NAND Flash ASP To Drop by 10%, SSDs by 10-15% in 4Q20

Given oversupply

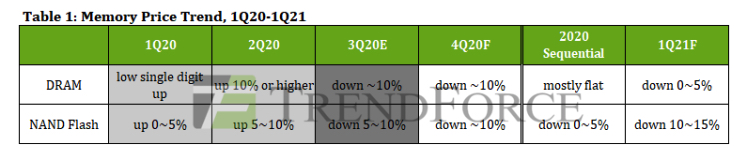

This is a Press Release edited by StorageNewsletter.com on October 13, 2020 at 2:13 pmThe memory market (including DRAM and NAND flash) is still in a state of oversupply in 4Q20, according to TrendForce, Inc.‘s investigations.

In light of recent US sanctions vs. Huawei, other smartphone brands have been actively stocking up on memory products in an effort to capture Huawei’s lost market shares, but this procurement momentum is insufficient to improve the lethargic state of the memory market. In addition, as memory demand from the server industry has yet to make a noticeable recovery, overall memory ASP is expected to remain weak in 4Q20 and decrease by about 10% Q/Q.

With regards to DRAM, the market is primarily concerned with the mobile DRAM and server DRAM categories, which account for the majority of DRAM bit consumption. In terms of mobile DRAM, the preemptive inventory pull by Huawei has quickly alleviated the three major DRAM suppliers’ pressure to destock their inventories. As well, Xiaomi, OPPO, and Vivo are all urgently stocking up on key components, in turn providing some support for mobile DRAM ASP, which is expected to undergo a 0-5% Q/Q decline in 4Q20. On the other hand, since most CSPs and enterprise server clients are currently maintaining a relatively high inventory level of server DRAM, server DRAM ASP may potentially drop even further, with a forecasted Q/Q decline of about 15% in 4Q20. By the end of this year, prices for mainstream 32GB modules are also projected to reach about $100-110, which is close to the previous cyclical downswing’s lowest point. All in all, overall DRAM ASP is projected to decline by about 10% in 4Q20.

With regards to NAND flash, although preemptive stock-up demand from branded clients similarly provided some support for NAND flash ASP, the high level of supply bits and high customer inventory levels at the moment have led to an oversupply situation that is more evident than in the DRAM market. Owing to aggressive NAND flash demand from Chinese smartphone brands, the decline in eMMC and UFS ASP is expected to narrow to a 3-7% Q/Q drop in 4Q20. Likewise, the continually rising supply of NAND flash wafers will likely result in a nearly 20% Q/Q decline in wafer ASP. As for SSD, owing to weakening demand from server manufacturers, enterprise SSD ASP is expected to drop by 10-15% Q/Q. Overall NAND flash ASP is projected to drop by about 10% in 4Q20.

Furthermore, the spot market, which is indicative of the overall memory market’s movement as a whole, once again turned sluggish after mid-September. Although low priced products comprise a relatively low share of DRAM and NAND flash spot transactions, transactions for mid-range and high-end memory products have not risen by a noticeable amount, thereby constraining the momentum of the overall memory market.

Looking ahead to 1Q21, the decline in DRAM ASP is expected to narrow, thanks to increased stock-up demand from purchasers. Conversely, the abundance of NAND flash suppliers and persistently high level of supply bits will likely widen the decline in NAND flash ASP, resulting in a 15% Q/Q decrease in 1Q21.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter