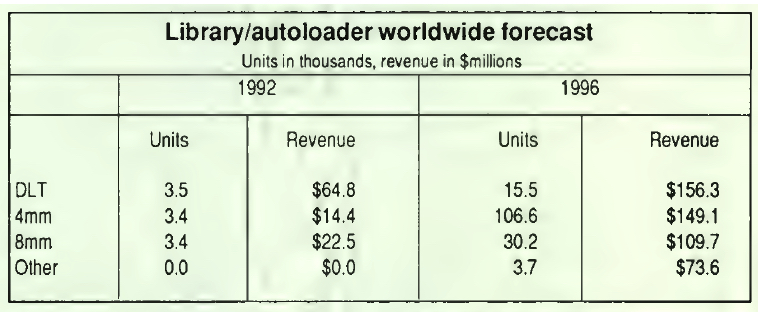

History (1993): Revenue Generated by DLT Libraries Dominates 4mm and 8mm in 1992

Performance primary reason for this success

By Jean Jacques Maleval | September 21, 2020 at 2:16 pmAccording to a new report released by Peripherals Strategies Inc. (Santa Barbara, CA), a market research and consulting firm, half-inch Digital Linear Tape (DLT) libraries command a strong lead in revenue despite the rapid unit growth of 4mm and 8mm libraries and autoloaders.

Success with DLT sales into its installed base along with DLT’s performance advantages are the primary reason for this success.

4mm autoloaders, which is just entered the market in late 1992, will grow dramatically through 1997, primarily in the PC LAN environment.

QIC cartridges and minicartridges are expected to enter this market by the end of 1993.

Current forecasts show small market penetration of this product class by QIC.

DLT is also sold by Conner Peripherals that took over Cipher’s activity.

“4mm and 8mm libraries (and autoloaders) are a strategic product for the PC LAN and mid-range systems environments,” says Michael Peterson, president, Peripherals Strategies. “But DLT stiff has a capacity and performance advantages that many large networks will pay the higher price for. All 3 tape technologies will do well in this product class. Once again, QIC and minicartridge are late entrants and unless they achieve some outstanding price/performance results, they will not make significant inroads in this market.”

The Tape Library and Autoloader Market Report ($495) offers market analysis from 1991 to 1997.

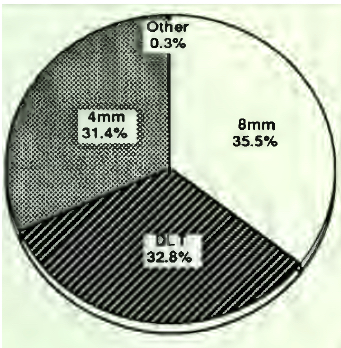

New shipments of tape libraries autoloaders in 1992

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 64, published on May 1993.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter