Marvell: Fiscal 3Q21 Financial Results

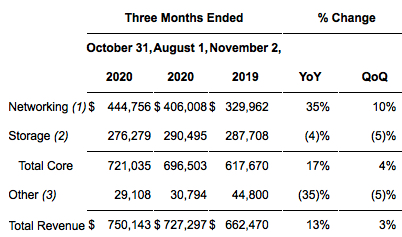

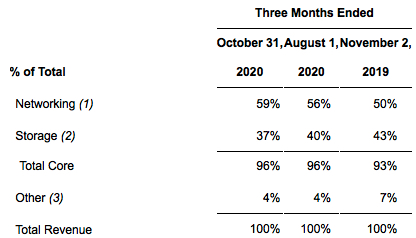

Weaker than anticipated, storage at $276 million, down 5% Q/Q, contributing to 37% of total sales

This is a Press Release edited by StorageNewsletter.com on December 4, 2020 at 1:48 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 727.3 | 750.1 | 1,981 | 2,171 |

| Growth | 3% | 10% | ||

| Net income (loss) | (157.9) | (22.9) | (188.3) | (293.8) |

Marvell Technology Group Ltd. reported financial results for the third quarter of fiscal year 2021.

Revenue for 3Q21 was $750 million. GAAP net loss for this quarter was $23 million, or $0.03 per diluted share.

Non-GAAP net income was $168 million, or $0.25 per diluted share. Cash flow from operations for 3Q21 was $258 million.

On October 29, 2020, Marvell announced the execution of a definitive agreement to acquire Inphi Corporation with cash and stock consideration. The transaction is expected to close by the 2H21, subject to the approval of both companies’ shareholders and the satisfaction of customary closing conditions, including applicable regulatory approvals.

“Marvell continued to deliver strong revenue growth in the third fiscal quarter. Overall revenue increased 13% year on year, driven by our networking business, which grew revenue 35% year on year. Strong 5G and Cloud product ramps are fueling our ongoing success in these strategic growth markets,” said Matt Murphy, president and CEO. “Demand continues to increase, and we are guiding fourth fiscal quarter revenue at the mid-point to grow approximately 5% sequentially. Our team is working to mitigate the impact of industry-wide supply constraints that are currently limiting our ability to fully satisfy the increase in demand.”

4FQ21 guidance takes into account the US Government’s export restrictions on certain Chinese customers. Given the ongoing uncertainty associated with Covid-19 and related public health measures, the company also have temporarily widened the guidance range on revenue.

4FQ21 Financial Outlook

• Revenue to be $785 million +/- 5%.

• GAAP gross margin to be approximately 52.8%.

• Non-GAAP gross margin to be approximately 64%.

• GAAP operating expenses to be approximately $379 million.

• Non-GAAP operating expenses are expected to be approximately $280 million.

• Basic weighted average shares outstanding to be 673 million.

• Diluted weighted average shares outstanding to be 686 million.

• GAAP diluted income (loss) per share to be $(0.03) to $0.07 per share.

• Non-GAAP diluted income per share to be $0.25 to $0.33 per share.

Comments

Global revenue for more recent quarter was $750 million, growing 3% Q/Q and 13% Y/Y slightly missing the estimate of $751 million.

Shares fell 3.34% after the company reported these financial results.

Weaker than anticipated, storage revenue for the third quarter was $276 million, declining 5% sequentially and 4% yearly, contributing to 37% of total sales, compared to 40% last quarter and to 43% one year ago..

During the quarter demand for FC products from enterprise server and storage customers was impacted more heavily than anticipated, although the firm expects this level of weakness to be temporary.

Nevertheless, sequential revenue growth expected from storage controller business did materialize, led by a ramp on custom SSD controllers. Cloud HDD business also grew sequentially.

1) Networking products are comprised primarily of Ethernet solutions, embedded processors and custom ASICs.

(2) Storage products are comprised primarily of storage controllers and FC adapters.

(3) Other products are comprised primarily of printer solutions

Next quarter, storage business is expected to rebound strongly and project sequential revenue growth in the low teens on a percentage basis, driven from multiple products. Marvell projects a strong recovery in FC business towards a more normalized run rate. It also expects cloud storage revenue to continue to grow, which includes more meaningful contribution from our preamplifiers.

Custom SSD controller programs have recently started to ramp and it will benefit from a full year of shipments in FY22.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter