Phison: February 2020 Financial Results

Total memory module shipment growing 36% Y/Y

This is a Press Release edited by StorageNewsletter.com on May 15, 2020 at 2:14 pmPhison Electronics Corp. reported financial results for February 2020.

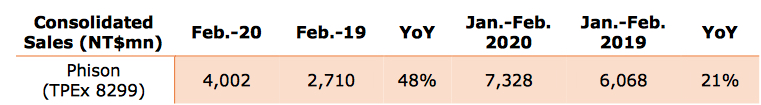

- Revenue totaled NT$4,002 million, up 48% Y/Y.

- Accumulated revenue for January-February 2020 totaled NT$7,328 million, up 21% Y/Y.

- Main R&D center and most manufacturing partners are in Taiwan, minimizing the impact from the coronavirus.

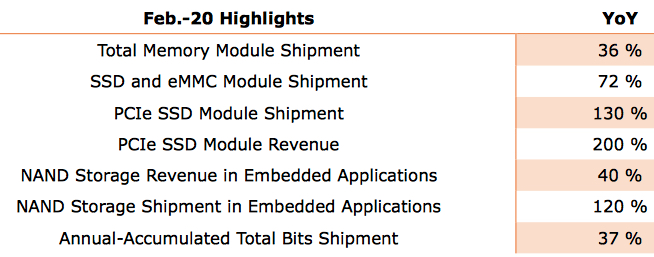

- NAND module shipment remains growth of 36% Y/Y.

- PCIe SSD module hits growth of 130% Y/Y (shipment) and 200% Y/Y (revenue), showing high-performance storage demand raises.

- High-end embedded storage hits growth of 120% Y/Y (shipment) and 40%Y/Y (revenue)

Key takeaways

Phison’s February 2020 revenue totaled NT$4,002 million, up 48% Y/Y. Accumulated revenue for January-February 2020 totaled NT$7,328 million, up 21% Y/Y even facing coronavirus epidemic.

Regarding the coronavirus outbreak, the firm have taken the necessary safety precautions. Its main R&D center and most of its module manufacturing facilities are in Taiwan, and all operations are currently normal. Therefore, the operation and revenue are on the track to expand as expected globally. Global customers continue to place orders stably and no sign of cutting orders due to coronavirus.

Breaking down the shipment and revenue details, total memory module shipment grows over 36% Y/Y, and SSD and eMMC module shipment grows nearly 72%. Furthermore, PCIe SSD module shipment increases nearly 130%, demonstrating high-end PCIe SSD storage demand is raising rapidly. Plus, revenue of PCIe SSD module hits over 200% Y/Y growth.

Speaking of high-end storage market (embedded applications), the total revenue of embedded storage maintains a nearly 40% Y/Y growth, higher-margin embedded-related module shipment even hits 120% Y/Y growth, showing the firsm is raising market share in global high-end NAND storage market. Additionally, annual-accumulated total bits shipment hikes nearly 37% Y/Y growth, indicating both NAND storage capacity and quantity are growing as expected.

Given the current strength in demand for SSD from datacenter, enterprise applications, and the expected introduction of new gaming consoles by leading brands in 2H20, according to market intelligence provider, NAND flash pricing and demand trends are currently favorable.

Phison’s quick facts

- Over 20 years experiences in NAND controller IC design and module integration.

- Over 2,000 employees globally, and more than 75% are engineers

- Over 1,900 memory-related patent globally.

- 3 major focuses: enterprise, embedded, and consumer market.

- 600,000 average annual controller shipment.

- $1.45 billion sales revenue in 2019 (no debt).

- Confident that business model can produce consistently strong cash flows and profits over the long-term amidst NAND memory market cycles.

- Maintain long-term partnerships with global NAND flash supply sources and with downstream module customers.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter