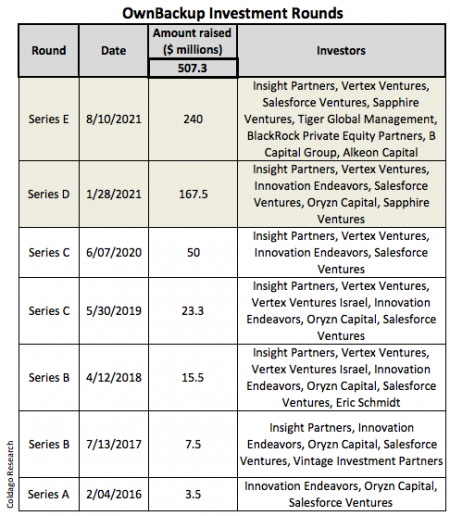

Financial Funding of $240 Million for OwnBackup After $167.5 Million Last January

Total at nearly half billion dollar, and cloud start-up approaching $3.35 billion valuation

This is a Press Release edited by StorageNewsletter.com on August 12, 2021 at 1:32 pmOwnBackup, Inc. announced a series E investment of $240 million co-led by Alkeon Capital and B Capital Group, including a secondary investment in the company by BlackRock Private Equity Partners and Tiger Global.

Existing investors Insight Partners, Salesforce Ventures, Sapphire Ventures, and Vertex Ventures also participated.

The company has cumulatively raised nearly $500 million, resulting in a $2 billion valuation increase in 6 months.

It also announced plans to expand its comprehensive backup and recovery solutions across other cloud platforms later this year, beginning with Microsoft.

OwnBackup’s continued focus on empowering customers to own and protect their data on any cloud platform began with Salesforce’s customer ecosystem. The additional funding bolsters its pattern of success in creating cloud data protection and management products that people need and love. The firm currently provides cloud data protection, sandbox seeding and data archiving solutions for nearly 4,000 organizations worldwide.

“Our commitment to protecting our customers’ data and providing solutions that enable precise, rapid recovery continues to grow. While the cloud is crucial to doing business, the mass adoption of SaaS has resulted in a huge amount of data, and our work with Salesforce, Microsoft and other critical SaaS ecosystems enables companies to thrive in today’s digitally driven world,” said Sam Gutmann, CEO. “The story of every business is written with data, and this latest round of funding will support our ongoing vision to empower our customers to own and protect their data on any cloud platform.”

With this latest funding round, OwnBackup is poised to extend its cloud data protection expertise to Dynamics 365 later this year. It will help Dynamics 365 customers meet complex regulatory requirements and eliminate data disruptions due to user and integration errors. The offering will allow companies to maintain complete ownership of their data backups, rapidly restore lost or corrupted data, and drive greater organizational adoption of Microsoft Azure and Dynamics 365.

“We’re pleased to partner with OwnBackup and give Dynamics 365 customers an additional layer of protection for their data,” said David Totten, Chief Technology Officer at Microsoft Corp. “By enabling organizations to automate the backup process and restore the precise data they need in minutes, OwnBackup’s solutions will help Dynamics 365 customers run more business-critical workloads while eliminating the risk of data loss.”

Along with Salesforce and Microsoft, OwnBackup is exploring other cloud providers as potential partners to deliver on its promise for customers to own and protect their mission-critical data.

“In the last 18 months, data has really taken center-stage as the virtual workplace expands,” said Abhi Arun, managing partner, Alkeon Capital. “Executives are focused on data solutions and their workforce’s ability to access and secure it when and where they need it. Likewise, customers demand seamless transfer and control of their data on a platform independent of their SaaS provider, while maintaining the highest levels of security for their end-users. That’s why we are thrilled to collaborate with and support OwnBackup’s leadership team as they continue to deliver incredible customer value in the Salesforce ecosystem and beyond.”

Nearly 4,000 customers trust OwnBackup across every industry, such as AECOM, Aston Martin, Ciena, Delivery Hero, Guidewire Software, the Make-A-Wish Foundation, Medtronic, Navy Federal Credit Union, Singapore Economic Development Board, and the University of Miami.

Comments

Total investment is huge.

Here are historically the only 9 start-ups getting more than half billion dollar in total financial funding:

| Start-ups | Total financial funding* |

| Dropbox |

1,700 |

| Cloudera | 1,041 |

| Kaseya |

567 |

| Box | 554 |

| Rubrik |

553 |

| Pillar Data |

544 |

| Veeam |

500 |

| Pure Storage | 531 |

| OwnBackup |

507 |

* in $ million

(Source: StorageNewsletter.com)

With this new round, just a few months following the previous one, OwnBackup confirms its role and position on the market illustrating a leadership role.

Historically, the team has found a remarkable niche, surfing on the incredible lack created, given, not considered or even ignored by Salesforce, identifying very early on the need as Salesforce gained a must have role within enterprises. We already wrote about the Salesforce irresponsibility to offer such critical strategic SaaS service without a data protection aligned with its role. We understand that for IaaS, the developer of the service has to build this, for PaaS, this is in the middle but for SaaS, it is a must and should be integrated as everything is simple, masked and adopted often by "just users" and not IT people.

At the same time, Salesforce refused for a long time to offer a serious service for that letting its partner ecosystem growing and developing such solution. We respect this strategy and recognize that Salesforce Ventures has made several investments especially in OwnBackup. The company has even decided to stop its service in July last year and they finally resumed it after a few weeks. Our articles have probably participated to this reaction as users continue to complain about this Salesforce absence of enterprise level service even if they don't have choice finally. Users adopt Salesforce at a real risk as they consider the CRM SaaS as a must have. This is incredible, these adopters prefer to operate at risk, a real one, without any similar protection they use and deploy internally for their on-premises services and applications. This is very paradoxical as they refuse to start an internal service or application without such protection mechanism in place. Remember the OVHcloud disaster a few months ago that also triggered some leaders reactions.

Considering this SaaS applications data protection, we need to mention that this recent need is now considered as a key criteria or component for modern data protection (MDP) solutions with several other key topics.

To summarize, here is a list:

- Legacy model considered as foundation essentially with bare-metal and horizontal coverage, cross OS and large databases support represented by established players such Veritas NetBackup, Dell Networker, IBM Spectrum Protect, Commvault Complete Data Protection or Atempo Tina, etc.

- VM protection with same players trying to fill the gap with dedicated vendors like Veeam,

- Cloud integration with multi and hybrid support with Cohesity, Rubrik in addition to previous vendors,

- Container and Kubernetes with newcomers like Kasten, Trilio, CloudCasa, Portworx, HYCU or Velero,

- SaaS in 2 categories: Backup-as-a-service with pretty generic approach with again HYCU, Clumio among others and SaaS Applications backup with OwnBackup but also CloudAlly, Kaseya Spanning, Datto Backupify, Spin coupled with the presence of "usual suspects" like Acronis, Commvault, Cohesity, Druva, Rubrik, Veeam or Veritas,

- With the ransomware protection know as the new must-have capability.

And of course several of them check all these 6 points.

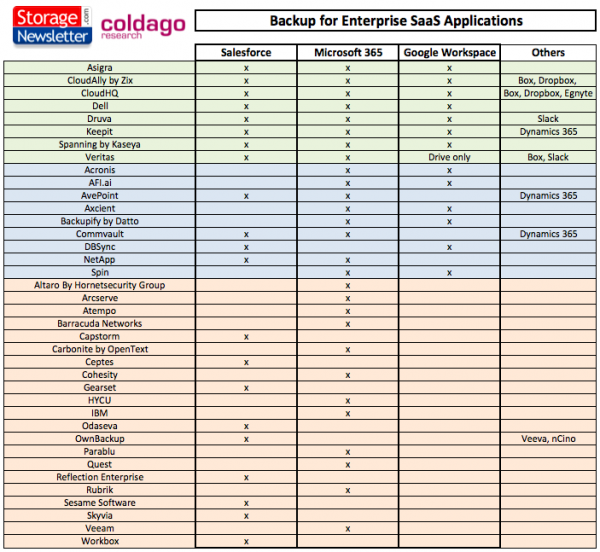

But all data protection players covering these different points face a real challenge on how they cover all aspects of the needs without being considered as a point solution or just a vertical one. Imagine a SaaS backup solution who can protect only Salesforce, what about Workday, NetSuite, Oracle, Google Workspace, Microsoft 365, Dynamics 365, so for such the SaaS applications, the solution can be just a tool, and finally create a complexity while the data protection is not a production asset.

In just 8 months, OwnBackup has raised more than $400 million. Then this last round - series E - of $240 million confirms that investors believe in this new Eldorado around SaaS applications and associated environments and also supporting a small list of next/new (recent) generation of data protection independent players such Clumio, Cohesity, HYCU, Rubrik, Trilio among others. Important to notice that some other got already acquired if you remember players such Datos.IO or Imanis Data respectively swallowed by Rubik and Cohesity. The total addressable market alone covered by OwnBackup and its competitors is huge and the battle to control that segment has already started a few years ago based on companies trajectories. We even anticipate some M&As, OwnBackup acquisition price is now close to $4 billion so we'll see smaller transactions with high potential players. We remember that HPE acquired recently Zerto, OK for other reasons, Veeam bought Kasten, Pure Storage has targeted Portworx - beyond data protection - but the data protection merger wave is still very active. But it won't be a surprise to see such new moves, the opportunity is too big to be ignored.

All financial rounds for OwnBackup see the participation of Salesforce Ventures and, except the series A, there is Insight Partners. This is really interesting as the latter has a strong data protection practice and investments lines with Acronis, Spanning, OwnBackup and Veeam. Kasten was an Insight Partners company and we now the next step. And we can even extend this with the security line with several famous companies. Imagine if just a few of them merge like Veeam + Acronis + Kaseya + OwnBackup + others, a software data and infrastructure management giant of immediately $3+ billion of revenue, $15+ billion at least of valuation. And Insight even invested in DataCore when the Fort Lauderdale, FL based company joined the container battle with Maya Data.

Without any doubt, OwnBackup drives the segment of the Salesforce data protection and we can even associate the term SaaS applications backup to the company. We also clearly see several other small players trying to clone, follow and develop similar model, some profiles are interesting coming from established players and others are considered more as toys.

To summarize the backup for SaaS enterprise applications market offerings and the active competition, we can share the following matrix.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter