 for automotive applications

- 1-alpha and 1z DRAM nodes combined now represent the majority of company's DRAM bit production, and by the end of 2021 expecting 176-layer NAND to represent the majority of NAND bit production

- Recently took delivery of the EUV system NXE 3600 at Boise HQs.; goal of implementing extreme ultravioletn (EUV) in high-volume manufacturing in the 2024 timeframe

- Successfully navigated the challenges of Covid-19 across or global manufacturing network while maintaining continuity of supply to customers

- Enhancing NVMe SSD portfolio and soon introducing soon PCIe Gen4 data center SSDs with own controllers

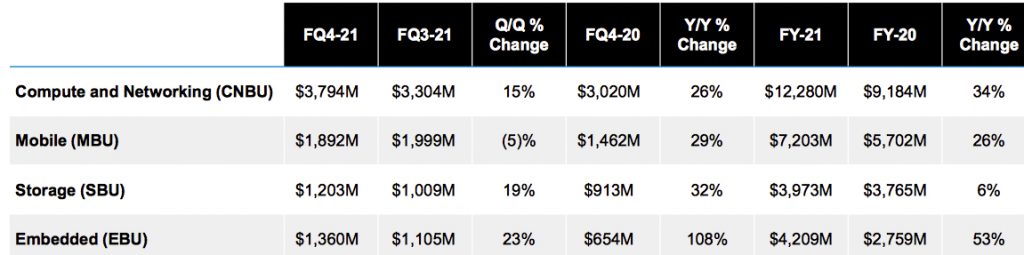

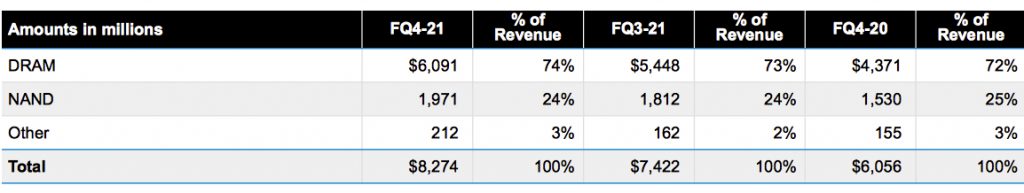

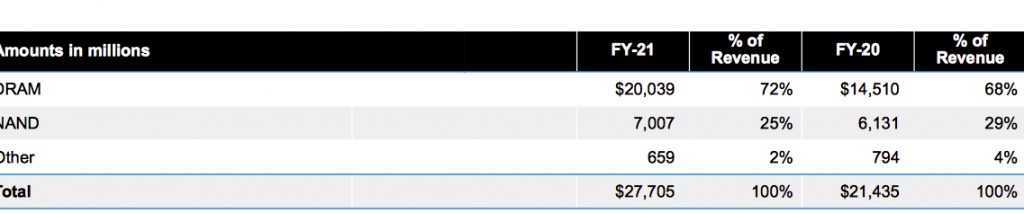

Revenue by business unit

Revenue by technology

| For 4FQ21 | For FY21 | |

| DRAM |

|

|

| NAND |

|

|

| Industry outlook according to Micron |

|

|

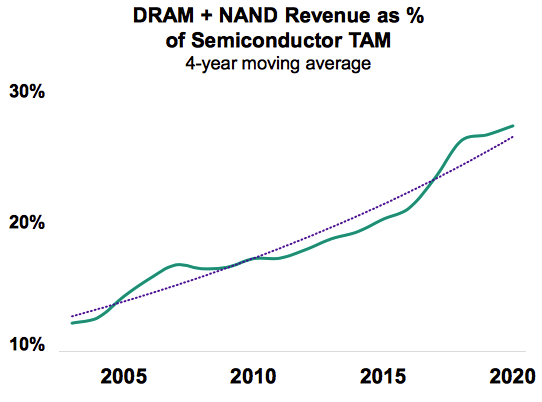

Outlook of Micron of DRAM and NAND business

- Long-term bit supply growth CAGR in line with industry demand

- CY22 bit shipment growth expected to be in line with industry demand

- FY22 bit shipment to lag long term demand CAGR

- Annual cost per bit reductions expected to be competitive with the industry in FY22 and over the long term

Micron Outlook

The firm plans to deliver record revenue with solid profitability in FY22, but for next quarter, revenue is supposed to sequentially decrease from 5% to 10%, as bit shipments are expected to decline in both DRAM and NAND.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter