Seagate: Fiscal 3Q20 Financial Results

Revenue up 18% Y/Y in spite of decreasing global HDD market and Covid-19, thanks to nearline drives

This is a Press Release edited by StorageNewsletter.com on April 24, 2020 at 2:34 pm| (in $ million) | 3Q19 | 3Q20 | 9 mo. 19 | 9 mo. 20 |

| Revenue | 2,313 | 2,718 | 8,019 | 7,992 |

| Growth | 18% | 0% | ||

| Net income (loss) | 195 | 320 | 1,029 | 838 |

- Achieved revenue of $2.72 billion

- Reported GAAP operating margin of 13.8%; non-GAAP operating margin of 15.5%

- Delivered GAAP diluted earnings per share (EPS) of $1.22; non-GAAP diluted EPS of $1.38

- Generated $390 million in operating cash flow and $260 million in free cash flow

Seagate Technology plc reported financial results for its 3FQ20 ended April 3, 2020.

“Seagate executed very well in the third quarter while navigating the unprecedented challenges brought on by the Covid-19 pandemic. Our teams worked tirelessly to safeguard the health of their colleagues, support customer demand, and execute our product roadmap. In this challenging environment, we achieved strong financial performance, delivering revenue and non-GAAP EPS that were above our guidance midpoint and continuing to generate solid free cash flow,” said CEO Dave Mosley. “Our results demonstrate the resilience of our business model, which combined with our strong balance sheet and liquidity offer stability to manage through this uncertain environment. Over the long-term, we believe the strength of our technology innovation and product portfolio position Seagate well to capitalize on secular demand for mass capacity storage as well as the growing necessity for cost effective data management solutions driven by the transition to IT 4.0.”

The company generated $390 million in cash flow from operations and $260 million in free cash flow during the fiscal third quarter 2020.

It maintained a healthy balance sheet and, during 3FQ20, it paid cash dividends of $170 million and repurchased 4 million ordinary shares for $195 million.

Cash and cash equivalents totaled $1.6 billion at the end of the quarter. There were 257 million ordinary shares issued and outstanding as of the end of the quarter.

The board of directors declared a quarterly cash dividend of $0.65 per share, which will be payable on July 8, 2020 to shareholders of record as of the close of business on June 24, 2020. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Business Outlook for 4FQ20

• Revenue of $2.6 billion, plus or minus 7%

• Non-GAAP diluted EPS of $1.28, ±10%

Comments

In a global HDD market dipping in 1CQ20, Seagate surprisingly released remarkable financial results thanks to booming high-capacity drive business, even if it continues to be a poor player in faster growing competitive SSD market.

Generally, WD announced its financial figures few days before its main competitor, and so we have to wait to see if, with Toshiba, they will do as well as Seagate for HDDs. Probably not.

Seagate achieved revenue of $2.72 billion, up 1% Q/Q and up 18% Y/Y - in correlation with last quarter's prediction of $2.7 billion ±7% -, shipping 120.2EB of HDD capacity, an increase of 12% Q/Q, but total drive shipments at around 29 million are down 11% Q/Q.

Average capacity per drive reached 4.1TB, a 26% jump Q/Q and nearly 70% Y/Y. ASP increased as much as 13% quarterly at $86.

Mass capacity storage booming

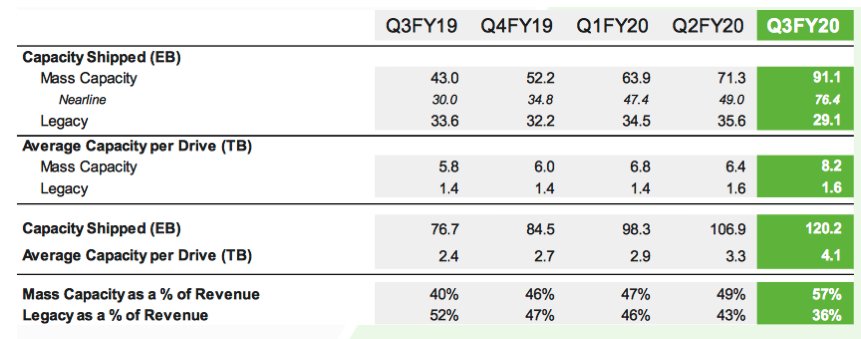

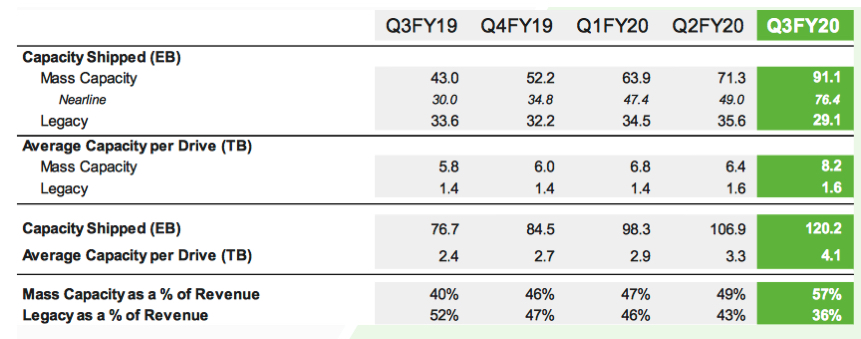

In the March quarter, mass capacity storage increased to 57% of total revenue and represented 62% of total HDD revenue. These figures are up from 49% and 53%, respectively in the December quarter.

Mass capacity trends

Mass capacity storage includes nearline, video and image applications and NAS.

Mass capacity storage includes nearline, video and image applications and NAS.

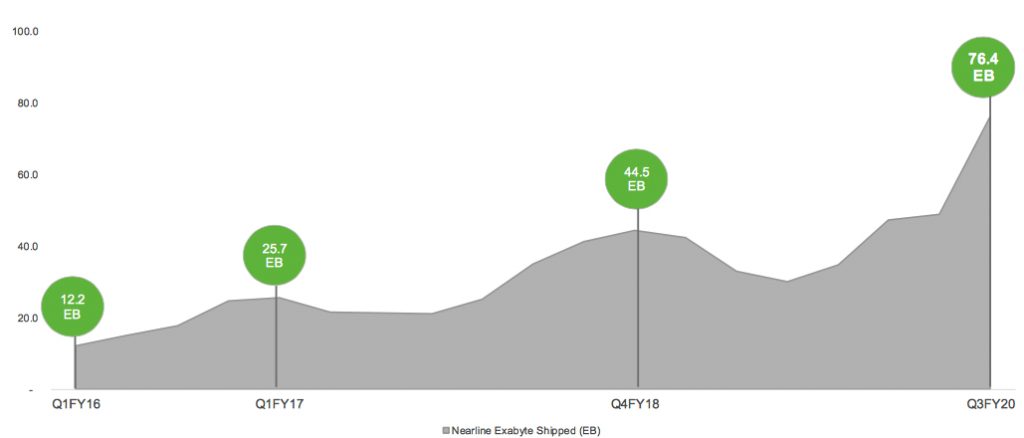

Nearline products

In 3FQ20, mass storage capacity increased 18% Q/Q and 68% Y/Y supported by record sales of nearline products.

Exabyte shipments into this market increased 28% Q/Q reaching a record level of 91EB.

On its side, total nearline shipments increased to 76EB with an average capacity of 10TB per drive, another record. Revenue from 16TB nearline drives more than doubled Q/Q. Seagate began shipping 18TB HDDs in limited quantities to select customers as part of system solutions. 20TB HAMR units are expected before the end of 2020.

Nearline demand trend

Revenue contribution from the legacy market decreased to 36% Y/Y in more recent quarter, down from 43% in the December quarter, as initial virus outbreak and extending Chinese New Year impacting demand for consumer electronics, explains the company. Exabyte shipments into this business declined 18% sequentially to 29EB.

HDD product mix trends

Mass capacity storage includes nearline, video and image applications and NAS. Legacy markets include mission critical, desktop, notebook, digital video recorders, gaming consoles and consumer applications. The markets were previously categorized as enterprise, edge non-compute, and edge compute.

Mass capacity storage includes nearline, video and image applications and NAS. Legacy markets include mission critical, desktop, notebook, digital video recorders, gaming consoles and consumer applications. The markets were previously categorized as enterprise, edge non-compute, and edge compute.

Non HDD business

7% of 3FQ20 global revenue was derived from non-HDD business, down 10% sequentially. The majority of the decline in its tiny sector is attributed by Seagate to system business and Covid-19 related supply constraints, as manufacturing partners were impacted by factory shutdowns and labor shortages.

Revenue by products in $ million

| 2FQ20 | 3FQ20 | Q/Q Growth | % of total revenue in 3FQ20 |

|

| HDDs | 2,482 | 2,526 | 2% | 93% |

| Enterprise data solutions, SSD and others |

215 | 192 | -11% | 7% |

Covid-19

It caused disruptions in Seagate's supply chain and those of its manufacturing partners and customers as they also adapt to rapid shifts in demand. Teams acted with speed and agility to tackle a range of operational challenges from securing parts to produce drives, obtaining materials to package them and addressing logistics challenges to shift finished goods in order to support customer demand in the March quarter.

Today, supply chain in certain parts of the world are almost fully recovered, including China, Taiwan and South Korea and the company sees indications for conditions to begin improving in other regions of the world. Based on its current assumptions, it does expect some supply related impact in the June quarter. At the surface, the quarter played out largely as expected with the seasonal slowdown in the consumer-facing legacy markets offset by growing demand for mass capacity storage.

This disruption exacerbated the anticipated seasonal slowdown in the March quarter. The manufacturer started to see some demand improvement in certain Asian markets and expect revenue to normalize when the pandemic impact abates on a global basis.

On legacy markets which encompass the consumer electronic space, desktop and notebook PCs and performance mission-critical applications, March is typically a slower demand quarter for these markets following the holiday rush and Chinese New Year. With the consumer markets among the first to get impacted by the onset of the coronavirus, the firm saw greater than expected revenue declines for its consumer and desktop PC drives. While it sees pockets of healthy demand in certain markets and is starting to see improvements across its supply chain, the full extent of the Covid-19 related impacts to the broader economy and associated impact to its market and business operations are yet unknown, said Seagate, adding that recovery will likely be dictated by the duration of the outbreak, timing of containment and duration of restrictive measures.

The strength in nearline demand more than offset below seasonal sales for video and image applications such as smart cities, safety and surveillance as Covid-19 impacted sales early in the quarter.

Next quarter, the firm is seeing an improvement in the supply condition, particularly among our OEM partners. However, it will take a couple of quarters to fully recover.

Next quarter, the vendor expected that demand for nearline products to continue supported by ongoing cloud and hyperscale investment. In China, the company started to see demand recovery in certain markets, including video and image application. However, there is still considerable uncertainty at the micro level limiting its visibility. Company expects revenue for the following quarter going down at $2.6 billion, ±7%.

Seagate's HDDs from 2FQ15 to 3FQ20

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3F20 |

$86 |

120.2 |

4,100 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter