DataCore Acquires Caringo

Enabling to offer complete SDS solutions for block, file and object from single vendor

This is a Press Release edited by StorageNewsletter.com on January 27, 2021 at 2:20 pmDataCore Software Corp. acquired Caringo, Inc.

The combined entity will enable the acquirer to offer complete SDS solutions for block, file, and object – from a single vendor.

The acquisition will also add talent and expertise to the its team, as well as customers in key markets such as CSPs, media, and government.

Caringo was a pioneer in the object storage market, founded in 2005, designing software to solve the issues associated with relentless data growth. Its flagship product, Swarm, provides a foundation for hyperscale data storage, access, and analysis at petabyte scale, while guaranteeing data integrity and eliminating hardware dependencies. Its software-defined solutions are now used to manage rapidly scaling data sets by organizations such as BT Television, Department of Defense, Disney Streaming Services, National Institutes of Health (NIH), Argonne National Labs, and hundreds more worldwide.

The acquisition of Caringo accelerates the DataCore ONE vision: to realize the power of SDS to break silos and hardware dependencies and unify the storage industry, enabling IT to make storage smarter, more effective, and easier to manage.

Caringo’s product line complements DataCore’s SDS including: vFilO software, a next-gen distributed file and object storage virtualization technology uniquely designed to help enterprises organize, optimize, and control large volumes of data scattered on-premises and in the cloud, as well as the benefits of hardware independence, flexibility, availability, performance, and efficiency/cost savings provided by DataCore SANsymphony software for block-based storage.

“This latest acquisition expands DataCore’s ability to offer its customers the right solution for their technical and business needs, whether the answer is block, file, or object—or a combination,” said Scott Sinclair, senior analyst at ESG. “Businesses and IT organizations have been turning to software-defined storage for years now as a way to increase infrastructure flexibility and choice while also helping to reduce the cost of managing large volumes of data efficiently and securely. This move makes DataCore’s portfolio even stronger and more valuable to its customers as they work to achieve those goals.”

“DataCore’s acquisition of Caringo offers compelling use case advantages and product synchronization, with both platforms offering enterprises the benefits of fast recovery, zero downtime and fast throughput software-defined storage running on x86 commodity hardware,” said Barry Griffiths, MD, NAS UK Ltd, a long-term Caringo and DataCore partner. “It will bring together best of breed software solutions for managing and archiving structured and unstructured data – not least because one of the biggest challenges that IT managers worldwide will face in 2021 is how to effortlessly move swiftly growing capacities of unstructured block and file data easily into the cloud/object world.”

“IT is accelerating adoption of software-defined storage technologies as it has proven to deliver flexibility, hardware independence, and efficiency. Object storage adoption is rapidly increasing as more companies look for more cost-effective, secure, and reliable methods to manage large amounts of data,” said Jeff Horing, co-founder and MD, Insight Partners. “We are excited DataCore is adding leading object storage technology from Caringo to become the vendor with the most comprehensive software-defined portfolio in the industry.”

The acquisition news comes on the heels of a strong 2020 close for DataCore. The company is consistently adding over 100 new customers per quarter and saw double-digit Y/Y growth in capacity sold and customer expansion in 4Q20. It also added multiple key executives in the last year including Kevin Thimble, chief financial officer and Geoff Danheiser, chief people officer.

The company also opened a new, corporate headquarters in Ft. Lauderdale, FL and a new R&D center in Bangalore, India to accelerate innovation. The company already has a staff of almost 30 in Bangalore, which complements other R&D centers in Eastern Europe and Florida. The acquisition of Caringo will increase DataCore’s presence in Austin, TX, where Caringo was headquartered, and where DataCore now has sales, marketing, and R&D staff along with a lab and room for expansion. The upgraded executive team, expanded geographical resources, and expanded product portfolio position to accelerate adoption of software-defined technologies in 2021.

“In today’s economic environment, IT organizations are looking for ways to save money. Yet compliance requirements, increased use of backup, business continuity, and the continuous growth of data present a challenge that object storage can solve,” said Dave Zabrowski, CEO, DataCore. “With our acquisition of Caringo, we are excited to offer a proven, highly reliable object storage technology with an unmatched breadth of features to IT departments, service providers, and government customers worldwide. As we continue to deliver on our DataCore ONE vision with our product portfolio, we also continue to build out a world-class executive management team that will allow us to deliver the best-of-breed software-defined solutions to our customers.”

Comments

This is a surprise, it shakes the small object storage world and at the same time the market has expected some moves from these 2 companies for quite some time. And even if some people had some M&As in mind, how many thought that Caringo will land in DataCore arms?

This acquisition is just the third one for DataCore following RTware in RSM software in 1999, and then Demand Technology Software in 2000. It appears far and for real reasons we don't speak here about start-ups. Let me explain and start first with some background.

Both companies are pioneers and experts in their respective domain, block storage for DataCore and object storage for Caringo having 2 different cultures. The first believes in SCSI and more recently NVMe and the second in HTTP who, time after time, was adopted as a storage/transport protocol finally. These are 2 old companies especially for DataCore as the company was founded in 1998 more than 20 years, representing 7 years more than Caringo, founded in 2005.

As experts they're identified as pure players with strong expertise even if they tried to extend their offering towards files with different approaches and roots.

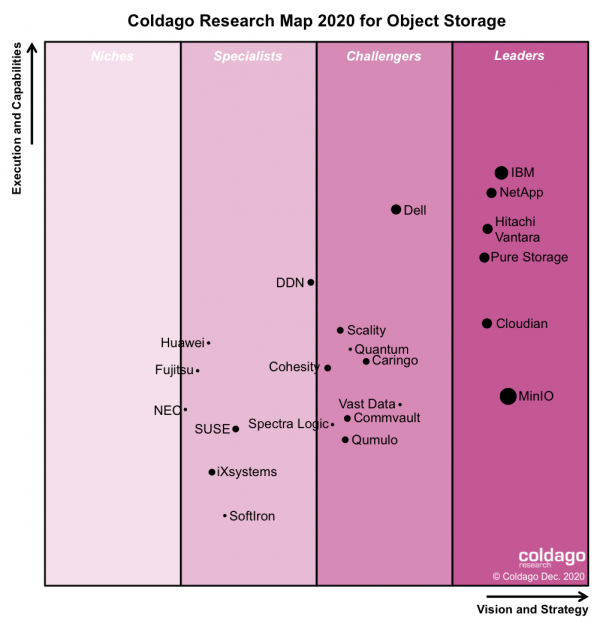

Caringo is recognized again as a challenger in the Coldago Map 2020 for Object Storage.

Covid-19 has also generated some stress and make companies positions more fragile. Some others get lucky raising new round. This current climate makes normal companies fragile and fragile ones disappear or get acquired. At the same time, this kind of period presents some opportunities and real bargains. It is one for Caringo as an exit is offered and one for DataCore with the promise to grow with this new blood.

Pioneer means also being early players anticipating some trends and having a real influence on the market direction. DataCore was hot during the SAN famous days, refused some M&A proposals but finally never get bought or even made an IPO. Some people would name this kind of company a zombie. The market had some doubt but the company resisted and continued its independent trajectory. The new team driven by Dave Zabrowski, as CEO, injected new blood, spirit, dynamism and motivation with a clear direction fueled by SDS as a key positioning factor. We can say that DataCore is block SDS and Caringo an object SDS. Having said that, we understand the SDS DataCore strategy and they know it's no longer enough.

On the Caringo side, we know the story. It was founded by Paul Carpentier, Jonathan Ring and Mark Goros, and the company name was then obvious, read the first few letters of each last name and you'll get it. Pioneer for Caringo means FilePool, acquired in 2001 by EMC, then a new adventure launched in 2005 under that Caringo name by Paul Carpentier. Caringo is a reference in the domain.

At that time, object storage was covered by CAS - Content Addressable Storage - and others like Archivas (acquired by Hitachi in 2007), Bycast (acquired by NetApp in 2010), Cleversafe (acquired by IBM in 2015), EMC with Centera (coming from FilePool acquisition in 2001), Evertrust (acquired by Nexsan in 2005 now owned by StorCentric as Assureon), Gluster (acquired by Red Hat in 2011), Permabit (acquired by Red Hat in 2017), Persist (acquired by HP in 2003) and even Ceph was launched in 2004, Red Hat acquired Inktank in 2014. We can can even list the Honeycomb project at Sun Microsystems or Gemini Mobile Technologies who morphed into Cloudian later. We invite the reader to read an article published on The Register a few years ago. All these moves illustrate perfectly the Build, Buy or Partner model and again object storage confirms that innovation comes from small agile companies and teams rather than large companies where decision inertia, reality check and team repurposing are difficult.

Until last week, Caringo was the oldest vendor in that domain.

This merger makes sense for both companies and adds a real domain for DataCore and set a destiny for Caringo. But the question we had for Caringo is still valid for DataCore about its future, after all it's just a question of size. We anticipate some desire to find an exit later following a new higher value made by this acquisition.

For DataCore, this move means that its SDS line is now covered by a native block and object storage technology. File is another story addressed by vFilO - OEMed from Hammerspace - or SwarmFS on top of Caringo Swarm. vFilO can also exposes S3 and can be considered as a file SDS being essentially a data virtualization layer on top of existing storage acting as a data mover and router with intelligent policies and data management capabilities. DataCore realized they need a new storage engine, an agile one, in addition to SANsymphony, for new IT challenges like DevOps, container storage and Kubernetes, distributed IT, collaboration or for some vertical use cases. With Caringo, the proposal is pretty compelling as they can now control completely a new storage entity and then address new business opportunities with the same worldwide channel. Clever.

For Caringo, it represents the end of a tough story for last few years and a new era for its technology that will survive beyond the company. It ends also a battle against open source - Ceph, MinIO or recent Seagate initiated project Cortx - that are largely deployed (Ceph and MinIO, Cortx being too recent) and adopted confirming the difficulty for a pure commercial object storage to justify its price. To put things in perspective, MinIO has more than 15 million instances running ! Add Ceph ones and you get the picture. Does it mean we approach the end of the game, we'll see... but clearly open source put pressure on commercial vendors and even on other small open source tentative.

This M&A also invites to think about other object storage players who remain independent and loss once again a new exit opportunity as all giants have already their object storage offering. We mentioned some players above and almost all get acquired. Quantum has finally swallowed Amplidata technology early 2020 after the company get acquired by HGST/Western Digital in 2015. In 2020, SwiftStack disappeared silently being swallowed by Nvidia and OpenIO landed at OVHcloud in a strange French move, both confirming difficulties. In 2019, Commvault acquired Hedvig, Pure Storage got Compuverde but FlashBlade is independent and was designed internally with a specific dedicated team and DDN picked Nexenta having already WOS. We can even list NooBaa acquired by Red Hat in 2018. All large storage vendors even some smaller ones have now an object storage except one giant, HPE, only with partners, who has shown some fuzzy storage strategy illustrating some preferences to sell its hardware whatever the software is. Will this DataCore acquisition trigger and accelerate some new moves, we'll see.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter