In 2Q21 SSD Units Flat at 100 Million but Capacity Climbs More Than 10% to 69EB

Samsung leader in front of WDC

This is a Press Release edited by StorageNewsletter.com on August 19, 2021 at 1:03 pmThis is an Executive Summary of Trendfocus, Inc.‘s NAND/SSD Information Service 2CQ21 Quarterly Update published on August 16, 2021.

2Q21 SSD Unit Volumes Flat at 99.6 Million Units While Capacity Shipments Climb More Than 10% Q/Q to 68.6EB

All enterprise SSD segments post growth, client SSDs dip in units whil capaâcity shipments rise slightly

Total client SSDs dipped slightly to 86.86 million units, down 1.7% Q/Q, driven by a continued lack of component supply, especially in the channel, while modules shipping to mostly PC OEM customers saw slight growth, with units up 1.5% to 71.48 million and capacity up 8.8% to 32.81EB. Total client capacity increased by 6.7% to 41.55EB.

Enterprise SATA remained very strong with 5.79 million units and 5.25EB shipped, a rise of over 17% Q/Q for both metrics.

SAS SSDs held above the one-million-unit mark shipping 1.1 million units, rising 1% Q/Q, with capacity shipped increasing over 13% to 3.68EB as storage OEMs drove demand.

Data center demand continued its rebound into 2Q21 helping enterprise PCIe continue its climb, shipping 5.84 million units and 18.16EB, up 14.9% and 17.1% Q/Q, respectively.

Total NAND bit shipments increased slightly to 141.19EB, up 3.4% sequentially, with growth across all three major NAND segments; mobile continued to claim the highest share mix at 33.1%, followed by cSSD with 29.4%, then eSSD with 20.7% of the mix, while all other applications experienced a decline to 16.8%.

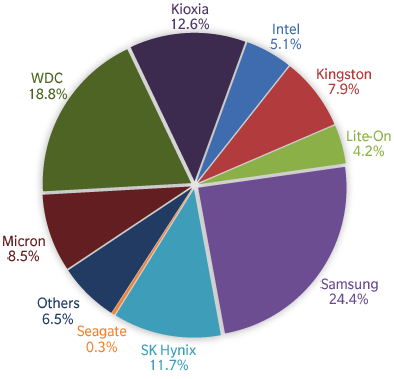

Total SSD Market: 99.596 Million Units Total in 2Q21

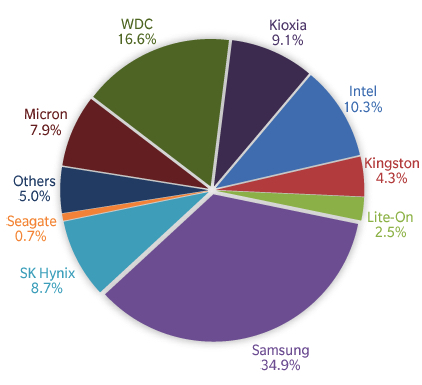

SSD Market: 68.630EB in 2Q21

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter