Nutanix: Fiscal 4Q21 Financial Results

Nutanix: Fiscal 4Q21 Financial Results

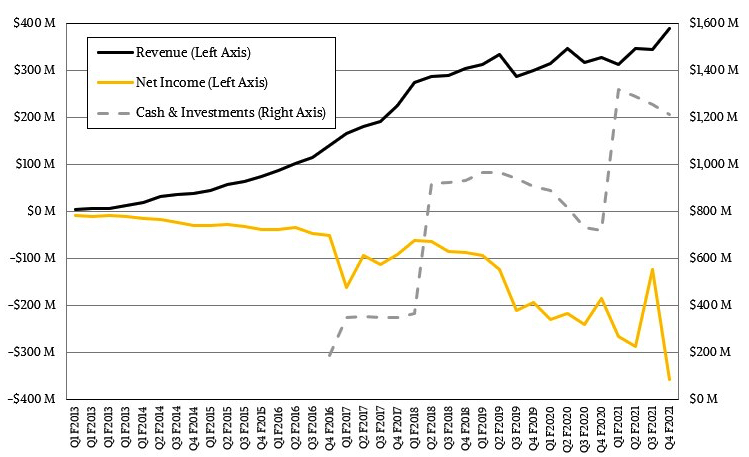

$1,394 million FY revenue up 7% for $1,034 million net loss increasing 18%

This is a Press Release edited by StorageNewsletter.com on September 7, 2021 at 1:32 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 327.9 | 390.7 | 1,308 | 1,394 |

| Growth | 19% | 7% | ||

| Net income (loss) | (185) | (358) | (873) | (1,034) |

Nutanix, Inc. announced financial results for its fourth quarter and fiscal year ended July 31, 2021.

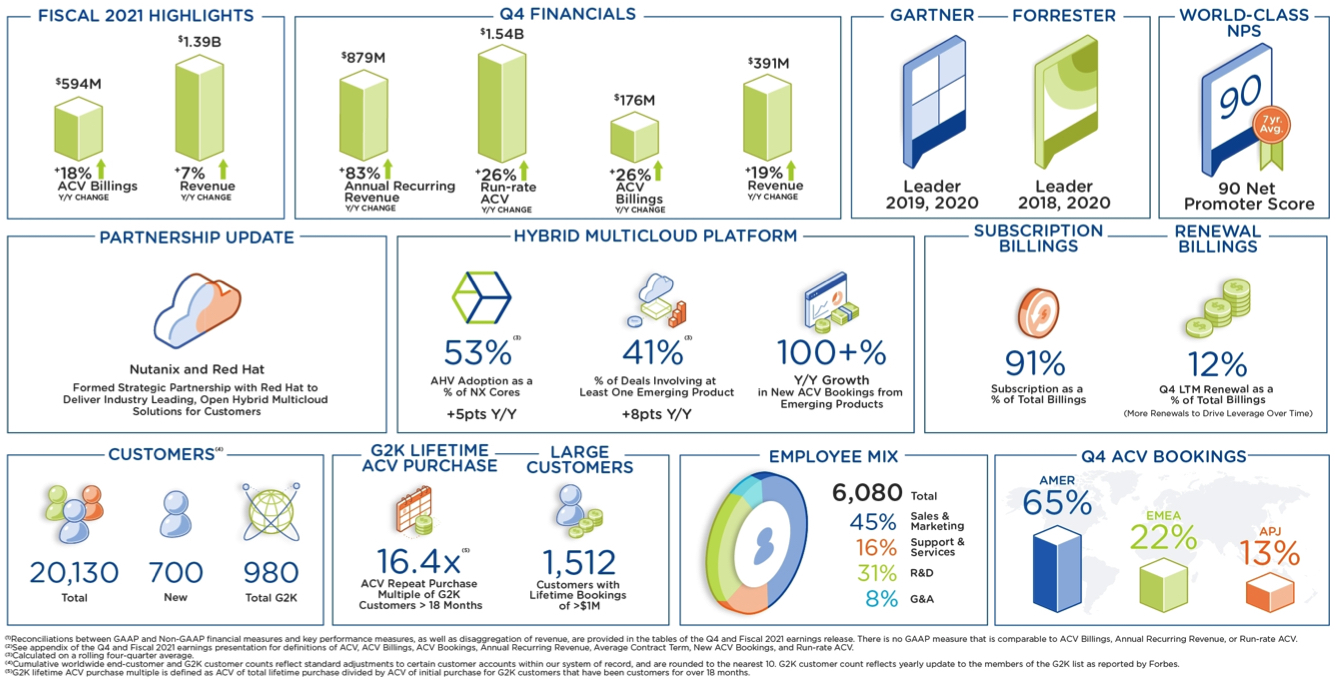

“Our fourth quarter was a strong end to an excellent fiscal year, which was marked by consistent execution and solid progress across both financial and strategic objectives,” said Rajiv Ramaswami, president and CEO. “We have entered our FY22 with good momentum and a solid plan for growth, executing on the model we laid out at Investor Day and delivering on our vision of making clouds invisible.”

“We achieved records across a number of key metrics in the fourth quarter, including ACV billings and revenue, which grew 26 and 19% Y/Y, respectively,” said Duston Williams, CFO. “In FY22, we expect our growing base of low-cost renewals will drive further improvements in top and bottom line performance.”

2FQ22 outlook:

- ACV billings: $172-$177 million

- Non-GAAP gross margin: Approximately 81.5%

- Non-GAAP operating expenses: $365-$370 million

- Weighted average shares outstanding: Approximately 216 million

Comments

Fastest growth was recorded in quarterly revenue at $390.7 million for the last 3 years, substantially above the Street consensus number of $365 million, and ACV billings of $176 million up 26% Y/Y, was fastest growth over 2 years.

Stock rose to $40.85 after this financial announcements.

ACV billings for the quarter were $176 million, reflecting 26% growth Y/Y, above guidance range of $170 million to $175 million, and ahead of the Street consensus of $173 million.

New ACV bookings across multiclloud porfolio grew 100%+ Y/Y with record attach rate of 41%.

The firm got 700 new customers in the quarter, for total of 20,130.

1,512 customers of Nutanix products spent more than $1 million, up from 1,433 in 3FQ21 and 1,204 in 4FQ20.

Cash and cash equivalents reached $285.7 million, down from the $318.7 million in 4FQ20.

No guidance was revealed for 1FQ22 revenue as usual and the company is far to be profitable totaling huge losses, $3,642 billion at the end of FY21 since the beginning of its business, even increasing for the last 3-month period.

Revenue and loss of Nutanix

(in $ million)

| FY ended in July |

Revenue | Loss |

| 2012 | 6.6 | 14.0 |

| 2013 | 30.5 | 44.7 |

| 2014 | 127.1 | 84.0 |

| 2015 | 241.4 | 126.1 |

| 2016 | 444.9 | 168.5 |

| 2017 | 845.9 | 379.6 |

| 2018 | 1155 | 297.2 |

| 2019 | 1136 | 621.2 |

| 2020 | 1308 | 872.9 |

| 2021 |

1,394 | 1,034 |

| Total | 3,642 |

($238 million IPO in 2016)

Read also this article from THENEXTPLATFORM:

If hyperconverged is so good, why it is not pervasive and profitable?

Nutanix financial results

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter