No, NAND Will Not Displace Nearline HDDs in 2026

Contrary to recent Wikibon article

This is a Press Release edited by StorageNewsletter.com on February 22, 2021 at 2:41 pm This article was written by VP John Chen in Trendfocus, Inc.‘s Information Services

This article was written by VP John Chen in Trendfocus, Inc.‘s Information Services

An HDD Industry Milestone and A Path to the Future …

And, No, NAND Will Not Displace Nearline in 2026

2020 was a heck of a crazy year due to the Covid-19 pandemic, severely impacting global economies and affecting nearly all businesses. As reported in Trendfocus’ CQ420 reports, consumer PC demand skyrocketed to support remote work and education, but the benefit went primarily to client SSDs as attach rates, especially in notebook PC models, climbed to the mid-80% range for the year.

Enterprise IT spend plunged in the face of uncertain economic conditions causing a drag in storage demand for traditional on-premises applications, with HDDs improving somewhat at the end of the year while SSD demand for the segment eroded sharply in 4CQ20.

Cloud remained the bright spot for storage and the effects of the pandemic appeared to accelerate storage demand in the early days of the outbreak. Despite hyperscale HDD digestion beginning mid-year and demand weakness in mid-capacity models for traditional enterprise applications for most of 2020, nearline HDD capacity shipments grew 34% Y/Y to nearly 635EB.

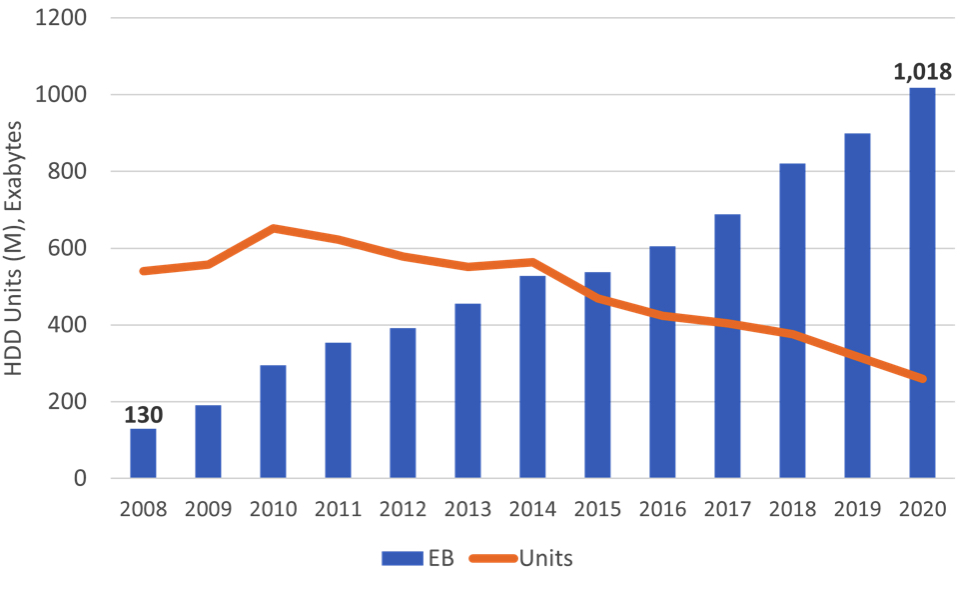

Total HDD capacity for 2020 achieved a significant milestone in 2020 as a result of continued cloud absorption of storage, passing one zettabyte of capacity shipped for the first time in history. This landmark is a nearly eight-fold expansion of capacity shipped in 12 years, even as total HDD units were half that of 2008 and 60% fewer than the peak unit shipment year for HDDs that occurred in 2010.

The HDD market, of course, has fundamentally changed over the past decade with many client end-markets ceding to SSDs in that time but with capacity growth fueled by high-capacity nearline growth.

In 2008, at the depths of the last economic crisis before the pandemic, nearline capacity represented a mere 7% of total exabytes shipped, but by 2020, that share expanded to 62% of the more than 1ZB shipped.

Contrary to a recent Wikibon article claiming that flash bits outpaced HDD capacity shipments in 2020, NAND did not ship more capacity than HDDs – in fact HDDs outpaced NAND by a factor of 2.3x. While this executive brief does not intend to refute every point of that extensive article, some of its fundamental arguments hinge on incorrect historical data for HDD capacity shipments in total and by segment. In addition, the article projects future flash pricing reductions at rates far outpacing the expectations of most of the NAND manufacturers based on numerous direct discussions the analyst firm has had with the flash players.

Nearline will continue to represent the primary future of HDDs offering a value proposition for cost-effective random-access mass storage over the coming years. As the industry entered 2021, 18TB models began to ramp following qualifications at 2 major US tier-1 hyperscale companies, with Western Digital apparently leading the way and Seagate soon to follow.

On February 18, Toshiba entered the fray, announcing its MG09, 18TB, 9-platter nearline models, which will sample in late CQ1 and should become the third volume production player later in the year. Toshiba is claiming its use of flux-controlled MAMR, or FC-MAMR. Not to be confused with the name of a major football (soccer to you Americans) club, Toshiba did not publicly specify the difference between FC-MAMR and, for lack of better description, “regular” MAMR. FC-MAMR may be an intermediate step used to achieve 2TB/disk, similar to Western Digital’s use of what it calls ePMR, although the 2 technologies may be physically different.

As 16TB continues as the leading volume nearline capacity entering 2021, 18TB transitions across major cloud customers will occur through the year and fuel the next hyperscale expansion cycle. Looking forward, Trendfocus recently published its latest 5-year forecast for nearline, projecting capacity growth to track a 5-year CAGR of 32% through 2025. More importantly, the latest model projects a product roadmap utilizing incremental improvements to existing technologies, the addition of more disks to future models along with the transition and implementation of full energy-assisted recording technologies at high volume over the coming years.

Pricing models also include the additional costs required to support this product evolution while also supporting gross margins needed for companies to make the needed investments to expand component production capacity. On a $/GB basis, total nearline HDDs shipped to all segments – hyperscale, OEMs, and others – will support a -10% CAGR over the five-year forecast. Trendfocus has attempted to remain relatively conservative in its current pricing model, so the industry could outpace these declines with reduced costs through efficiency improvements, while still remaining fiscally healthy.

Finally, it is expected that HDDs to play a significant role in mass storage, working in tandem with SSDs in a significant way through continued expansion of the cloud and maintaining a critical role in traditional enterprise bulk storage applications through the 5-year forecast and beyond. NAND itself – not in the form of a finished SSD, enterprise or otherwise – is projected to be more than 6x higher than most nearline HDDs shipping to the cloud in 2025, not even close to a cross-over.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter