Quantum: Fiscal 2Q21 Financial Results

Suffering from impact of Covid-19 on M&E market

This is a Press Release edited by StorageNewsletter.com on November 4, 2020 at 2:23 pm| (in $ million) | 2Q20 | 2Q21 | 6 mo. 20 | 6 mo. 21 |

| Revenue | 105.8 | 85.8 | 211.4 | 159.1 |

| Growth | -19% | -25% | ||

| Net income (loss) | (2.2) | (4.6) | (6.1) | (15.3) |

Quantum Corporation announced financial results for its fiscal second quarter ended September 30, 2020.

2FQ21 Financial Summary

• Revenue of $85.8 million

• Gross margin of 45.1%

• Total operating expenses decreased $4.1 million, or 10%, compared to 2FQ20

• GAAP net loss of $4.6 million , or $(0.11) per diluted share

• Adjusted net loss of $0.2 million, or $(0.01) per diluted share

• Adjusted EBITDA of $8.9 million

Jamie Lerner, chairman and CEO, commented: “Our results in 2FQ21 exceeded our forecasted outlook, benefitting from the strength of our Federal government business, and solid sales execution. We are seeing a gradual and steady recovery across most of our vertical markets and key geographies, and simultaneously maintaining discipline with our expenses while increasing our investment in R&D to support the introduction of new software products. The 300 basis point sequential improvement in gross margins during the quarter, bolstered our adjusted EBITDA to $8.9 million , meaningfully exceeding our guidance. Our pipeline remains strong, and we continue to identify and pursue significant opportunities to help customers manage video and other forms of unstructured data across its lifecycle.”

He continued: “At our analyst and investor day in August, we discussed Quantum’s transformation over the next few years to a more software-defined and recurring revenue driven model that will drive margin enhancement and expansion of our addressable market. On November 10, 2020 we take the first step in this regard, with the launch of next gen data management software to classify, visualize, and orchestrate data, both on premise and in the cloud, along with new ways to automate data movement in the highly anticipated release of StorNext 7. These new solutions will enable our customers to gain visibility into their data, derive new insights, and unlock more business value from this data. All of these new offerings will be available on a subscription basis, driving more predictable revenue streams and improved margins for us in the future while increasing our addressable market in the near-term.”

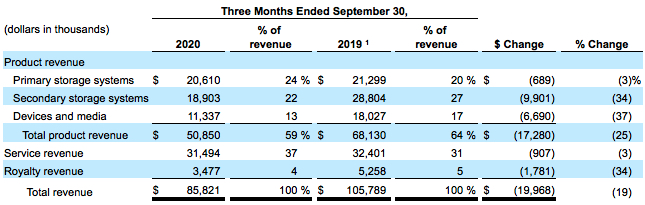

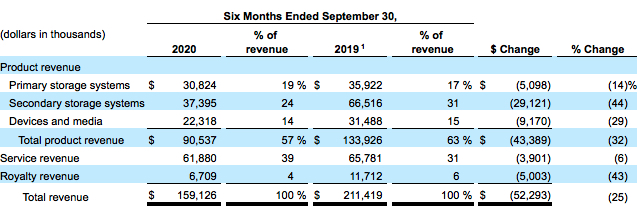

2FQ21 vs. 2FQ20

- Revenue was $85.8 million, down 19% compared to $105.8 million in 2FQ20 and exceeding guidance. Business with Federal government customers improved, partially offsetting Covid-19-related declines in the company’s other vertical markets as well as challenges related to fluctuating purchase cycles with hyperscaler customers.

- Gross profit was $38.7 million, or 45.1% gross margin, compared to $43.5 million , or 41.1% gross margin, in 2FQ20. Gross margins improved Y/Y primarily due to a more favorable mix of enterprise products sold.

- Total operating expenses were $35.2 million, or 41.1% of revenue, compared to $39.3 million , or 37.2% of revenue, in 2FQ20. Selling, general and administrative expenses declined 3% to $23.4 million compared to $24.2 million in 2FQ20. R&D expenses were $10.2 million 2021, up 9% compared to $9.4 million in 2FQ20.

- Net loss was $4.6 million, or ($0.11) per basic and diluted share, compared to a net loss of $2.3 million, or ($0.06) per basic and diluted share, in 2FQ20.

- Excluding stock compensation, restructuring charges and non-recurring charges, adjusted net loss was $0.2 million , or ($0.01) per diluted share, compared to adjusted net income of $5.1 million , or $0.11 per diluted share, in 2FQ20.

- Adjusted EBITDA decreased $3.8 million to $8.9 million , compared to $12.7 million in 2FQ20.

Balance Sheet and Liquidity

• Cash, cash equivalents, and restricted cash of $18.3 million as of September 30, 2020, compared to $12.3 million as of March 31, 2020. Both balances include $5.0 million in restricted cash required under the company’s credit agreements, and $0.8 million of short-term restricted cash.

• Outstanding debt as of September 30,2020 on a gross basis was $195.2 million and on a net basis was $172.4 million after netting $22.8 million in unamortized debt issuance costs. This compares to $167.8 million of outstanding debt as of March 31, 2020 on a gross basis, and on a net basis was $154.1 million after netting $13.7 million in unamortized debt issuance costs.

• Total interest expense was $7.6 million for 2FQ21.

Outlook dor 3FQ21

The company expects revenues of $93 million + or – $2 million. It expects adjusted net loss to be $1 million + or – $1 million and related adjusted net loss per share of $(0.02) + or – $0.02. Adjusted EBITDA is expected to be $8 million + or – $1 million.

Comments

For 2FQ21, the company expects revenues of $83 million + or - $2 million. The results here ($85.8 million) is above expectations, up 17% from horrible decrease on former quarter, but down 19% Y/Y, and more than twice higher net loss quarterly.

The yearly decline of $20 million was driven by lower revenue across all the company's vertical markets with the exception of the federal government business, largely due to the Covid-19 pandemic, as well as a fluctuating purchase cycle with hyperscaler customers.

Yearly highest declines (-34%) were recorded in devices and media (-37%), secondary storage systems an royalties (-34%).

Note: Primary and secondary storage system revenue has been adjusted for the three months ended September 30, 2019 due to certain reclassifications from primary to secondary storage systems.

Note: Primary and secondary storage system revenue has been adjusted for the three months ended September 30, 2019 due to certain reclassifications from primary to secondary storage systems.

Outstanding debt as of September 30, 2020, on a gross basis was $195.2 million.

Jamie Lerner, chairman and CEO, stated: "We experienced a gradual recovery throughout the quarter with purchasing and procurement activity ramping up across most end markets. There's some encouraging signs of our customers starting to spend again on new projects and new business initiatives. And while there are signs of lights and M&E, we now believe the recovery in that industry may take more than 1 or 2 quarters, given how the pandemic has impacted movie and TV production and professional sports."

For 2FQ21, the company expects revenue between $81 and $85 million or down -1% to -6%.

Fiscal year ended March 31

| (in $ million) | Revenue | Y/Y Growth | Net income (loss) |

| 1998 | 1,189.8 | NA |

170.8 |

| 1999 | 1,302.7 | 9% | (29.5) |

| 2000 | 1,418.9 | 9% | 40.8 |

| 2001 | 1,405.8 | -1% | 160.7 |

| 2002 | 1,087.8 | -23% | 42.5 |

| 2003 | 870.8 | -20% | (264.3) |

| 2004 | 808.3 | -7% | (62.0) |

| 2005 | 794.2 | -2% | (3.5) |

| 2006 | 834.3 | +5% | (41.5) |

| 2007 | 1,016.2 | +22% | (64.1) |

| 2008 | 975.7 | -4% | (60.2) |

| 2009 | 809.0 | -17% | (356.1) |

| 2010 | 681.4 | -16% | 16.6 |

| 2011 | 672.3 | -1% | 4.5 |

| 2012 | 652.4 | -3% | (8.8) |

| 2013 | 587.6 | -10% | (52.4) |

| 2014 | 553.2 | -6% | (21.5) |

| 2015* | 543.7 | -2% | 15.4 |

| 2016* | 479.8 | -12% | (75.6) |

| 2017* | 493.1 | 3% | (2.4) |

| 2018 |

437.7 |

-11% | (43.3) |

| 2019 |

402.7 |

-8% | (42.8) |

| 1FQ20 |

105.6 |

-2% | (3.8) |

| 2FQ20 |

105.8 |

18% | (2.3) |

| 3FQ20 |

103.3 | 1% | 4.7 |

|

4FQ20 |

88.2 |

-15% | (3.8) |

| 2020 |

402.9 |

0% | (5.2) |

| 1FQ21 |

73.3 |

-31% | (10.7) |

| 2FQ21 | 85.8 |

-19% | (4.6) |

* figures as restated

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter