Pure Storage: Fiscal 4Q21 Financial Results

Pure Storage: Fiscal 4Q21 Financial Results

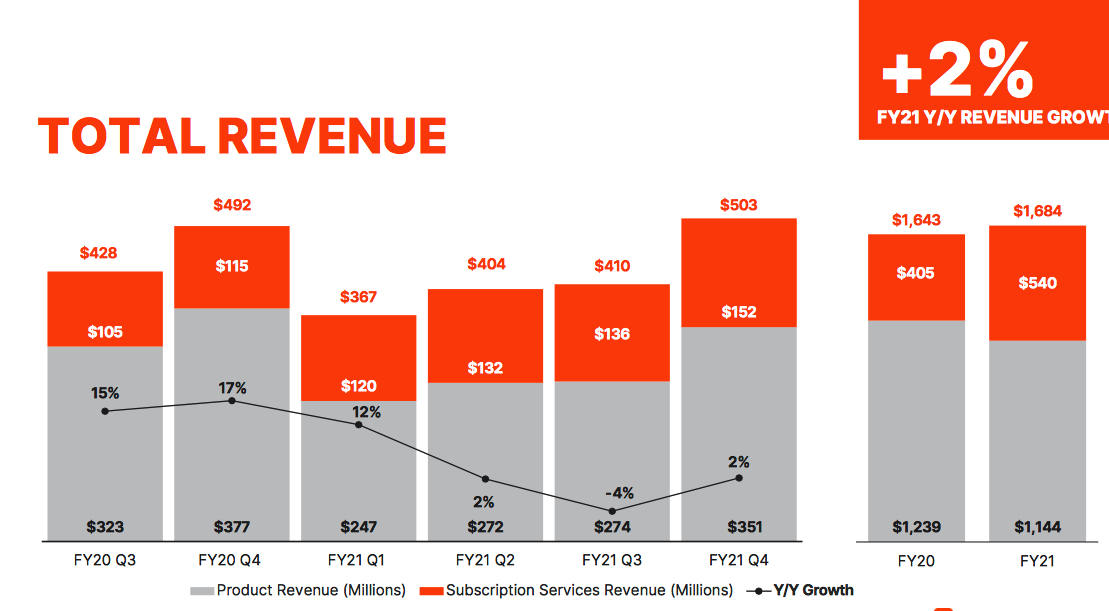

Sales only up 2% and up 111% for net loss never ending each year since inception

This is a Press Release edited by StorageNewsletter.com on February 26, 2021 at 2:14 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 492.0 | 502.7 | 1,643 | 1,684 |

| Growth | 2% | 2% | ||

| Net income (loss) | (4.7) | (52.3) | (201.0) | (282.1) |

Pure Storage, Inc. announced financial results for its fiscal fourth quarter and full year ended January 31, 2021.

“Pure ended FY21 with great strength and growth, setting new revenue and sales records for the quarter and for the full fiscal year,” said Charles Giancarlo, chairman and CEO. “I am confident in our opportunity, our long-term strategy, and our ability to accelerate growth. Our 4FQ21 results are a leading indicator of that acceleration. We saw broad based growth Y/Y, including in our subscription services, our enterprise and cloud segments, our new product lines, and in every theater.“

4FQ21 and FY21 Highlights

• 4FQ21 revenue $502.7 million, up 2.2% Y/Y

• Full-year revenue $1.684 billion, up 2.5% Y/Y

• 4FQ21 GAAP gross margin 67.8%; non-GAAP gross margin 69.4%

• FY21 GAAP gross margin 68.2%; non-GAAP gross margin 70.0%

• 4FQ21 GAAP operating loss $46.8 million; non-GAAP operating income $36.7 million

• FY21 GAAP operating loss $261.0 million; non-GAAP operating income $46.0 million

• 4FQ21 operating cash flow $69.0 million; and FY21 operating cash flow $187.6 million

• 4FQ21 free cash flow $47.7 million; and FY21 free cash flow $92.7 million

• Total cash and investments $1.25 billion

• Remaining performance obligations (RPO) $1.1 billion, up 24% Y/Y; and deferred revenue $843.7 million, up 21% Y/Y

“We are very pleased to be exiting this year on a high note as sales and revenue have surpassed our expectations with particular strength from our enterprise customers,” said Kevan Krysler, CFO. “The momentum we are seeing is the result of our consistent focus on investing in innovation for our customers.”

Guidance for 1FQ22: Revenue of $405 Million, $20 million for non-GAAP operating loss

Guidance for FY22: 14%-15% Y/Y growth for revenue, $90 million for non-GAAP operating loss

Comments

Pure Storage was expecting $480 million for 4FQ21 but finally it's much better, $503 million, corresponding to 2% Y/Y growth rather than 2% decline.

For FY21, it's also a little better than expected, $1,68 million rather than $1.66 billion.

Stock was up 7.2% to $27.60 following this announcement.

Sales growth, excluding cancelable orders, was slightly over 9% in the most recent quarter compared to last year, driven by slight growth both in the US and international markets compared to strong 4FQ20, as well as consecutive record sales for FlashBlade and FlashArray//.

The AFA maker ended the quarter with $1.25 billion in cash and 3,800 employees. Cash flow from operations was $69 million and free cash flows was $48 million in the period.

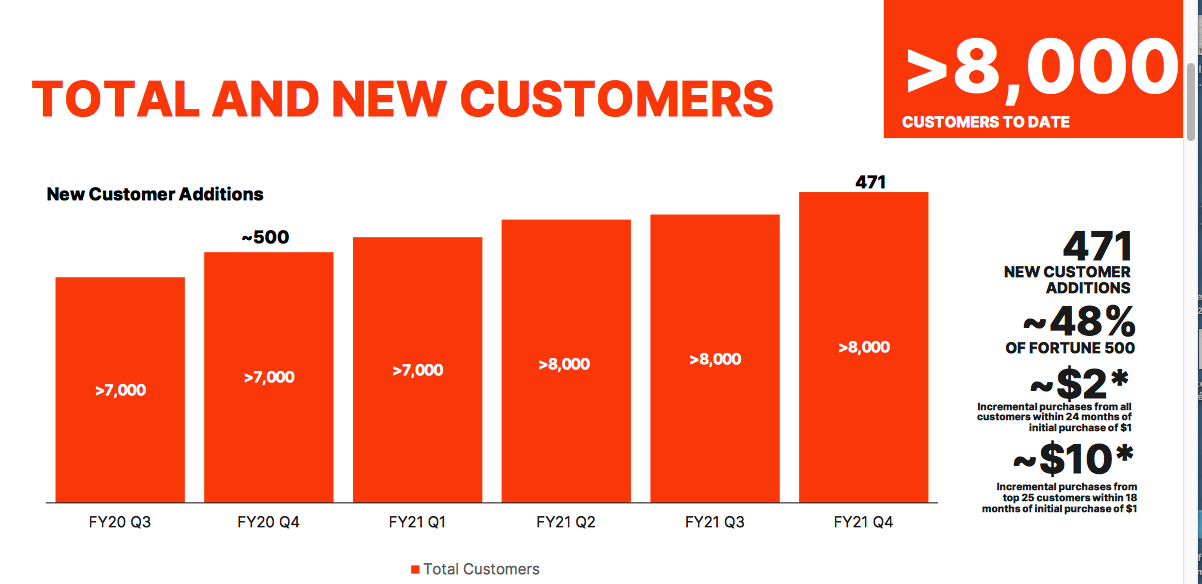

In 4FQ21, 471 new customers choose one or more of firm's solutions. It booked a record of 8 figure deals, a new record. The company now has more than 8,937 clients.

During the quarter, subscription services, at $500 million, grew 32% Y/Y, and represent 30% of total revenue. They include Evergreen and unified Pure as-a-Service subscription, which includes Cloud Block Store. New customers for Pure as-a-Service offering included one customer over $10 million, as well as US customer Cloud at Work, MACA mining services in Australian and German telecom provider Wob-Com GmbH.

Pure competes especially with Dell, HPE and NetApp announcing for the same quarter much more in AFA revenue, $652 million, as Pure saw product sales down 7% Y/Y.

CEO Charlie Giancarlo, declared: "I have increasing confidence that this year will be far better than last."

The company is forecasting next quarter total revenue to be $405 million, growing 10% from last year, and total sales up 14% to 15%, or $1,920 to 1,937 million.

Considering its 1FQ seasonality, it is forecasting an operating loss of $20 million for next quarter and expects to generate positive operating income during the remainder of the year.

According to Seeking Alpha, Pure's market cap is $7.03 billion and enterprise value at $6.73 billion, with $903.7 million debt.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

| 3F21 |

410,.6 | -4% |

(74.2) |

| 4F21 |

502.7 | 2% |

(52.2) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1Q22* |

405 | +0% |

NA |

| FY22* |

1,920-1,937 |

14%-15% |

NA |

* Estimations

Earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter