WW Revenue of DRAM Market Drops by 4.6% Q/Q in 1Q20 at $14.8 Billion

Due to Covid-19 impact on shipment

This is a Press Release edited by StorageNewsletter.com on May 28, 2020 at 2:24 pmThe DRAM market has changed from falling prices and rising shipment to rising prices and falling shipment, according to an investigations by the DRAMeXchange research division of TrendForce, Inc.

DRAM suppliers were able to successfully reduce their inventories in 1Q20, with lower inventory levels at the end of 1Q20 compared to the beginning of the year. Hence, suppliers are no longer under imminent pressure to slash prices, and overall DRAM ASP rose by about 0-5% Q/Q.

However, while governments responded to the Covid-19 pandemic by implementing citywide and nationwide lockdown policies, the resultant logistic disruptions in turn affected DRAM bit shipment as well.

Therefore, in spite of the minor rise in ASP, global DRAM revenue decreased by 4.6% Q/Q, reaching $14.8 billion.

Backlog of orders in 1Q20 will be deferred to 2Q20. In 2Q20, as the magnitude of Q/Q increase in DRAM ASP expands, and bit shipment rebounds, TrendForce forecasts a Q/Q increase of more than 20% in overall DRAM revenue. DRAM suppliers are projected to continue improving their revenue and profitability.

The slight increase of DRAM ASP helped strengthen suppliers’ profitability in 1Q20

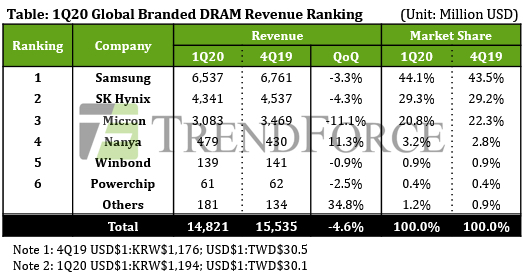

As the pandemic-related disruptions in the supply chain caused delays in bit shipment, and the market situation changed to a state of rising prices and declining shipments, the 3 dominant DRAM suppliers all experienced revenue contractions in 1Q20 of 3%, 4%, and about 11%, for Samsung, SK Hynix, and Micron, respectively (Micron’s 11% contraction refers to its fiscal 2Q20 revenue performance, from December 2019 to February 2020).

In terms of market shares, Samsung, SK Hynix, and Micron occupied 44.1%, 29.3%, and 20.8% of the market, respectively. Since suppliers have not made any major changes to their capacity plans for this year, it is projected that their market shares to remain mostly unchanged in 2Q20.

The Q/Q rise in overall DRAM ASP made a positive contribution to suppliers’ profitability in 1Q20.

Samsung had a relatively strong base period in 4Q19 compared to 1Q20 because it was able to recover some of the write-offs related the quality issue of its 1X-nm process and produce a dramatic one-time gain during the period. As such, although the company posted a drop in its 1Q20 operating margin to 32%, its actual profitability has been steadily improving.

SK Hynix’s operating margin rose considerably to 26% from 19% in the previous quarter.

The increase in Micron’s ASP for its 2FQ20 has been smaller compared with the increases in the two Korean suppliers’ ASPs. Micron has also experienced a jump in its operating costs resulting from its 1Z-nm migration. Consequently, Micron’s operating margin fell slightly, but the US-based supplier is expected to make a decent recovery in its 3FQ20 (from March to May).

The 3 dominant suppliers are cautious about capacity planning and are further scaling back their Capex

On the matters of technology and production, Samsung continues to shift the wafer processing capacity at its Line 13 from DRAM production to CMOS image sensor production, but it intends to commence DRAM production at P2L in 2H20 to compensate for the shortfall of wafer input at Line 13 while expanding the share of the 1Z-nm production in its output. Samsung remains conservative in its planning as the pandemic has severely weakened the overall demand; the amount of production capacity that it plans to add this year is thus quite limited.

SK Hynix is gradually shifting the wafer processing capacity of its fab M10 to CMOS image sensors, while DRAM production is being raised at its main memory plant M14. It has also decided to slightly increase wafer starts at its Wuxi base in 2H20. Nevertheless, this year it will be expanding its output primarily through its transition to the 1Y-nm production, without increasing its overall production capacity.

Micron’s total DRAM production capacity will stay relatively constant from last year, since much of its Capex in 2020 is budgeted for moving its 1Z-nm process into the mass production phase and raising output. Mass production for Micron’s 1Z-nm products is expected to be realized soon, as OEMs are keen on testing the samples sent by Micron.

On the whole, the top 3 suppliers are making good progress in their technology migrations despite some delays in process development and deployment. None of them have encountered a serious quality issue that could set back the schedule. Total DRAM production capacity is not expected to show noticeable growth this year, and dominant DRAM suppliers are continuing to dial back their Capex. Hence, the growth of the DRAM industry’s bit output in 2020 will be mainly driven by suppliers’ 1Y-nm and 1Z-nm migrations instead of a rise in wafer starts.

Taiwanese suppliers will focus on the development and deployment of advanced processes

Nanya posted a Q/Q increase of nearly 10% in its revenue for 1Q20 as it was able to raise its bit shipments by a double-digit percentage. Its operating margin also rebounded to 12.7% in 1Q20 from 11% in 4Q19, owing to the effective control of the R&D cost. In addition, the company is expected to see a further increase in its profitability in 2Q20 because its ASP will follow the general market trend and keep climbing.

Winbond’s quarterly DRAM revenue for 1Q20 was similar to the figure for the previous quarter as there were no major Q/Q changes in the ASP and bit shipments. However, Winbond recorded a noticeable gain in its NAND flash revenue for the same period.

Powerchip maintained the same product mix strategy that favors CMOS image sensors over DRAM because demand stayed high for the former during 1Q20. As a result, Powerchip’s DRAM revenue for the quarter slid by 3% (the calculation of Powerchip’s revenue covers the sales of the company’s own branded, in-house manufactured PC DRAM products and excludes foundry DRAM orders).

Although the 3 Taiwanese suppliers varied in their revenue performances, all of them will be concentrating on developing their most advanced processes during 2020.

Nanya, for example, is focusing on the deployment of its in-house 1A-nm and 1B-nm processes after announcing that it will no longer use technologies licensed from Micron.

Meanwhile, Winbond is working on raising the yield rate of its new 25nm process and diversifying its memory offerings.

As for Powerchip, it is improving its 25nm DDR4 memory products with respect to stability and compatibility.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter