WW Enterprise External OEM Storage Systems Market Revenue Increased 9.7% in 2Q21 to $6.9 Billion

Among top 7, only IBM and Hitachi down Y/Y, 36% and 4%, respectively

This is a Press Release edited by StorageNewsletter.com on September 14, 2021 at 1:32 pmAccording to the IDC Worldwide Quarterly Enterprise Storage Systems Tracker, global market revenue for enterprise external OEM storage systems grew 9.7% Y/Y to $6.9 billion during 2Q21.

Total external OEM storage capacity shipped was up 27.9% year over year to 22.1EB during the quarter.

Revenue generated by the group of original design manufacturers (ODMs) selling directly to hyperscale datacenters declined by 7.7% Y/Y in 2Q21 to $6.4 billion, while capacity shipped grew yearly 13.8% to 88.7EB. Enterprise storage capacity shipments for the entire market (External OEM + ODM Direct + Server-Based Storage) increased 25.2% to 156.1EB.

“The external storage systems market recovery observed during first quarter of 2021 continued even stronger during the second quarter,” said Zsofia Madi-Szabo, research manager, infrastructure platforms and technologies. “The degree to which demand returned was highly influenced by the rate at which each regional economy has recovered from the difficulties associated with the global pandemic.”

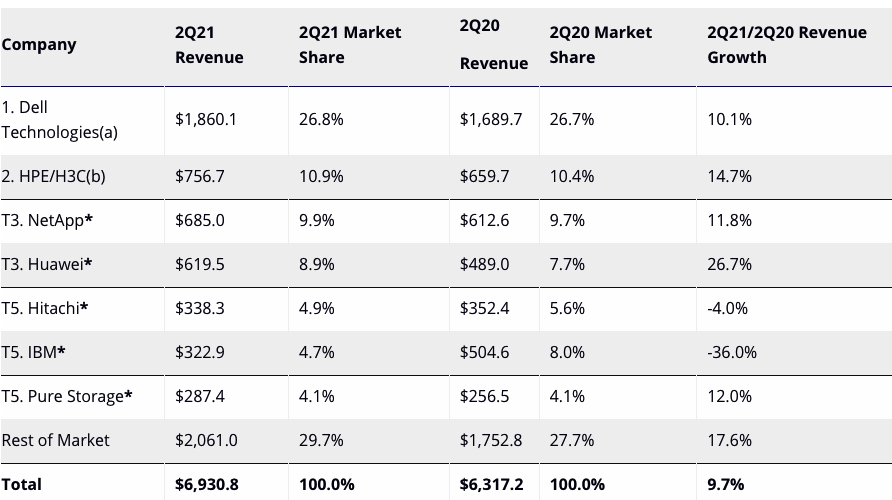

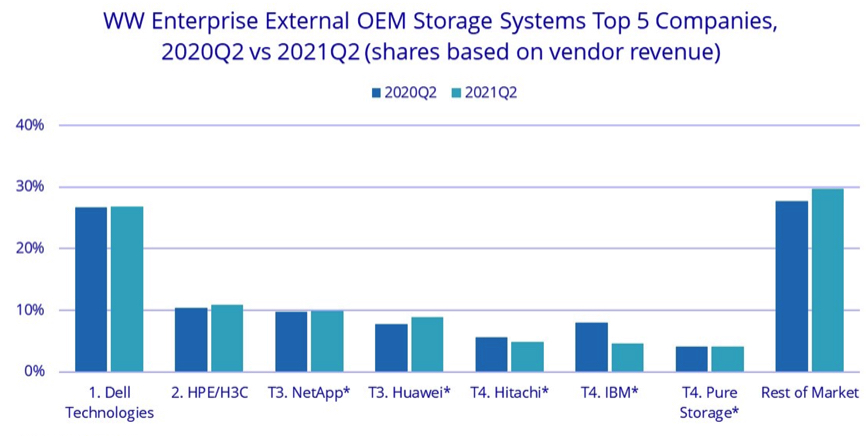

Enterprise External OEM Storage Systems Results, by Company

Dell Technologies(a) was the largest external enterprise storage systems supplier during the quarter, accounting for 26.8% of WW revenue. HPE/H3C(b) was the second largest supplier during the quarter with 10.9% of revenue. NetApp and Huawei tied* for third place with 9.9% and 8.9% of total revenues, respectively. Three vendors, Hitachi, IBM, and Pure Storage, tied* for fifth place in the market with shares of 4.9%, 4.7% and 4.1%, respectively.

Top 5 Companies, WW Enterprise External OEM Storage Systems Market, 2Q21

(revenue in $ million)

Notes:

* IDC declares a statistical tie in the worldwide enterprise external storage market when there is a difference of one% or less in the share of revenues or shipments among two or more vendors.

(a) Dell Technologies represents the combined revenues for Dell and EMC.

(b) Due to the existing joint venture between HPE and H3C, IDC is reporting external market share on a global level for HPE and H3C as “HPE/H3C” starting from 2Q 2016. Per the JV agreement, Tsinghua Holdings subsidiary, Unisplendour Corporation, through a wholly-owned affiliate, purchased a 51% stake in H3C and HPE has a 49% ownership stake in the new company.

Flash-Based Storage Systems Highlights

The total AFA market surpassed $2.7 billion in revenue during the quarter, up 7.6% Y/Y. The Hybrid Flash Array market surpassed $2.8 billion in revenue, up 13.3% from 1Q21.

Regional External Storage System Highlights

Storage revenue in China grew 33.3% Y/Y. Japan declined 21.2% in 2Q21 compared to 2Q20, while AsiaPac (excluding Japan and China) was up 15.4%. EMEA grew 3.7% on a Y/Y basis with Central and Eastern Europe showing double-digit growth of 26.0%. USA was up 5.9% and Canada grew 29.5%. Latin America saw its first growth in external storage revenues this quarter since 1Q20, up 12.5%.

Taxonomy Notes

IDC defines an enterprise storage system as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with 3 or more disks. A system may be outside of or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e., switches) and non-bundled storage software.

The information in this quantitative study is based on a branded view of the enterprise storage systems sale. Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included in this study.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter