History (1992): 300,000 Helical Scan Tape Drives Shipped in 1991

Market approaches $1 billion mark at OEM price levels.

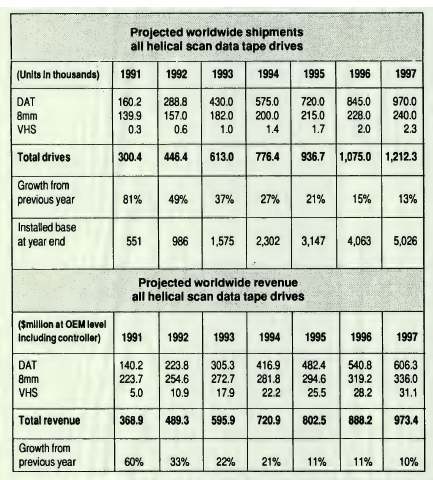

By Jean Jacques Maleval | June 9, 2020 at 2:29 pm“Worldwide market demand for computer tape drives utilizing helical scan technology will approach the $1 billion mark at OEM price levels in 1997, an 18% annual growth rate from the $369 million value of the 1991 market,” declared Robert C. Abraham and Raymond C. Freeman, Jr., authors of the newly released Helical Scan Products (247 pages, $1,775) from Freeman Associates, Inc. (Santa Barbara, CA), one of three volumes in the Freeman Report series: Computer Tape Outlook.

Unit shipment of all types of helical scan tape drives will grow from 300,400 units in 1991 to more than 1.2 million units in 1997 – a 26% compound rate – according to their predictions.

“In spite of the general economic downturn in 1991, the market for helical scan tape drives grew at an 81% rate in units and a 60% rate in revenue. This strong showing in an otherwise adverse market foretells a bright future for helical scan recording technology,” asserted Freeman.

The markets for the 3 types of helical scan tape drives are analyzed and forecast in the report – DAT, 8mm, and VHS.

- DAT data drives currently provide 2GB of uncompressed storage capacity in a 3.5-inch form factor. These devices have wide appeal due to their compact, low-cost media and their potential to provide up to 16GB in a 3.5-inch package through the use of longer length metal evaporative tape, higher track density, and a new recording format.

- 8mm drives provide up to 5GB of capacity in a 5.25-inch form factor.

- VHS drives, available in desktop or rackmount configurations, currently provide 14.5GB on one VHS cassette.

Among the key findings in the report are:

– Shipments of DAT tape drives for storage, as previously predicted, overtook longer-established 8mm products in 1991. Unit shipments of DAT drives were 160,200 in 1991 – up 143% over 1990 shipments of 65,800 drives – vs. 139,900 8mm drives, which increased 40% over 1990 shipments of 100,200 units. Despite higher unit shipments, DAT drive revenue was only 63% of 8mm revenue until 1993, but will remain ahead thereafter. VHS-based drives, the third class of helical scan tape drives being actively marketed, will be limited to specialized, high performance applications.

– Shipments of DAT drives will grow to 970,000 in 1997, a 35% annual growth rate from 160,200 units in 1991. Declining prices will limit compound revenue growth to 28% over this period, from $140 million in 1991 to $606 million, 1997. A highly competitive market environment has emerged, with the first signs of market consolidation appearing in 1991.

– 8mm drives continued their steady market penetration and broadened their OEM base. “This class of drive will remain a popular choice in networked desktop systems and workstations which utilize high capacity HDDs,” according to Freeman. “Automated media libraries and changers will further enhance their appeal.”

– Shipments of 8mm drives devices will rise from 139,000 units in 1991 to 240,000 in 1997, a 9% annual growth rate. Revenue growth for 8mm drives will be at an annual rate of 7%, rising from $223 million in 1991 to $336 million in 1997. 8mm drives have the highest native storage capacity of any small form factor tape drive, and drives with data compression capability are available.

– Shipments of VHS data drives will grow from 300 units in 1991 to 2,300 in 1997, a respectable 40% annual growth rate. Revenue growth will be at an annual rate of 36%, growing from $5 million in 1991 to $31 million in 1997.

Increased shipments of high capacity disk drives and the increased use of color graphics are fueling demand for high-capacity, small-form-factor tape drives such as DAT and 8m products, according to Abraham.

“The need for very high capacity tape products for unattended backup or high volume archiving is growing rapidly. Helical scan products can provide viable, cost-effective solutions,” he pointed out.

18 companies are identified that have announced helical scan drives or are believed to be developing such products. Of the 18 manufacturers, 15 are involved with DAT products, 2 with 8mm products, and 1 with HS products. Specs are given for 43 models of tape drives offered by 16 manufacturers and 21 offerings from 8 media makers are also listed.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠52, published on May 1992.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter