Battle of Cloud Storage Essentially on Price

Capacity and traffic being main metrics

By Philippe Nicolas | December 10, 2020 at 2:21 pmPricing and associated TCO and even ROI are interesting recurrent topics for any IT services even storage ones and we see them promoted everywhere in all dimensions with cloud storage. They illustrate different arguments in favor or against the cloud storage model seeing a growing adoption for a decade now. But for sure this storage model introduces some new economics that destabilize users behaviors and usages and classic vendors positions.

We try to study some vendors approaches and share some results and comments. It confirms a real battle among cloud giants, also with alternative ones trying to shake positions to finally gain market shares incrementally as data are silently swallowed by the cloud. And with data gravity, accumulating data implies some difficulties to move them to other places to process them or just make a copy or even switch them to an other player or location due to regulations pressure.

Some people argue that we know the end of the story with all data, let’s say almost, residing in the cloud and others continue to promote a hybrid model. In fact, hybrid model is what on-premises vendors defend wishing to limit their products erosion against online services. We should say that even hybrid is already a big gain for cloud providers. Hybrid is an implicit recognition that a good portion of data already resides outside of companies’ perimeter.

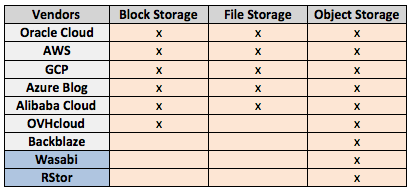

For this article, we choose AWS, Azure, GCP, Wasabi, Backblaze, RStor, OVHcloud, Alibaba Cloud and Oracle Cloud. The first comment is related to storage services each of them offer i.e cloud storage often represented by object storage. But AWS, Azure, GCP, Alibaba Cloud even Oracle really provide comprehensive storage services with block, file and object storage services while OVHcloud, Wasabi, RStor and Backblaze have limited offerings. This limitation and reciprocally why the wide offering of others explains how services are received and adopted on the market. But we have to say that these vendors chose deliberately to offer only object storage. For OVHcloud, it’s a different story, they offer block and object and omit file storage. As OVHcloud is always looking for bargains as recent examples have shown with OpenIO and Exten Technologies, we hope they have some ideas to offer scalable file services. The table below lists storage offering for these vendors, the 2 blue ones mean they don’t charge for traffic.

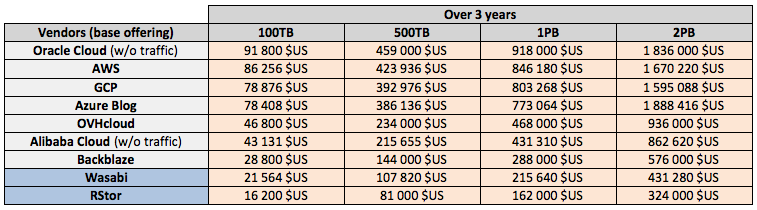

Our scope is cloud/object storage in the list above with standard service. We invite readers to compare these prices with open source as well. For the latter, readers can visit MinIO web site who released public pricing model for services on its web page recently, keep in mind the hardware part even with free software. To compare with on-premise storage software and hardware we use the StorONE TRUprice page available publicly. The comparison is not fully adequate as StorONE offers unified storage and here we just need S3. Of course, each vendor knows and controls its prices lists but they’re not accessible for the public. We don’t list any commercial on-premise object storage as well. And finally we select the capacity 100TB, 500TB, 1PB and 2PB with a traffic of 1% of the volume per day. Again the idea here is not to say that cloud or on-premise approach is better than the other. The table below shows the costs for 3 years, traffic included when it was easy to compute (not the case for Oracle and Alibaba) and we use 1,000 as the multiplier so it implies some very small approximations (roughly 1% difference). It was built with their respective pricing page. Again the 2 blue boxes indicate that these players don’t charge for traffic.

You realize that the 2 players in blue without any traffic charge are the ones who offer only object storage. Even if Backblaze offers only object storage, they charge for traffic and also sell an online backup service.

Now imagine some aggressive decision from vendors who charge for traffic outside of the leaders, let’s say from OVHcloud or Backblaze. The idea here would be to compete against cloud giants and gain market share. But it won’t be enough, you have to beat RStor price of $0.0045/GB/month with traffic at 0.

Another important consideration about cloud storage pricing for cloud giants is related to the ton of products they offer and the marketplace. For end-users, it’s an easy decision, pick on these players even if it costs more on cloud but the value come from all side services and data locality. If you need a simple single cloud service you can consider alternative but even with a good price, the battle is not easy. Again the current threshold is RStor, it would be a good idea for OVHcloud to think about that especially as they try to build services and marketplace.

To put things in perspective, we took as reference 1PB (exactly 1.06PB) of full HDD configuration in HA mode based on Dell PowerEdge servers coupled with Western Digital array based on the StorONE pricing model and we obtain $231,344 without tax and accessories. It places this on-premises approach in the above table above Wasabi and RStor but costs less than Backblaze, Alibaba, OVHcloud and others. Interesting, the next resistance will be around $0.004/GB/month (roughly $4/TB/mo.)…

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter