Why OVHcloud Acquired French Object Storage Vendor OpenIO?

Life becoming tougher for pure object storage vendors

By Philippe Nicolas | July 27, 2020 at 2:13 pmOn July 23, OVHcloud surprised the Lille, France microcosm with a storage acquisition.

The original press release is available here.

This move gives a strange feeling and raises one big question essentially on the OVHcloud side. Why did OVHcloud, a cloud service provider, leader in Europe, buy a confidential open source storage software company? What is the logic behind this acquisition?

A few immediate answers come to mind:

- OVHcloud can use the product without buying the company but it become difficult to continue to use a product without a company or a team behind it,

- Following its venture round and even later, OpenIO didn’t really get more visibility, got small adoption limiting its development capabilities and perspectives,

- The French firm had difficulty to raise a new round as its business is just weak, so thinking about this exit in the Lille ecosystem was just a way to save the technology and keep things in France.

One of the reason of the limited success comes from the absence of a real CEO – Laurent Denel being in fact a CTO – a good one well respected, and even if it’s a good model to start, it has to evolve with the company goal and ambition. Pressure from board’s members, even friends and other external people didn’t persuade Denel to move to this position to help the business grows. CEO position requires a different DNA.

Investors finally admit now what we said 3 years ago about the miracle of the $5 million raising campaign around the end of 2017 confirming that the acquisition multiple can’t be high and could be interpreted as a mayday. On the other hand, OpenIO technology stays in France which is a key strategic consideration for OVHcloud and France globally. There were some recent talks about the incredible choice made by French authorities to consider and sign with Microsoft Azure for the French Health Data Hub. In that case, OVHcloud should have been the preferred choice. We also see the GAIA-X project to build an European cloud initiated by Germany and France and OVHcloud with other cloud service providers like Orange, Scaleway or Outscale are also present. This is a clever idea as we still don’t understand why France has started several years ago Cloudwatt and Numergy, 2 sovereign clouds, that finally went nowhere.

Also it’s worth mentioning that Covid-19 has an impact of the business climate. Some normal companies became fragile and some fragile even disappeared.

All this invites us to ask a second question. Does OVHcloud really need to own its object storage solution? And why?

Like many users, when your provider becomes fragile, the question to keep, own or acquire the solution is crucial to continue to offer the service powered by this technology. And if OVHcloud wishes to continue to use the French open source product, there is no alternative, they have to buy OpenIO. With French cloud project and sovereignty around it, it would have been strange to swap OpenIO by other American open source peers. Just impossible and out of reality. For OVHcloud, this is the first acquisition (real first one was vCloud Air in May 2017 acquired from VMware) that help them achieve different goals at the same time and it is a bargain.

OVHcloud comment is not very positive, claiming the desire to build the best object storage product on the planet. So it immediately means the current product is far to be that and even if the ambition is respectable, it reveals the total ignorance of that storage segment.

We understand that the OpenIO brand will disappear and we doubt that the solution will be promoted outside. How an OVHcloud product could be installed elsewhere? In other words, OpenIO becomes a proprietary solution available as open source but no more acting as an ISV. Of course, OVHcloud is not an ISV. But what will OpenIO users will become? Will OVHcloud really support them and especially as some of them are competitors like Scaleway? What will be the choice for them? Swap to other open source solution such Ceph or MinIO? And finally adopt a non French product…

Like many second tier cloud providers such OVHcloud, Outscale or Scaleway, their storage offering is interesting representing 2/3, being optimistic, of what the big players – AWS, Azure and GCP or even Alibaba Cloud – offer. Their storage service page claims to offer a comprehensive storage services but it’s essentially block and objet storage and they completely omit file storage. In other words, you don’t find file storage services like AWS EFS, Azure File Storage or GCP Filestore or just a simple NAS service to name a few.

Being and acting as an ISV is real mission and the OpenIO team comes from a IT services company with different expertise and human behavior. For a commercial ISV, the strategy is pretty obvious but not easy, plenty of hurdles, you raise money, you iterate the product development for use cases you identified, do marketing and build a ecosystem and if that works you can expect to take off. For an open source ISV, the story is different, you potentially raise a small amount of money as the return is lower and you try to build a momentum in the open source community, battling for credibility, adoption and visibility. But here the game was over with 2 other famous products: Ceph and MinIO.

OVHcloud and OpenIO mentioned that they contributed to OpenStack Swift but this service was a pure failure even OpenStack globally. The Swift journey is perfectly illustrated by SwiftStack who hit a wall a few months ago trying to survive for several quarters. The company, promoter of Swift, was swallowed by Nvidia early 2020 and Nvidia never mentioned the acquisition, no press release was issued neither a blog by the GPU giant. The product is not mentioned at all on their website, only SwiftStack mentioned it. It means it was a perfect bargain for a negligible piece of software acquired for a very small amount of dollars.

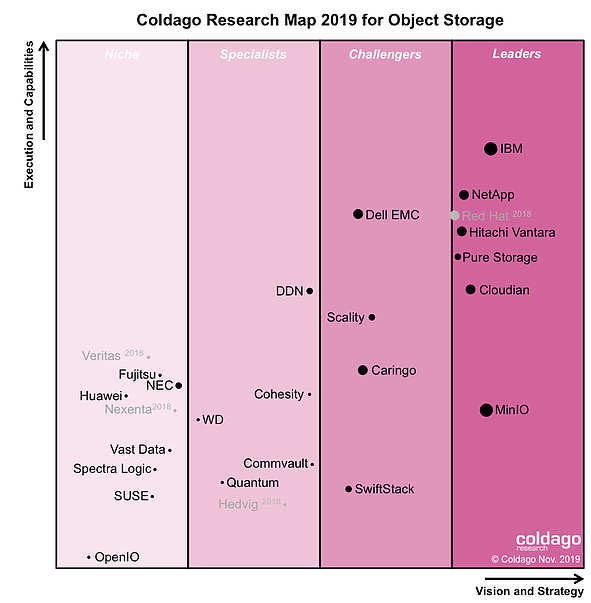

Coldago Research has published at the end of last year its annual Map that positions 22 object storage vendors. This map confirms the difficulty that OpenIO had to transform good ideas into real product traction then into revenue. For both 2 dimensions Execution and Capabilities and Vision and Strategy, the software vendor appears to be very weak.

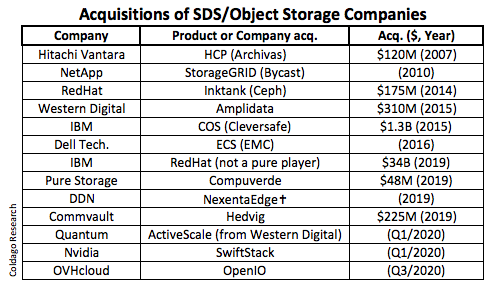

Past software-defined storage acquisitions, and especially a subset of it, illustrate the difficulty to survive in a crowded segment with lack of differentiators. It was not the case 5 years ago when not all companies were supporting S3 (imagine that some company thought about an alternative interface, brilliant prediction…) or erasure coding or file interface. Today you can try to list vendors and their offering and even try to establish features differentiators, just that, good luck. You can even describe a product to users by its features and they will miss to recognize the product as they’re so close. Differences come from different areas and one of them is the ecosystem, ecosystem of partners with integration. This acquisition is bad news for the segment confirming the difficulty of small players in a crowded segment. Therefore it reinforces leaders and innovators like IBM, NetApp, Hitachi Vantara, Cloudian, Pure Storage, Vast Data and MinIO.

OpenIO arrived very late, Veritas did same mistake as it entered into the segment too late to finally gave up a few months later. Veritas had time and money to insist but they did not. It proves that Symantec froze Veritas development in storage and data management. Some companies disappeared like Formation Data Systems, Coho Data, Skylable, some made a pivot like Igneous and reminds the OpenIO initiative in the similar domain. Quietly, OpenIO killed its Ethernet drives initiative finally.

MinIO is clearly the leader in open source object storage with tons of integration and adoption. The company even discovers some integrations made by users and partners with well documented solutions. Therefore the market traction is high, proven and recognized. Among this various integrations, there are Cisco, Datera, HPE MapR, Humio, iXsystems, McKesson, Nutanix, Pavilion Data Systems, Pivotal, Portworx, Qumulo, Robin.IO, Splunk, Ugloo and VMware.

None of the object storage vendors ever made an IPO and we don’t see and expect anyone doing so even if some had dreamed about it reaching some level of utopia when you compare reality, facts and projections. And such behaviors didn’t help their leaders, reputation and the segment as a whole. The more realistic goal is to find an exit but it became more and more difficult as the number of potential acquirers shrinks by itself, many of these players having a solution developed internally or by external operation. So the alternative is to become a zombie i.e a company that never got public, never got a stellar trajectory, still not profitable and continue to raise money, dilute capital to extend artificially their life… What a plan, we see companies on the market that were founded 10 or even 15 years ago. What’s the goal here, to get at the end a few $millions in their pocket if they ever find an acquirer? Avoid personal reputation disaster (it’s already the case)…? This survival mode is pathetic.

The object storage segment has seen different trends with S3 everywhere, on top of NAS, as gateway to tape, in HCI and even in unified storage confirming that object storage is just a S3 interface today. Read the article titled S3 eats the world published in June 2019.

As an unstructured data storage solution, it’s the perfect companion of file storage solution and we see more and more file storage product adding a S3 interface. So is there a place for pure object storage? This is a fundamental question as only a few of the market solutions got adoption, users prefer file + object, multiplying use cases on the same data platform.

At the end of the day, the OpenIO product and the team come from an IT services company and return to a new kind of player, a cloud service provider.

We suspect who will be the next one…

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter