Marvell: Fiscal 1Q21 Financial Results

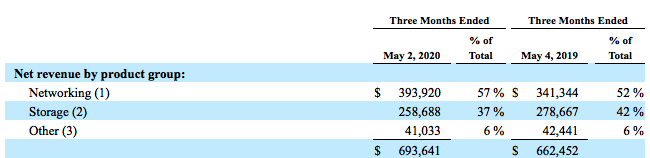

Storage, 37% of global sales, decreasing once more at $259 million, but +10% expected next quarter

This is a Press Release edited by StorageNewsletter.com on June 2, 2020 at 2:20 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

662.5 | 693.6 | 5% |

| Net income (loss) | (48.4) | (113.0) |

Marvell Technology Group Ltd. reported financial results for the first quarter of fiscal year 2021.

Highlights of 1FQ21;

- Revenue was $694 million, which exceeded the midpoint of the company’s guidance provided on March 4, 2020.

- GAAP net loss was $(113) million, or $(0.17) per diluted share. Non-GAAP net income was $118 million, or $0.18 per diluted share.

- Cash flow from operations was $176 million.

“In a challenging environment, solid execution by the Marvell team drove strong first quarter financial results with disciplined operating expense management, healthy operating cash flow, and revenue above the mid-point of guidance, enabled by stronger demand for our networking products from the datacenter and 5G infrastructure end markets,” said Matt Murphy, president and CEO. “While we did experience some Covid-19 supply chain impacts on our storage business in the first quarter, we expect a bounce back in the second quarter and we project our networking business to continue to grow.“

2FQ21 guidance takes into account the US Government’s export restrictions on certain Chinese customers. Given the ongoing uncertainty associated with Covid-19 and related public health measures, the company also has temporarily widened the guidance range on revenue.

2FQ21 Outlook

• Revenue is expected to be $720 million +/- 5%.

• GAAP gross margin is expected to be 50.6%.

• Non-GAAP gross margin is expected to be 63%.

• GAAP operating expenses are expected to be $393 million.

• Non-GAAP operating expenses are expected to be $300 million.

• GAAP diluted loss per share is expected to be $(0.10) to $(0.02) per share.

• Non-GAAP diluted income per share is expected to be $0.17 to $0.23 per share.

Comments

Globally, $694 million sales are down 3% from the former quarter, above the middle point of guidance.

Cisco and Western Digital now represent less than 10 % of total revenue, and distributor Wintech 11%.

(1) Networking products are comprised primarily of Ethernet solutions, embedded processors and custom ASICs.

(2) Storage products are comprised primarily of storage controllers and FC adapters.

(3) Other products are comprised primarily of printer solutions and application processors

For storage, revenue continues to decrease, here 8% Y/Y and 13% Q/Q.

Compared to firm's assumptions when the company provided revenue guidance for the first quarter, the impact of Covid-19 turned out to be greater than expected in storage business and lower in networking business.

Marvell expects that the 16TB HDD transition this year will drive strong growth.

SSD controller business remained resilient and grew sequentially, driven by higher shipments into data center applications.

Looking to next quarter, the firm expects storage business to start to recover from Covid-19 impacts on the supply chain, although a full recovery is more likely in 3FQ21. It will start initial shipments of custom SSD controllers for system level applications in 2FQ21.

As a result, Marvell is projecting storage revenue growth of approximately 10% sequentially for next quarter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter