Commvault: Fiscal 1Q21 Financial Results

Finally sales up (7% Y/Y an 5% Q/Q) and back to profitability after 5 consecutive quarters of decreased revenue and losses, but for how long?

This is a Press Release edited by StorageNewsletter.com on July 29, 2020 at 2:17 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

162.2 | 173.0 | 7% |

| Net income (loss) | (6.8) | 2.3 |

Commvault Systems, Inc. announced its financial results for the first quarter ended June 30, 2020.

“I could not be prouder of the team. Our first quarter results are validation that our streamlined operations and reinvigorated go-to-market engine are starting to execute well,” said Sanjay Mirchandani, president and CEO. “Together with our new product portfolio and robust partner program, our customers are starting to embrace our intelligent data management vision.”

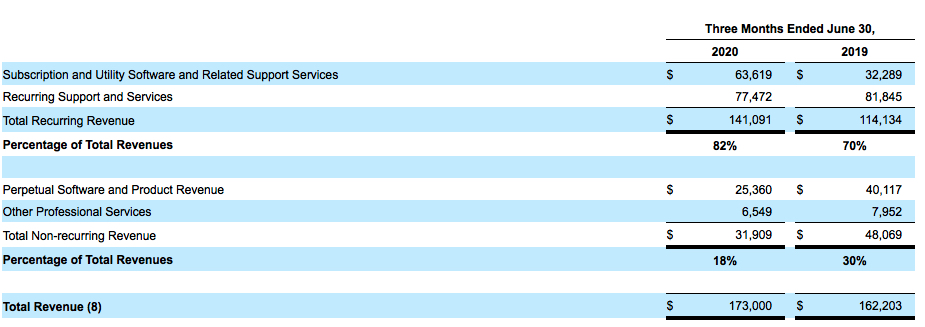

Total revenues for the first quarter of fiscal 2021 were $173.0 million, an increase of 7% Y/Y and 5% sequentially.

Total recurring revenue was $141.1 million, an increase of 24% Y/Y.

Annualized recurring revenue (ARR), which is the annualized value of all active recurring revenue streams at the end of the reporting period, was $471.6 million as of June 30, 2020, up 9% from June 30, 2019.

Software and products revenue was $76.6 million, an increase of 20% Y/Y and 15% Q/Q. The Y/Y increase was driven by a 41% increase in larger deals (deals greater than $0.1 million in software and products revenue). The volume of these transactions was up 5% and the average dollar amount of these transactions increased 35% to $403,000.

Services revenue in the quarter was $96.4 million, a decrease of 2% both year over year and sequentially.

On a GAAP basis, income from operations was $6.7 million for the first quarter compared to loss of $6.7 million in the prior year. Non-GAAP EBIT was $32.5 million in 1FQ21 compared to $15.5 million in 1FQ20.

For 1FQ21, Commvault reported GAAP net income of $2.3 million, or $0.05 per diluted share. Non-GAAP net income for the quarter was $23.9 million, or $0.51 per diluted share.

Operating cash flow totaled $15.3 million for the first quarter of fiscal 2021 compared to $31.1 million in the prior year quarter. Total cash and short-term investments were $356.3 million as of June 30, 2020 compared to $339.7 million as of March 31, 2020.

Comments

At the end of the former quarter, the company expected revenue of $150 million to $155 million for 1FQ21. Finally sales were much better, $173 million (up 7% Y/Y an 5% Q/Q) and, furthermore, the firm is back to profitability after 5 consecutive quarters of decreased revenue and losses.

But for how long? For next quarter of FY21, the company expects revenue of approximately $164 million, or -5% Q/Q, adding that software and products revenue will be at least flat Y/Y at $69 million and that the subscription renewal opportunity in 2FQ21 is the lowest of the year.

The main change appears in FY18, with the introduction of subscription-based pricing that align to customers’ workloads and purchasing preferences. FY21 marks the first year of firm's subscription renewal cycle.

Software and products revenue increased 20% Y/Y to $76.6 million, an all-time first quarter record.

Software transactions over $100,000 increased 41% Y/Y to $56 million. These large deals represented 73% of software revenue in the current quarter compared to 62% a year ago. The number of these transactions increased 5% Y/Y and the average deal size exceeded $400,000, yearly 35% higher.

1FQ21 services revenue was $96 million, declining 2% Y/Y. The decline was primarily due to Covid-related restrictions, which impacted on-site professional services. In addition, maintenance revenue growth was impacted by the transition of legacy perpetual customers to subscription licensing arrangements.

For the last 3-month period, subscription revenue represented 69% of total software revenue vs. less than 10% in FY17. Commvault added 200 subscription customers in the quarter and its subscription net dollar retention rate was above 100%, exceeding expectations.

Total recurring revenue increased 24% Y/Y to $141 million and represented 82% of total revenue in the quarter. This compares to 50% in FY17. As of June 30, 2020, ARR (annual recurring revenue) increased 9% Y/Y to $472 million.

1FQ21 expenses, including both cost of sales and operating expenses, declined 4% Y/Y to $138 million.

The most recent quarter benefited from $12 million of temporary and Covid-related expense reductions. The firm expects approximately half of these reductions to repeat in 2FQ21, while the balance of these temporary reductions are likely to return to near prior levels as business normalizes.

Revenue and net income (loss) in $million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

| 1Q21 |

173.0 |

7% |

2.3 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter