Box: Fiscal 1Q21 Financial Results

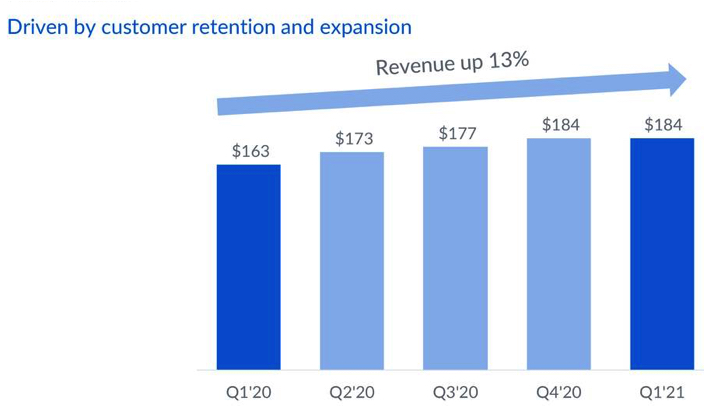

$184 revenue up 13% Y/Y, stable Q/Q, good outlook, but always enable to be profitable

This is a Press Release edited by StorageNewsletter.com on May 29, 2020 at 2:05 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

163.0 | 183.6 | 13% |

| Net income (loss) | (36.8) | 2.6 | (25.6) |

Box, Inc. announced financial results for the first quarter of fiscal year 2021, which ended April 30, 2020.

“While these remain challenging and unprecedented times, we are at the beginning of one of the most transformative periods in business history,” said Aaron Levie, co-founder and CEO. “The need for more organizations to develop remote work and digital transformation strategies on modern cloud platforms has never been greater, and Box is in a strong position to help our customers remain resilient, productive, and innovative during these times. Our Q1 results demonstrate the progress that we’ve made on driving a balance of growth and profitability, and our ability to power secure remote work for enterprises provides us a large opportunity going forward.”

“In the first quarter, we delivered strong top and bottom line results despite a challenging macroeconomic environment,” said Dylan Smith, co-founder and CFO. “Our heightened focus on driving expansion and renewals in our existing customer base, combined with a predominantly recurring revenue model, create strong financial resiliency in light of this dynamic situation. At the same time, our focus on overall cost discipline will allow us to deliver significant profitability improvements as we build on the foundation that we’ve laid to capture our long-term market opportunity. For FY21, we now expect our non-GAAP operating margin to be 11 to 12% of revenue, an improvement from the 9 to 10% range that we provided on our last earnings call.“

1FQ21 Highlights

• Revenue was $183.6 million, an increase of 13% from the first quarter of 1FQ20.

• Remaining performance obligations as of April 30, 2020 were $722.7 million, an increase of 13% from 1FQ20.

• Deferred revenue as of April 30, 2020 was $368.3 million, an increase of 11% from 1FQ20.

• Billings were $128.1 million, an increase of 8% from the 1FQ20.

• GAAP operating loss was $24.2 million, or 13% of revenue. This compares to a GAAP operating loss of $35.4 million, or 22% of revenue, in 1FQ20.

• Non-GAAP operating income was $17.2 million, or 9% of revenue. This compares to a non-GAAP operating loss of $3.0 million, or 2% of revenue, in 1FQ20.

• GAAP net loss per share, basic and diluted was $0.17 on 151.9 million weighted-average shares outstanding. This compares to a GAAP net loss per share of $0.25 in 1FQ20 on 145.3 million weighted-average shares outstanding.

• Non-GAAP net income per share, diluted was $0.10. This compares to a non-GAAP net loss per share of $0.03 in 1FQ20.

• Net cash provided by operating activities totaled $61.9 million. This compares to net cash provided by operating activities of $25.5 million in 1FQ20.

• Free cash flow in was positive $39.8 million. This compares to positive $13.4 million in 1FQ20.

Outlook

Box’s revenue guidance incorporates its current assessment of the impact that Covid-19 could have on its business, including its expectations that enterprise customers will continue to increase their adoption of its solutions, while also taking into account some softness the company expects from its small business customers and professional services revenue. Its pivot to a remote workforce has enabled it to accelerate how it operates more efficiently and, as a result, has allowed the company to forecast stronger GAAP and non-GAAP EPS guidance.

• 2FQ21 Guidance: Revenue is expected to be in the range of $189.0 million to $190.0 million. GAAP basic and diluted net loss per share are expected to be in the range of $0.13 to $0.11. Non-GAAP diluted net income per share is expected to be in the range of $0.12 to $0.14. Weighted-average basic and diluted shares outstanding are expected to be approximately 154 million and 161 million, respectively.

• FY21 Guidance: Revenue is expected to be in the range of $760.0 million to $768.0 million. GAAP basic and diluted net loss per share are expected to be in the range of $0.55 to $0.50. Non-GAAP diluted net income per share is expected to be in the range of $0.47 to $0.52. Weighted-average basic and diluted shares outstanding are expected to be approximately 155 million and 162 million, respectively.

Comments

27% of quarterly revenue came from regions outside US , driven by continued strength in Japan.

In 1FQ21, the firm closed 40 deals worth more than $100,000 vs. 33 a year ago, up 21% year-over-year. It closed 5 ones over $500,000 vs. 6 a year ago and 3 over $1 million in line with a year ago. 80% of $100,000-plus deals included at least one add-on product.

It ended the most recent three-month period with an annualized net retention rate of 107%, up from 106% a year ago and 104% last quarter due to improvements in customer expansion rates. In 1FQ21, full churn rate was 5% on an annualized basis, stable vs. 1FQ20 and 4FQ20.

Recurring revenue representing 95% of total revenue.

The heightened need for solutions like Box that power remote work have benefited sales to existing customers, which contributed more than 70% of new bookings in Q1.

While the firm expects to see softness in small business segments due to the economic environment, it is seeing greater momentum from enterprise customers

FY revenue and losses for Box in $ million

| FY | Revenue | Y/Y growth | Net income (loss) |

| 2011 | 21.1 | NA | (53.3) |

| 2012 | NA | NA | NA |

| 2013 | 58.8 | NA | (112.6) |

| 2014 | 124.2 | 112% | (168.6) |

| 2015 | 216.4 | 74% | (168.2) |

| 2016 | 302.7 | 40% | (202.9) |

| 2017 | 398.6 | 32% | (150.8) |

| 2018 | 506.1 | 27% | (155.0) |

| 2019 | 608.4 | 20% | (134.6) |

| 2020 | 696.2 | 14% | (144.3) |

| 2021 (est.) |

760-768 | 9%-10% | NA |

Note: IPO in 2015 raising $175 million

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter