History (1991): How Far Can Go 8mm Company Exabyte?

Exceptional success but for how long?

By Jean Jacques Maleval | May 25, 2020 at 2:34 pmExabyte Corporation (Boulder, CO) has based its entire activity on 8mm magnetic tapes using helical scan recording technology to store data.

Its success is exceptional as it is difficult to impose a standard on removable media when your name is not IBM or Apple.

In its October 7, 1991 issue, Fortune has just ranked Exabyte ≠3 of America’s fastest-growing companies in sales growth in these 3 to 5 last years. Conner Peripherals is ≠24, Komag ≠73 and Quantum ≠84.

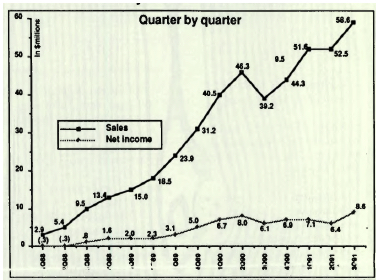

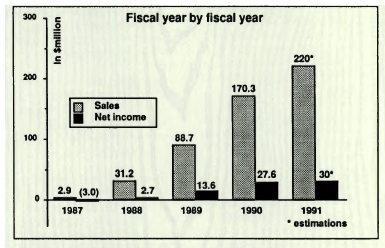

There was no single quarter since January 1, 1988, where Exabyte had to report sales or net income that hadn’t increased, except in 1990 and 1991 with a slight drop in profits (see graphic just below).

Exabyte’s financial results

From 3 people in 1985, the company has grown to 7,000 worldwide employees and should reach close to $220 million sales and $30 million benefits for its current fiscal year ending December 91. Exabyte’s stock market value was estimated at half of a billion dollar and the company has a zero long term debt. In the 9 months, ending September 1991, its sales reached $162.6 million, a 26% increase compared with last year’s same period. During this same time, net income grew 6.2%, from $20.8 to $22.1 million, which is actually rather an exception in this rough period for the storage industry.

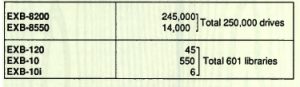

In less than 4 years, it shipped 275,000 drives, including more than 250,000 EXB-8200, the 250,000th one being sold to Sun Microsystems (Mountain View, CA) and was showed at Comdex in Las Vegas, NV.

If you follow the figures from Peripherals Strategies (Santa Barbara, CA), the manufacturer represents by itself 11.2% of the revenues of the WW tape drive market, which is quite amazing when you know that Exabyte shipped its first drive less than 5 years ago.

Originated by 3 StorageTek’s veterans

The company was founded in 1985 by 3 StorageTek veterans: Kelly Beavers, Harry Hinz and Juan Rodriguez to design, manufacture and market 8mm cartridge tape subsystems to provide unattended backup for workstations, mid-range, high-end computers and file servers.

Hinz got the idea of storing computer data on the small 8mm video tape being introduced by Sony, but couldn’t rise the interest of his employer, Storage Technology (Louisville, CO).

Rodriguez, now 50, left IBM to co-found StorageTek in 1969 with Jesse Aweida. He left the company when it decided to close an ambitious optical storage division he was heading. He held the position of chairman of the Boulder’s company and was CEO until July 1990, when Peter D. Behrendt, now 52, a 26-year veteran at IBM, who joined Exabyte in 1987 as president, took over the position of CEO.

In the company’s actual board of directors there are Behrendt and Rodriguez, but also Ken Nakoo, GM, Kubota Corp. and notably James M. McCoy, founder and COB of Maxtor Corp. (San Jose, CA). Let’s not forget that Kubota and Maxtor own a common subsidiary in the optical disk segment, Maxoptix Corp. (San Jose, CA).

Sony, the unavoidable partner

The first agreement between Exabyte and Sony of Japan was in 1987 to supply specially modified 8mm video mechanisms and heads. This agreement was extended until 1993.

“We probably are the largest single consumer in 8mm,” said Behrendt.

Is the Colorado-based company entirely depended on this sole supplier? “There are five 8mm mechanism manufacturers throughout the world,” replies Behrendt. “In fact, our first mechanism came from Canon.”

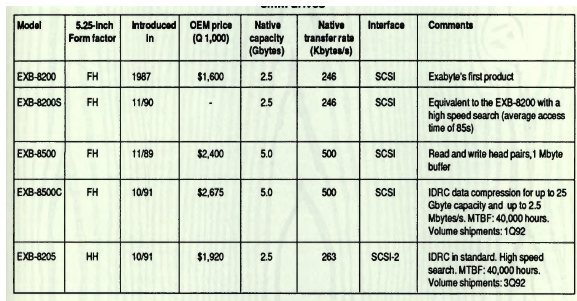

5GB in 5.25-inch drive

In 1987, the company introduced its first product, the EXB-8200 8mm cartridge tape subsystem using helical scan technology originally developed for the consumer video market by Sony.

Helical scan devices record data to slow-moving tape from R/W heads that are mounted on a rapidly spinning drum at a 5° angle from vertical. The slow linear motion of the tape, less than one half-inch per second, causes the heads to trace an oblique path or track across the tape of nearly three inches in length. The head drum contains read, write and servo heads rotating at over 1,800rpm. It writes 800tpi for the EXB-8200 and 1,600tpi for the EXB-8500. The 8200-SX model is similar to the 8200 but includes alternate short file marks and a faster search system, at nearly 15MB/s.

Soon, the 5GB 8500 model is expected to completely eclipse the 2GB 8200 unit. Then a half-height model (8505C?) is awaited, with 5GB native capacity, fast search and data compression.

Data compression and half-height form factor

This year, the Colorado firm put out new drives with a possibility of data compression using IDRC algorithms developed by IBM for its half-inch tape 3480 cartridges. IDRC could multiply by 2 to 5 the capacity of the tape and its data transfer rate. The 8500C model includes this data compression just like Exabyte’s latest unit, the 8205, the first 8mm cartridge drive in a half-height 5.25-inch form factor.

To use IDRC, Exabyte pays royalties to IBM, “at a reasonable price,” that was not unveiled.

The 8mm drive manufacturer doesn’t favor data compression too much because it believes it has several disadvantages: 1/ if data was already compressed before it was written on the tape, not only is there no gain but you can end up with a larger file; 2/ it can also occur when you try to compress purely random data; 3/ for unattended backups, you cannot predict the capacity of the media and the data rate. For the maker, the tape drive is the worst place to make compression and advises users to do such operations on an HDD or on the main computer’s memory.

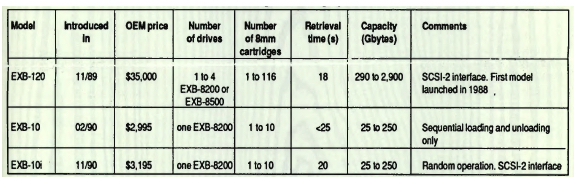

Automatic libraries for 10 and 116 cartridges

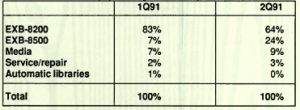

Sales of cartridge handling systems don’t represent very much in the revenues of the Boulder’s company.

There are two main models, the EXB-120 that holds up to 116 cartridges and the EXB-10 for 10 cartridges. This last one was changed into EXB-10i to allow random and not only sequential research of a cartridge.

The real weak point of these libraries is the lack of software that should be developed by integrator customers or VARs.

Exabyte also markets media products including 8mm data cartridges, a cleaning cartridge, and a data cartridge holder.

The company has sold more than one million cartridges to date, approximately 4 per drive.

Sales by type of product (in percentage of sales)

Total placements at mid-september 91

Exabyte’s products

8mm drives

8mm cartridge handling systems

Standardization

The company owns 9 US patents and has 4 patent pendings relating to its 8mm digital technology which cover data formatting, tape backup, rapid tape search and error correction.

Exabyte’s patented EXB-8200 recording format is recognized as formal standard by ECMA (standard 145) in Europe. ECMA is expected to standardize the EXB-8500 recording format in the summer 1992. A few weeks ago, the International Standards Organization (ISO) voted to standardize the format defined in the document ISO/IEC 11319 that will be published in March 1992. In addition an accredited subcommittee of the ANSI is currently processing.

But why is the company trying to obtain national and international standards for recording formats when it is the only one to implement them, thus making them de facto standards in the 8mm industry?

$15 million in new customers

Exabyte recently signed with 3 computer manufacturers, Control Data, Geac Canada (Markham, ONT) and ICL (London, England). Additionally aerospace electronic firm, Aydin Vector Division will adapt and market 8mm subsystems for airbone and field instrumentation/data collection systems, and Brastex Electronica of Brazil will distribute subsystems in South America. The 5 contracts, signed during the past 9 months, run for terms of 12 to 18 months and represent a combined value of about $15 million.

Control Data will integrate the EXB-8200 and EXB-8500 across 8 Unix platforms. Chuck Horton, product marketing manager for Control Data, said: “The Exabyte 8mm drives will be used to support tape backup on our entire Control Data 4000 series of information servers as well as our 910 graphics workstation line.”

Geac, a $82 million publicly-traded company which is listed on the Toronto Stock Exchange, delivers Unix and GeOS-based computer solutions to various vertical markets including library and hotel automation, construction systems, financial services, manufacturing and distribution and property management.

Geac spokesman Harrison Cheung said: “Geac serves various vertical markets where online transaction response is critical, and where efficient, effective backup of data bases is imperative.”

ICL, a leading European information technology company, will integrate the EXB-8200 into its SPARC RISC-based DRS 6000 system, and will also offer the product on its Intel-based DRS 3000 system.

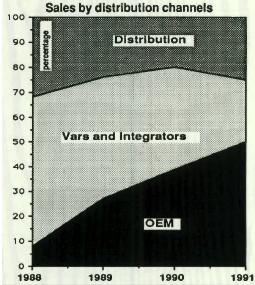

Distribution: first VARS, then OEMs

At its beginning, customers were mostly VARs and integrators who are more willing to take risks than big computer makers that take time before integrating a new product and especially here with a pioneering technology. The company’s success with OEMs today is amazing when you know that they usually don’t like to depend on one single source. And even if, as we’ll see later, another company manufactures 8mm drives, it’s under Exabyte’s license.

The list of large computer manufacturers that are customers of Exabyte is longer than those who are not, like Hewlett-Packard and Digital Equipment who adopted 4mm tapes and even if several VARs developed subsystems based on 8mm tapes for them.

“IBM represents between 10% and 20% of our sales and is the only one over 10%,” says Behrendt.

The 8mm drive connection was chosen by Big Blue for some of its PS/2 microcomputers, RS/6000 workstations and a few AS/400 minicomputers. After IBM, Sun Microsystems is probably Exabyte’s second best customer. But it also has among its main customers companies like Control Data, Data General, Fujitsu, ICL, NCR, Siemens/Nixdorf, etc.

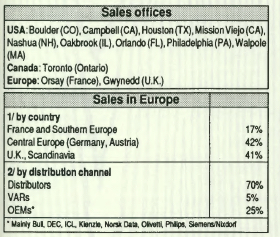

“International sales accounted for 17% in 1990,” adds Behrendt.

He estimated, however, that 45% of total shipments found their way to foreign markets via US-based OEMs or VARS.

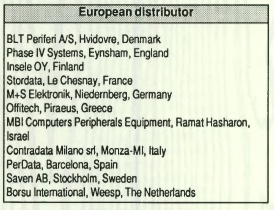

Exabyte counts 175 customers in 29 different countries, including VARs, integrators, OEMs or distributors. In Europe, usually one distributor per country, it has two direct subsidiaries, one in Tokyo, mainly to handle its relationship with Sony, the other one in Amsterdam for Europe with an international repair depot in Cumbernauld (Scotland) plus 2 sales offices in Orsay (France) and Gwynedd (UK). In the Pacific Rim, Nippon Systemhouse Ltd. (Tokyo, Japan), an affiliate of Kubota with the sales exclusivity.

“Our philosophy is one distributor per country in Europe,” said Don VerMeer, sales director. “For the Eastern block, we operate through M+S, Saven and soon DDC Pertec who are Western companies because we have not found distributors on the sites.“

“Our distribution agreements make it impossible for us to sell competitive products, which are not named, but are mostly 4mm products,” explains sales manager of M+S.

One plant in USA, another one in Japan handled by Kubota

Behrendt estimates that one third of Exabyte’s EXB-8200 production is done in Boulder, two third in Japan. Standard versions, a total of 4, are done in Asia, special versions (150 different ones) in the US.

From Sony Japanese mechanisms, Exabyte mounts its 8200 models with PCBs supplied by Solectron.

It was in 1987 that Kubota Ltd. of Japan acquired 8% of Exabyte’s stock in exchange of one seat on its board of directors and a license to manufacture the drives. The US firm is required to purchase a minimum of 58% of its annual product requirements from its largest investors through December 3,1991. Purchase aggregated approximately $54 million in 1990. Kubota has the exclusive right to sell the product in the Pacific Rim for royalties. Royalty aggregated $154,000 last year.

To meet the needs of the 1992 European Community, Exabyte designed the Scotland facility in Cumbernauld to be easily adapted to manufacturing in the future.

“This Scotland facility will open when it will be necessary,” but Marty McCoy, VP of manufacturing who won’t say anything more.

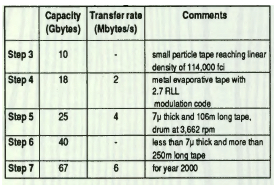

67GB on a cartridge in year 2000

Kelly Beavers, co-founder and VP of customer satisfaction, at an European press meeting in Budapest, Hungary, gave us a general view on the future evolution of the 8mm tape systems in terms of capacity and transfer rates. It is resumed in the following chart:

These forecasts are impressive but beneath the “exabyte” which means 1018 bytes, after the petabyte (1015), the terabyte (1012) and the Gigabyte (109).

8mm and the others

For backup, a huge fight seems to have started between optical disks and the different magnetic tapes (.5 inch, .25-inch, 4mm and 8mm) in cartridges with almost equal capacities.

IBM did not choose and offers for instance QIC cartridges as well as 8mm ones for its RS/6000s and AS/400s.

“QIC will hurt DAT more than 8mm because the price is very important and we don’t want to be in the low end,” says Behrendt, who, which is unusual for him, gets a bit carried away on the subject: “There was the biggest misjudgment on DATs: people thought they would become a success in audio technology in the consumer market. The reality is quite different. Not a single DAT manufacturer makes money. They will leave and do other things.”

But competition with DAT manufacturers is still going to lead to a drop in prices that has already started and that will keep on underlining the difference with 8mm drive prices.

Experts generally see a better future for 4mm tapes. Peripheral Strategies (Santa Barbara, CA) only forecasts a WW small increase in 8mm sales: 126,900 units in 1991 and 148,600 in 1995, compared with 104,200 and 480,700 DAT drives respectively. The same ones even plan a drop in revenues for 8mm drives: $213 million n 1991 and $187 million n 195.

Freeman Associates (Santa Barbara, CA) are not more optimistic. As of this year, they estimate that more DATs (169,000) has been sold in the world than 8mm drives (127,000) and that revenues of 4mm drives will be higher as soon as next year. Freeman nevertheless plans a sustained growth in 8mm drives: +15% in number of drives and an average of +13% per year in sales until 1996.

“Worn-out heads”

4 and 8mm tape backup systems are too recent, their long term reliability still has to be proved. Exabyte has specified a 20,000-hour MTBF for its products in the beginning, then 30,000 and finally 40,000 in November 1990.

We could nevertheless read in the Peripherals Strategies Industry Report (October 91, page 6): “Many peripheral OEMs are having to cope with a high in warranty customer return rate of 8mm drives with worn-out heads.”

4mm DAT, more recently on the market, based on the same type of technology, could have the same problems. But on the contrary, one of its main advantages is that there are already 3.5-inch form factor units. Since the cartridge is larger, nothing proves you can fit an 8mm unit in the same volume.

Is there an agreement with Sony to develop a 3.5-inch 8mm drive? Peter Behrendt did not want to answer this question.

On the other hand, theoretically, storage on 8mm tapes offers higher possibilities, on account of a larger media and a density that can considerably increase. It is 74Mb per square inch on the EXB-8500 model compared with 114Mb per square inch on DAT tapes. The 8mm cartridge has the magnetic cartridge market’s biggest native capacity, with 5GB if you don’t include T-120 or T-180 VHS type tapes based on helical scan recording that never really were successful in the computer industry. The real competitor for 8mm tapes could be a new 3480 type cartridge using high-density helical scan recording that could already be in StorageTek’s sleeve.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠47, published on December 1991.

Note: Exabyte was acquired by Tandberg Data for only $28 million in 2006. 8mm business was finally stopped, unable to compete with LTO.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter